Bitcoin has surpassed the $50,000 level for the first time since 2021, sparking significant excitement among both cryptocurrency enthusiasts and general economic observers. This surge in Bitcoin’s price has also triggered a rally in certain other altcoins. However, the question arises whether the rally in cryptocurrencies will continue or if it’s time for a price correction after briefly exceeding the $50,000 mark.

Will the Cryptocurrency Rally Continue?

While indicators have yet to provide clarity, investors continue their anxious vigil. During this waiting period, numerous data points emerge, and experts persist in their analysis.

In light of the recent surge in Bitcoin’s price, technical indicators seem to hold optimism. The Open Interest (OI) in Bitcoin Futures has witnessed a notable increase, reflecting the growing interest and activity in the market.

According to data provided by CoinGlass, OI saw a 7.58% increase, reaching a value of $23.48 billion, or in other terms, 468,200 BTC. Exchanges like CME and Binance appear to be leading this uptrend.

On the other hand, indicators closely monitored by cryptocurrency investors, such as the Fear and Greed Index and the Relative Strength Index (RSI), are also providing significant data. During this period, the Fear and Greed Index for Bitcoin approached the 80 level, indicating greed among investors, while the general cryptocurrency market lagged behind at a level of 72.

Furthermore, as Bitcoin’s price continued to rise, the RSI also climbed, reaching a level of 78, fully reflecting an overbought condition. During such times, investors looking to enter the market should be cautious of FUD (Fear, Uncertainty, and Doubt).

The Future of Bitcoin

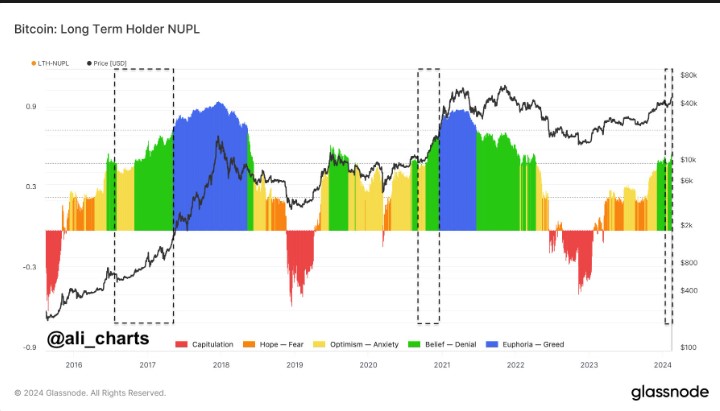

Prominent crypto analyst Ali Martinez notes that Bitcoin investors are optimistic in response to recent price movements, moving away from previous periods of concern.

Martinez’s observations align with Stockmoney Lizards’ comment that “$50,000 is not the final value.”

Additionally, il Capo Of Crypto suggests that Bitcoin could face resistance at the $50,000 level, but forecasts a rise for altcoins contrary to potential Bitcoin price movements.

Moreover, crypto analysts also emphasize the possibility of further rallies in Bitcoin linked to the upcoming halving event. Historical data shows that previous Bitcoin halvings have led to significant price movements.

Türkçe

Türkçe Español

Español