Hopes for a revival of FTX began to fade following reports of efforts to restart operations. Using data from CoinMarketCap, it was noted that the largely irrelevant cryptocurrency associated with the exchange lost 37% of its value last week.

Recent Developments at FTX

The latest crash further exacerbated the troubles of FTT. At the time of writing, the market value was nearly one-sixth of what it was before the collapse of FTX. The FTT token was at the heart of the sensational crash that paralyzed the entire cryptocurrency market in the fall of 2022. The balance sheet of its sister company, Alameda Research, being filled with native FTT tokens, raised concerns about its financial health. A bank run ensued as customers rushed to withdraw their funds from the platform, ultimately leading to FTX’s bankruptcy. Since that period, FTT has had no real use case, and market sentiment has severely declined.

However, hopes were briefly rekindled in the final period of 2023 when, according to a report by Bloomberg, FTX began exploring various ways to revive the exchange. Following these developments, the value of FTT quadrupled. But the excitement ended when a lawyer representing FTX stated that negotiations with potential bidders and investors had failed, leading them to abandon all revival plans.

The Future of FTT’s Price

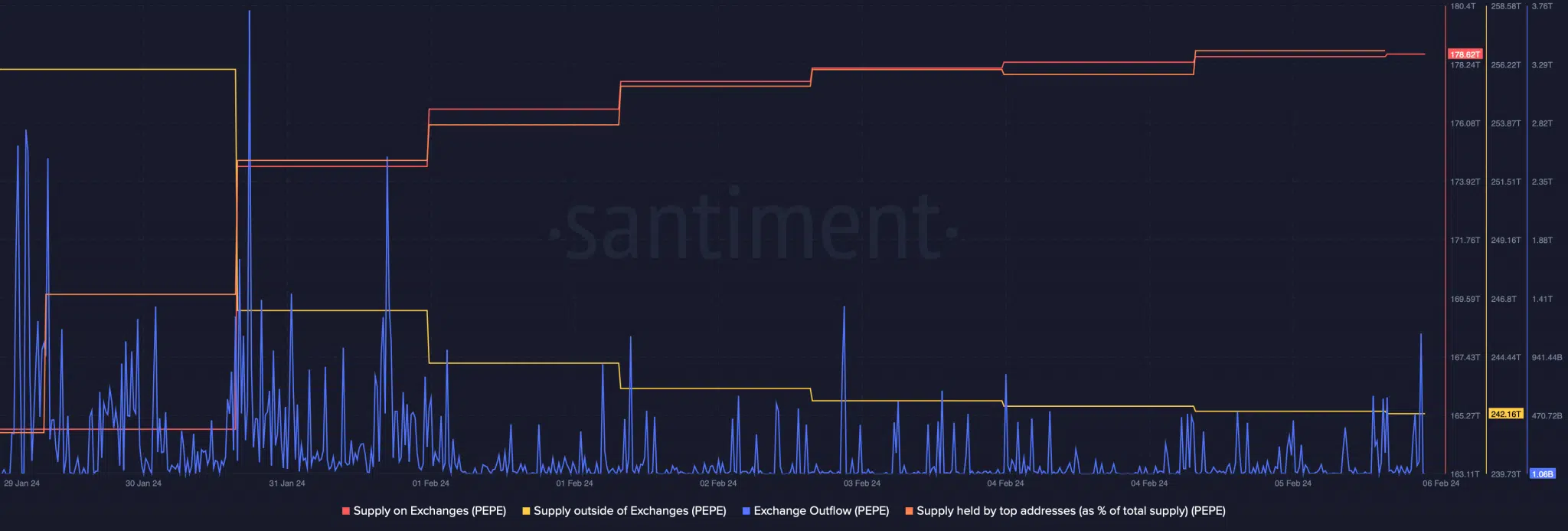

Instead, the focus will be on liquidating tokens to reimburse customers who lost deposits during FTX’s collapse. This event dampened the spirits of FTT advocates hoping for a comeback. It was likely that FTX would liquidate FTT to make payments to victims, leaving little hope for the future. According to analyses based on data from the cryptocurrency analytics firm Santiment, the flow of FTT to exchanges increased as the news spread. It was suggested that holders were liquidating their tokens and exiting the market. The prevailing sentiment also shifted into negative territory, deepening the market’s pessimistic view of the token.