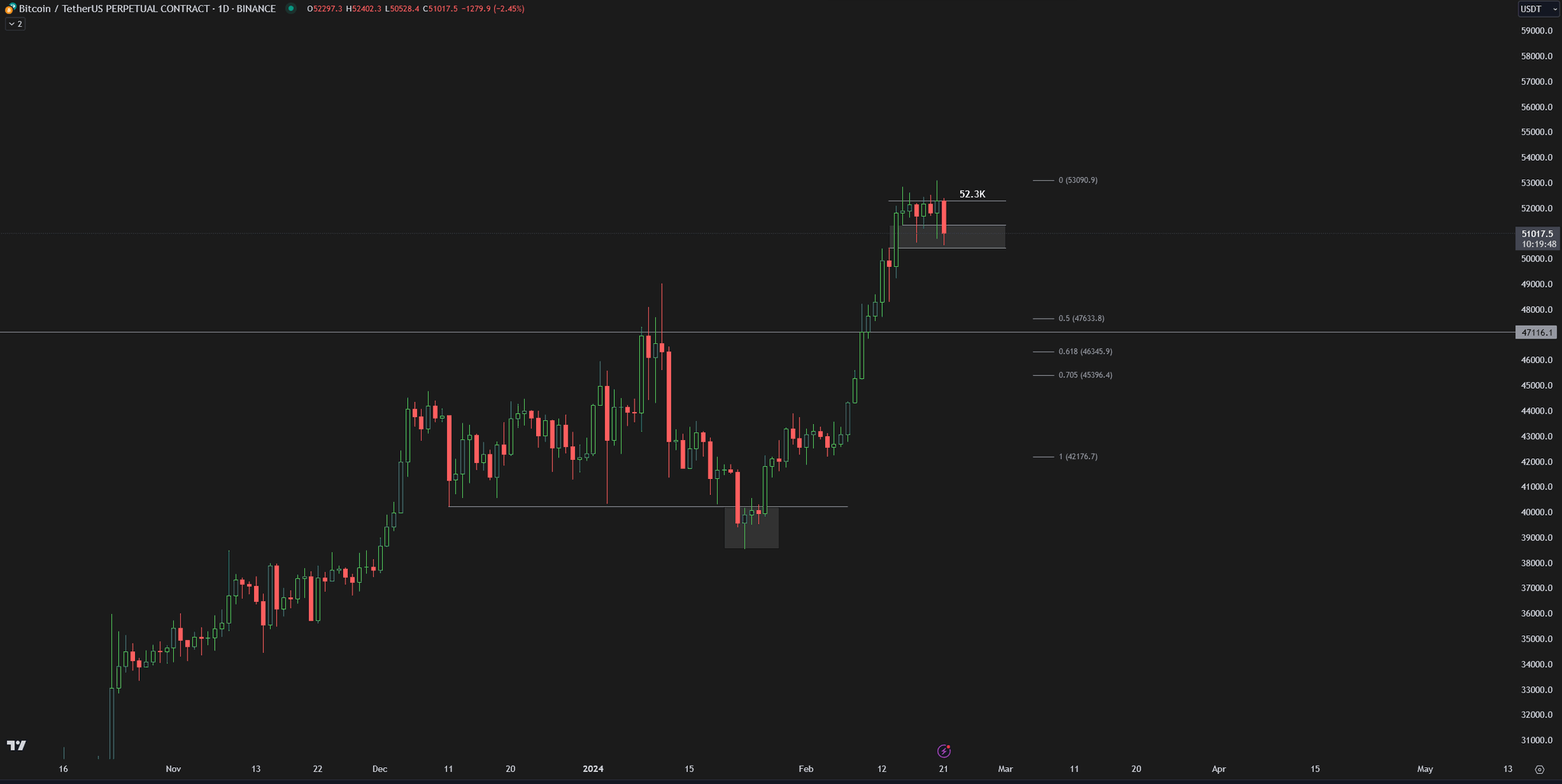

Bitcoin today dropped to as low as $50,625, causing investors to worry about further losses. So, what’s the reason for the decline? Initially, the price had recently reached a new peak for 2024, pushing up against the $53,000 limit. However, profit-taking at higher levels continued in a chain reaction. Additionally, the weakening of the latest ETF entries compared to the previous week negatively affected the price.

Why Is Bitcoin Falling?

Bitcoin turned its direction downward as sellers were emboldened by the strong resistance at the February 21 Wall Street opening. BTC price, reaching the highest level in the last 26 months, failed to achieve a new peak above $53,000. Popular cryptocurrency analyst Crypto Chase cited the “fair value gap” as the reason, suggesting the price is struggling with this issue.

“It looks ugly, but I’ve seen Bitcoin recover from worse.”

Keith Alan, founding partner of Material Indicators, mentioned in his latest market assessment that ETF entries, while supportive for short-term hype-driven movements, should not be relied upon too heavily.

“We see the BTC candle moving into the red zone mid-week. There’s definitely plenty of time for a recovery, and a large amount of BTC ETF entries will help mitigate some of the negativity, but the fact that we are seeing this pullback despite ETF demand shows two things: 1. Even in the age of ETFs, there is no such thing as ‘Only Up’ for Bitcoin. 2. BTC Whales are selling into ETF demand.”

Cryptocurrency Experts Weigh In

Firstly, such a correction was expected by most experts. Even the market-optimistic cryptocurrency expert Poppe had said we should see a price correction soon. Daan Crypto Trades said today’s drop should not cause a panic atmosphere and wrote;

“Sentiment usually follows the price. If sentiment is ahead and the price does not follow, that’s usually a reason to pay attention. There’s something to be said for both directions, but I feel the sentiment of a downturn has advanced a bit since we’ve only shown variability without a clear break throughout the past week. Wait for confirmation on both sides.”

Türkçe

Türkçe Español

Español