Developments in the world of cryptocurrency continue to unfold one after another. Despite all this, the direction in which the price will move remains uncertain and is trending within a consolidation range. While all this is happening, an increase in open interest for short positions has been observed for some cryptocurrencies, which may be triggering short-selling opportunities for February.

Short Selling and Liquidation

During periods of short selling, a sudden price increase in response can liquidate the positions of the investors who initiated the short sales. The resulting liquidations could force traders to buy back the cryptocurrency, potentially driving the price to higher levels.

This situation could trigger larger liquidations in the market and potentially pave the way for a price increase.

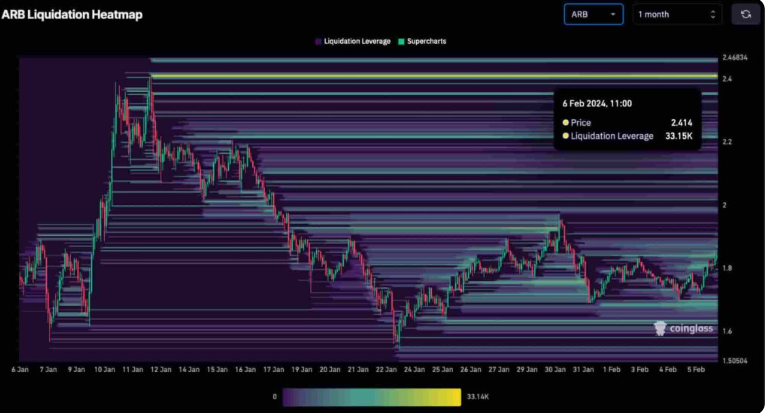

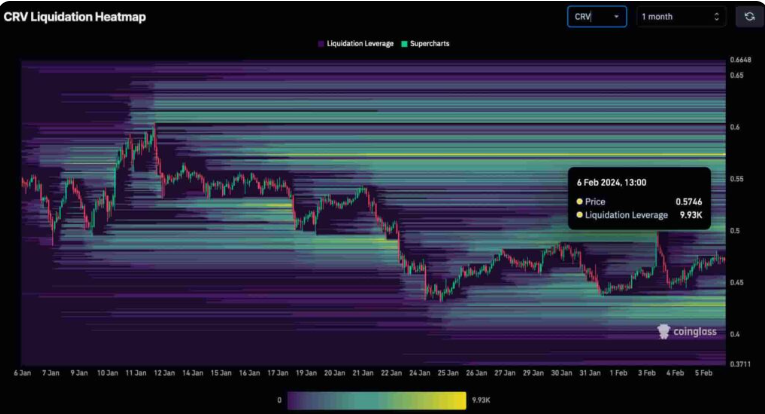

Investors seeking answers about the subject encountered significant data when they examined the liquidation heat maps dated February 6th from CoinGlass. In particular, the monthly time frame analysis highlighted areas on Arbitrum (ARB) and Curve (CRV) that had accumulated and could liquidate short positions.

Future of Arbitrum (ARB) Coin

Arbitrum (ARB), one of the standout projects of the recent period, was showing a dense liquidity accumulation at the $2.4 price level. A more in-depth analysis revealed a notable $33,150 short liquidation at $2.414, making it an attractive point for market-controlling investors.

On the other hand, ARB has experienced an increase of over 2% in the last 24 hours and is trading at $1.838. A possible price movement towards $2.4 could liquidate short positions and trigger a price rise.

Such a price movement could lead to Arbitrum marking the month of February with an increase of over 30%.

Future of Curve (CRV) Coin

Things also look exciting for CRV, the native token of Curve DAO. At the time of writing, it is trading at $0.471 with an open interest rate of $68.64 million, corresponding to an OI/Market Value ratio of 0.1324.

According to the liquidation heat map, CRV appears to have liquidity zones that could unsettle both shorts and longs. With this in mind, a price drop could occur before a rapid rise of the token.

On the other hand, the most favorable liquidation zone is seen at the $0.573 level. However, a price drop from this point could lead to an increase in short positions.

Türkçe

Türkçe Español

Español