Cryptocurrency investors have been closely affected by Fed policies, which have greatly influenced markets over the past two years. The halt in rate increases and the reaching of the interest rate ceiling in the last few meetings have pleased investors, but they need more. A return to monetary expansion and a gradual stop by the Fed are necessary. This will mean the start of a rise in risk markets.

When Will the Fed Interest Rate Cuts Begin?

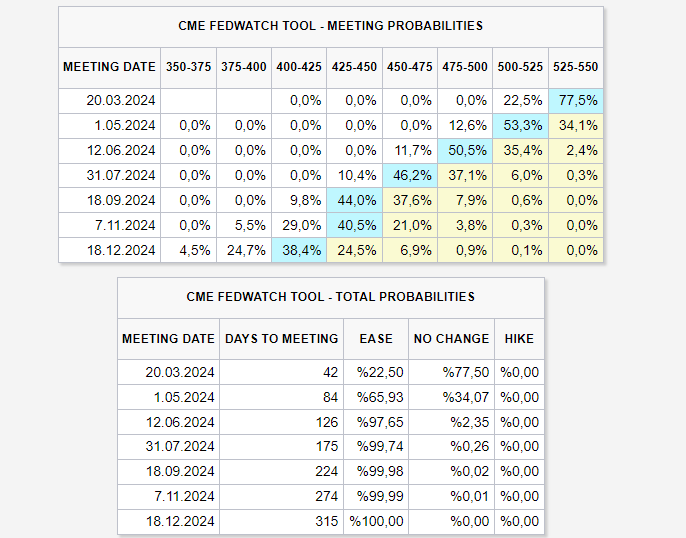

Just a few weeks ago, the market was pricing in an 80% probability of interest rate cuts starting in March. Now, this rate is at 22%. Even for May, the expectation of a cut has already dropped to 65%. The market is certain about the rate cut happening at the third upcoming meeting, which is the decision on June 12, 2024.

In the last meeting, Powell mentioned that unless there is an unexpected easing in employment, there won’t be early or excessive rate cuts beyond the planned ones. At the time this article was prepared, Fed member Kashkari stated;

“The resilience of the housing market has been surprising. Right now, 2-3 rate cuts this year seem appropriate. If the labor market continues to be strong, we can retract the policy rate quite slowly. If we see a few more months of good inflation data, it will give us confidence that we are on our way back to 2%. The economy appears to be extremely resilient.”

So the narrative of a 75 basis point reduction has not changed, and unless there is a surprise easing in employment (which recent strong data suggests is unlikely), the market is likely to face more disappointment. The Fed will most likely start reductions in May, but more probably in June.

Türkçe

Türkçe Español

Español