Upbit’s announcement to list the ID token created a shockwave in the market, resulting in an approximate 87% increase in prices. This sudden surge follows a series of strategic moves by key players in the cryptocurrency space, indicating potential upward momentum for ID. On the side of DWF Labs and AmberGroup, there is notable activity concerning ID. Let’s delve into the details.

Potential Market Dynamics for Space ID Revealed: The Impact of DWF Labs and Upbit

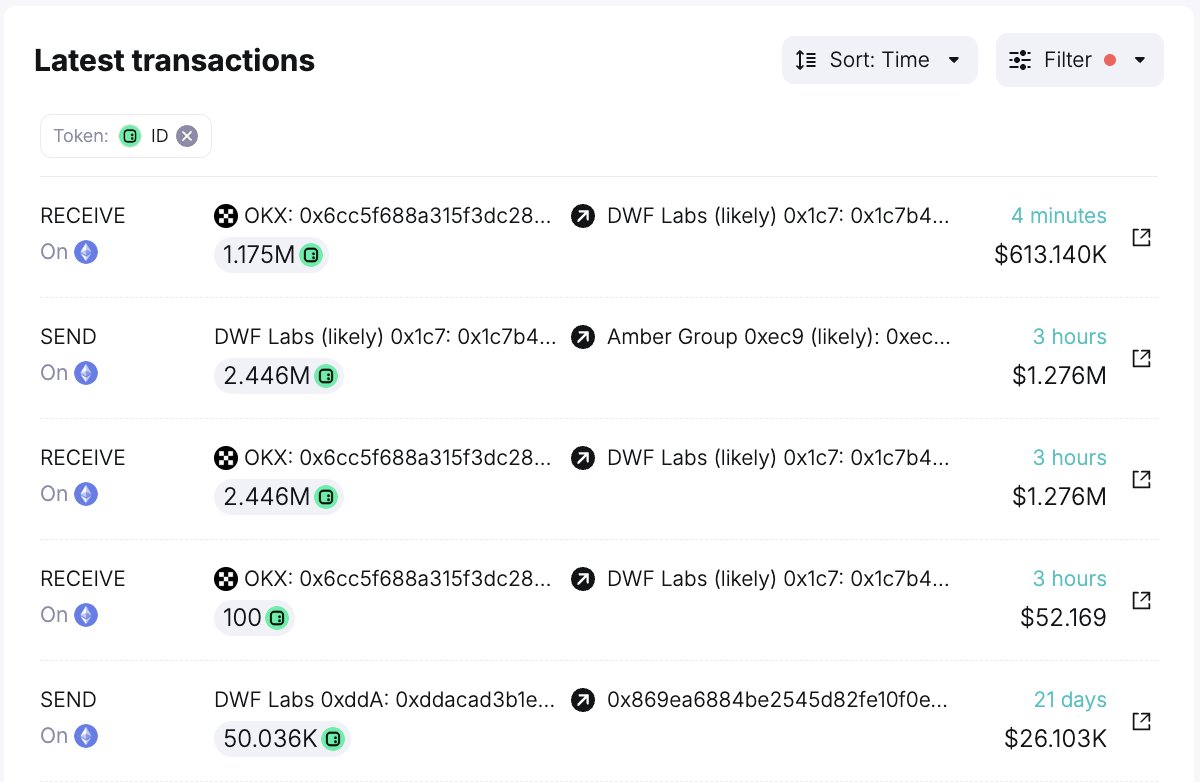

Spot on Chain’s monitoring system highlighted significant activity related to DWF Labs, showing that 3.62 million ID tokens worth $1.73 million were withdrawn from OKX in the last three hours. Following this, a substantial deposit transaction of 2.45 million ID tokens, equivalent to $1.12 million, was made to Binance through AmberGroup.

Such transactions, especially when they occur rapidly across multiple exchanges, often indicate coordinated efforts to influence market dynamics. Historically, both DWF Labs and Upbit have been associated with aggressive pump and dump activities involving various tokens.

This raises questions about the intentions behind their recent activities and whether they signal an upcoming demonstration in the market. While ID’s price saw a significant increase following Upbit’s announcement, it becomes crucial to examine the potential consequences of these maneuvers more deeply.

Upon closer inspection, the timing of DWF Labs’ transactions appears to be closely aligned with Upbit’s listing announcement. Such synchronized actions among major players often act as catalysts for significant price movements in the crypto space. However, the extent to which these movements are organic or planned continues to be a subject of scrutiny.

Navigating Volatility: Analyzing ID’s Future Trajectory

As ID continues to ride the wave of the surge triggered by Upbit’s listing announcement, investors should remain cautious in the face of the cryptocurrency market’s inherent volatility. While sudden price increases can offer profitable opportunities, they also carry natural risks, especially in the context of potentially manipulated markets.

In light of DWF Labs‘ history of involvement in pump and dump schemes, it is imperative for investors to approach current market conditions with a discerning eye. Conducting thorough research, assessing the legitimacy of price movements, and diversifying investment strategies can help mitigate risks associated with speculative trading.

Türkçe

Türkçe Español

Español