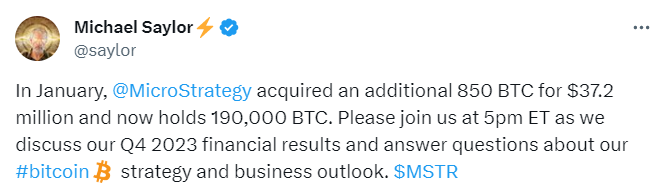

The famous technology giant MicroStrategy, known for its bullish stance on Bitcoin, has once again made headlines with its latest buying spree. In January alone, the company surprisingly added 850 BTC to its already hefty portfolio. The move, announced by the company’s vocal founder Michael Saylor through a social media post on platform X, came with a hefty price tag of $37.5 million. This represents a bold step that further solidifies MicroStrategy’s giant position in the cryptocurrency investment space.

An In-depth Look at MicroStrategy’s Accumulation Strategy

The company’s aggressive accumulation strategy did not stop with the last purchase. Since the close of the third quarter, MicroStrategy has acquired an additional 31,755 Bitcoins, spending approximately $1.3 billion during this period. This marks the 13th consecutive quarter that the company has expanded its Bitcoin assets, demonstrating unwavering commitment to the cryptocurrency under various market conditions.

The buying frenzy has increased the company’s total assets to 190,000 Bitcoins, acquired at an average cost of $31,224 per coin, representing a total investment of approximately $6 billion. MicroStrategy CEO Phong Lee shared his views on the company’s strategy, highlighting 2023 as a period of strategic capital increase to strengthen Bitcoin reserves.

Lee pointed out the launch of MicroStrategy AI, an artificial intelligence-based business intelligence tool, as part of the company’s innovation and growth strategy. The company aims to unlock unique value for shareholders by focusing on blending its operational structure with Bitcoin strategy and technological innovations.

Chief Financial Officer Andrew Kang emphasized the benefits derived from the increase in BTC prices during the fourth quarter. By reaffirming the company’s intention to continue expanding its Bitcoin portfolio, he signaled a long-term bullish outlook on the cryptocurrency.

The Financials Behind the Bitcoin Bet

MicroStrategy’s latest earnings report sheds light on the financial nuances of its Bitcoin investment. Despite facing a cumulative impairment loss of $2.269 billion since the beginning of its Bitcoin journey, the company reported a book value of $3.6 billion for its Bitcoin stash.

This figure reflects an average book value of approximately $19,172 per Bitcoin, based on a cost basis of $5.8 billion and a market value that has risen to $8 billion. MicroStrategy’s significant tax advantage associated with its Bitcoin assets led to the company reporting its first profit in nine quarters, creating a positive narrative.

This profit of $461 million, or $31.79 per share in the first quarter, contrasts sharply with the loss recorded in the same period of the previous year. The profit was primarily due to a 72% increase in Bitcoin prices and the company’s one-time tax benefit of $453.2 million.

Increase in Software Revenue as Well

Not content with just financial engineering, MicroStrategy also saw a modest increase in its core business area, with software revenue climbing to $121 million, surpassing Bloomberg analysts’ expectations. This financial revival came after Michael Saylor’s strategic move in 2020 to diversify the company’s cash reserves and invest heavily in Bitcoin as a hedge against inflation.

Saylor’s strategy appears to have paid off, with MicroStrategy’s stock price doubling this year and reflecting Bitcoin’s strong performance. The company’s unwavering commitment to Bitcoin, highlighted by Saylor’s readiness to liquidate personal shares for further Bitcoin investment, underscores a deep-rooted belief in the cryptocurrency’s value proposition.

Türkçe

Türkçe Español

Español