The popular smart contract platform Solana (SOL) has registered significant growth across all metrics. A post published by The Block Research confirms this situation. According to the data obtained, there were substantial increases in the stablecoin supply for other L1s such as Ethereum (ETH) and Tron (TRX). Solana also showed a similar upward trend, which could indicate growing interest in the crypto market.

Surge in Daily Transactions on Solana

Blockchain stablecoin supply increases could mean market participants have enough purchasing power to drive widespread price increases. However, when it comes to daily transactions, fees, and demand for related tokens, Solana has outperformed both Ethereum and Tron. This could be a sign of better performance from L1s and market interest in SOL and its ecosystem tokens. The reason could be linked to price performance.

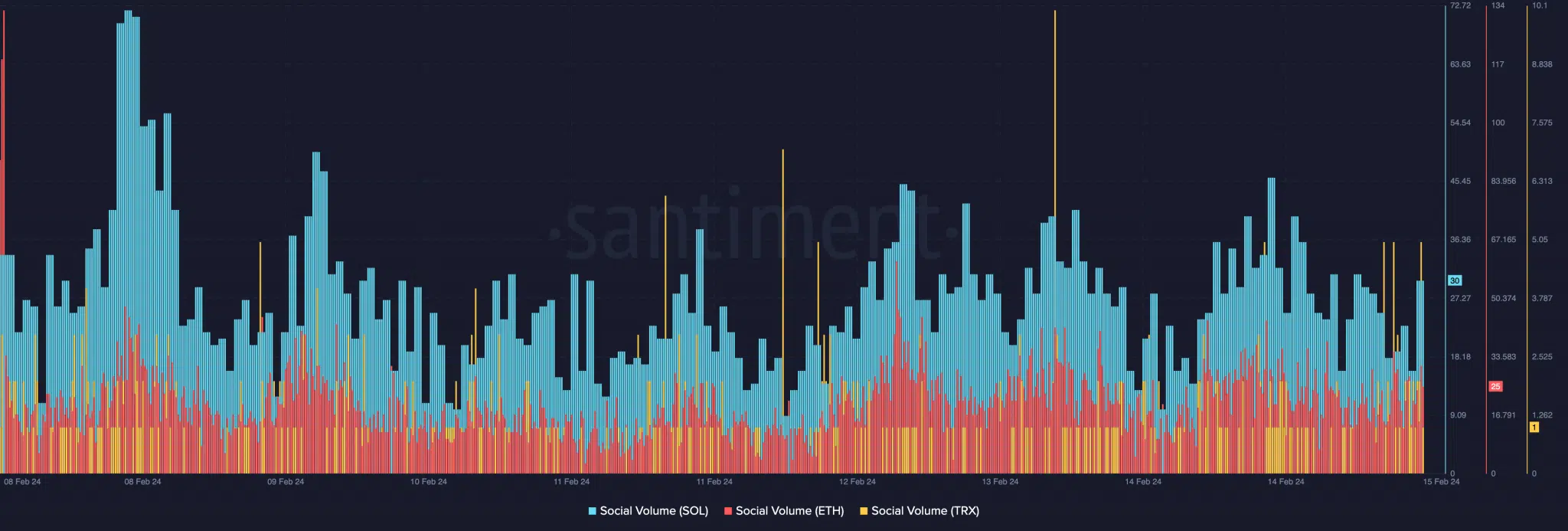

At the time of writing, SOL was trading at $115.91. This represents a 98.47% increase over 30 days. During the same period, the price of ETH increased by 42.67%. TRX saw an increase of 27.35%. In terms of social volume, on-chain data confirmed that Ethereum and Tron could not match Solana. ETH’s social volume was at 25, while TRX’s volume was lower, and SOL left both behind with a reading of 30. Social volume tracks text documents or searches related to a project.

Current Data on Solana

Therefore, it can be concluded that Solana is one of the most sought-after projects, with Ethereum falling behind. Additionally, experts believe that the increase in SOL’s social volume could push its price to $120 in the short term. However, if the metric rises too much, it could signify a local peak, which could lead to a decline in price movement. On the daily SOL/USD timeframe, the 9 EMA and 20 EMA are overlapping. Such movements could indicate that the short-term bullish outlook might be coming to an end.

SOL’s price could invalidate the previously established bullish thesis if it falls below the 9 or 20 EMA. If the EMA crossover remains bullish, SOL could progress towards $140. Meanwhile, the relative strength index (RSI) was at 68.35, which could indicate strong buying momentum. If the RSI reaches the 70 to 75 region, SOL may be overbought and require reevaluation.

Türkçe

Türkçe Español

Español