CryptoQuant reports that the largest Bitcoin mining companies in the US have continued to increase their BTC assets. An increase in BTC assets means that there is no selling happening. When there is no selling, the price of BTC tends to rise. As a result, the Bitcoin price has climbed above the $45,000 level in the last 24 hours.

Mining Giants Boost Bitcoin Reserves

On-chain data indicates that miner selling pressure is starting to ease, which has led Bitcoin to cross the $45,000 threshold on Thursday. According to CryptoQuant, on-chain data shows that the largest publicly traded Bitcoin mining companies in the US are continuing to increase their Bitcoin assets.

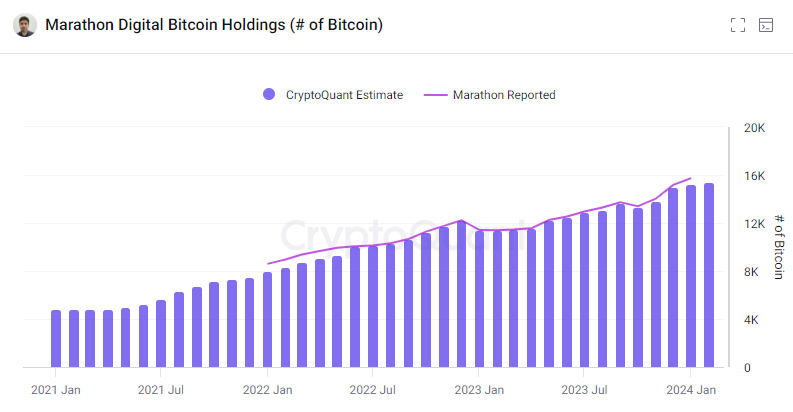

For example, CryptoQuant’s charts show that Marathon Digital’s bitcoin assets have been steadily increasing over the past few months.

Bitcoin Selling Pressure Decreases

In a weekly report, CryptoQuant mentioned that mining selling pressure has decreased following a high selling period in November and December 2023. The report states, “Daily sales by miners dropped from over 800 Bitcoins per day in November-December 2023 to below 300 Bitcoins per day so far in 2024.”

CryptoQuant analysts added that despite a drop in profits from cryptocurrency Bitcoin network fees, miners have maintained their reserves. The report contains the following noteworthy statement:

“The selling pressure from Bitcoin miners remained low in 2024 so far, even after daily fees dropped by 90% from record levels in December. The sharp decline in fees is related to lower network activity due to fewer transactions from Inscriptions and BRC-20 token creation.”

Decrease in Network Activities

Data from CryptoQuant shows that the number of transactions on the Bitcoin network has fallen from an all-time daily high of 731,000 at the end of December to a three-month low of 278,000. On the other hand, rewards paid to miners for producing valid blocks and processing transactions have also decreased from the highest levels of recent years in December.

At the time of writing this article, we see that the Bitcoin price is trading at $45,296. Analysts indicate that if BTC holds above $45,000, the next target could be $48,000. Reaching these levels could comfortably lead BTC to surpass the $50,000 mark.

Türkçe

Türkçe Español

Español