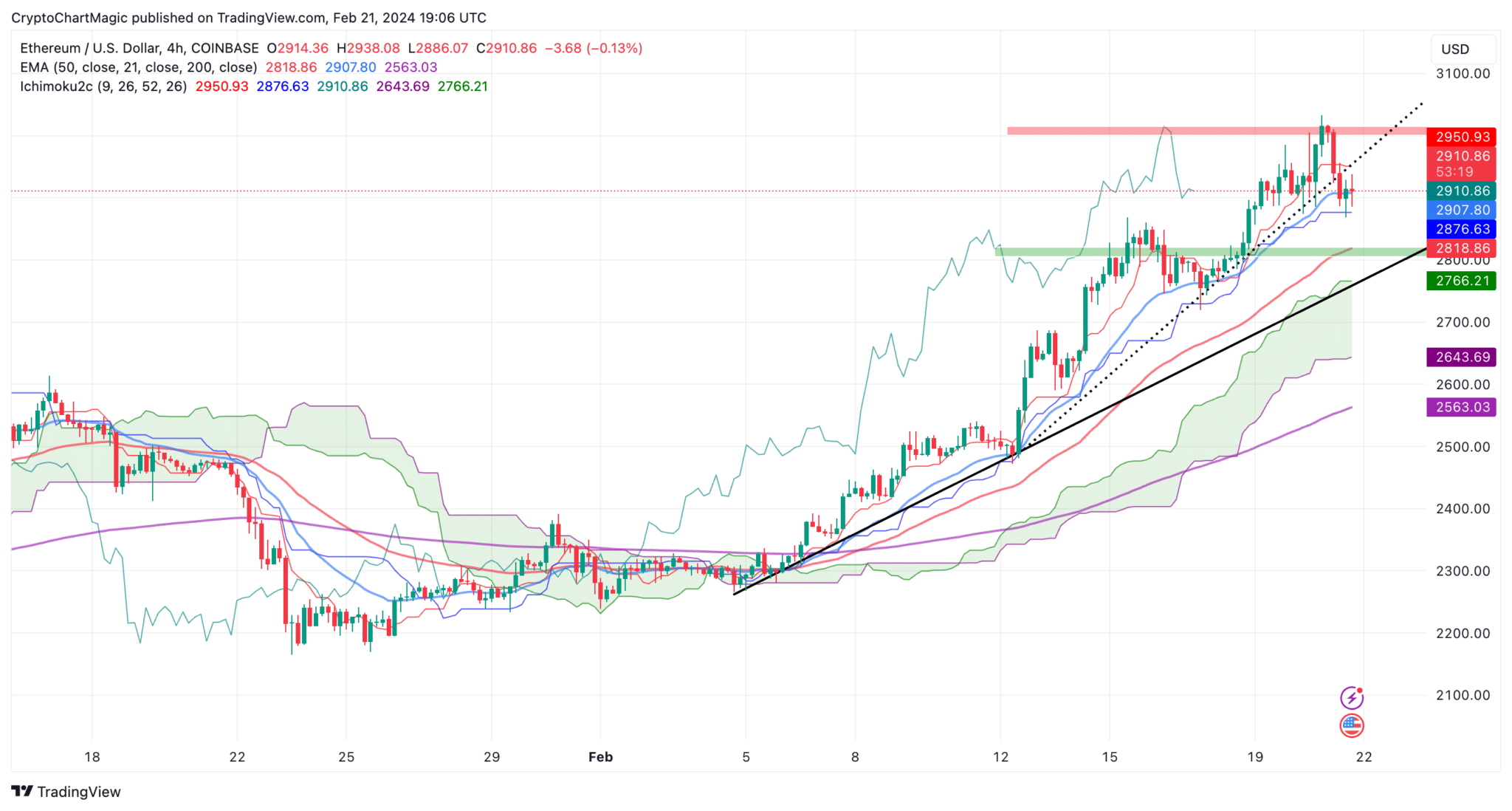

Ethereum (ETH) price followed a volatile path, reaching $3000 for the first time since April 2022, before retreating to $2900 to accumulate more liquidity. The performance of the second-largest cryptocurrency is said to be driven by various catalysts, including the Denison upgrade, which gives it an edge over Bitcoin, and the prospect of spot ETFs.

ETH Supply on the Decline

ETH gained 6% in value last week, surpassing its $53,000 liquidity counterpart as previously discussed. This could be a level it needs to maintain to keep the uptrend strong. The leading cryptocurrency fell below $51,000 on Wednesday, potentially paving the way for a stronger recovery targeting levels between $58,000 and $60,000 before the halving. According to Greg Magadini, Director of Derivatives at Amberdata, since the merge, the ETH supply has increased by 1,047,643. However, 1,407,200 ETH have been burned or removed from circulation, resulting in a net decrease of 359,557 in ETH supply.

In contrast, Bitcoin saw a 1.7% increase in its supply during the same period, indicating that Ethereum’s supply mechanism, which eliminates a portion of transaction fees paid to validators, has made it a deflationary token. Moreover, over a quarter of Ethereum’s supply, approximately 30.1 million ETH, is now locked in staking contracts, earning rewards in exchange for securing the network.

Ethereum’s Analytical Reports

According to DefiLlama data, the cumulative total value locked (TVL) in Ethereum’s decentralized ecosystem has risen from $20 billion at the start of last year’s bull market to over $45 billion. The rise in TVL confirms the market’s long-term bullish trend. Investors may be willing to invest in Ethereum’s long-term bullish outlook by locking their tokens out of circulating supply, effectively reducing sell-side pressure.

This situation, combined with significant market movers like the upcoming Ethereum Denison upgrade and the excitement around a potential spot ETF, could signal a parabolic rally in the coming months. Ethereum may also sustain the momentum from the anticipated Bitcoin halving in April. Historical price movements may support the notion that halvings are not only potential bull run triggers for BTC but also for altcoins. As Ethereum crosses $3000, several key levels emerge. Although a brief surge above $3000 is a positive move, the inability to close above this level allowed investors to take liquidity, which could explain the correction to $2900 on Wednesday.

Türkçe

Türkçe Español

Español