Significant developments continue to unfold in the cryptocurrency market. Accordingly, the largest US-based crypto exchange, Coinbase, announced the introduction of commission fees for swap transactions over 75 million dollars from USDC to USD. An exception will be applied for Tier 1 and Tier 2 members of the Coinbase Exchange Liquidity Program regarding this step.

Coinbase’s Noteworthy Move

The announcement of the swap fees was published on the official Coinbase website on January 30th. According to the page, starting from February 5th, Coinbase will begin assessing a commission fee for net conversions from USDC to USD that exceed 75 million dollars per 30-day period.

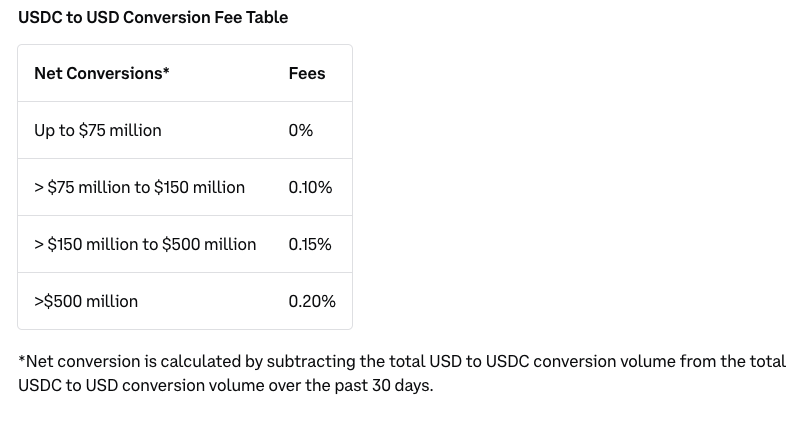

A customer will pay 0.10% for monthly volumes between 75 million dollars and 150 million dollars. Customers with transaction volumes between 150 million dollars and 500 million dollars will pay 0.15%, and those exceeding 500 million dollars will be charged 0.20%. All fees will be assessed directly from the USDC to USD conversion amount.

As announced by Coinbase, the net conversion is calculated by subtracting the total USDC to USD conversion volume in the last 30 days from the total USD to USDC conversion volume.

On January 23rd, JPMorgan analysts downgraded Coinbase’s stock to a low weight rating, citing the falling price of Bitcoin and listing shares of spot Bitcoin exchange-traded funds. On January 25th, the company’s stock price reached a monthly low of 121 dollars. At the time of writing, COIN stock is trading at 132.82 dollars, which is nearly 20% lower than at the beginning of the month.

Coinbase and the Crypto Industry

Moreover, the exchange continues to be one of the main advocates for the crypto market in the United States. Coinbase openly responded to the US Treasury Department’s Financial Crimes Enforcement Network’s (FinCEN) proposal to tighten scrutiny on crypto mixers, calling it a waste of time on January 22nd.

Coinbase’s nonprofit organization Stand with Crypto is actively monitoring the stance of US lawmakers towards the crypto sector and recently counts 18 crypto-friendly Senators.

The company is also conducting its own legal battle against the Securities and Exchange Commission (SEC). The SEC filed a lawsuit against the crypto exchange on June 6, 2023, alleging violations of federal securities laws. However, analysts believe Coinbase has a 70% chance of having the case completely dismissed.

Türkçe

Türkçe Español

Español