According to the latest data, the largest Ethereum (ETH) may be aiming for a strong rise to exceed $3,300 in the short term. At the time of writing, ETH is trading at $3,257 with a 1.61% increase in the last 24 hours and a market value of $391 billion, and on-chain data suggests that the largest altcoin could see up to a 10% rise.

Data Supports a Bullish Outlook

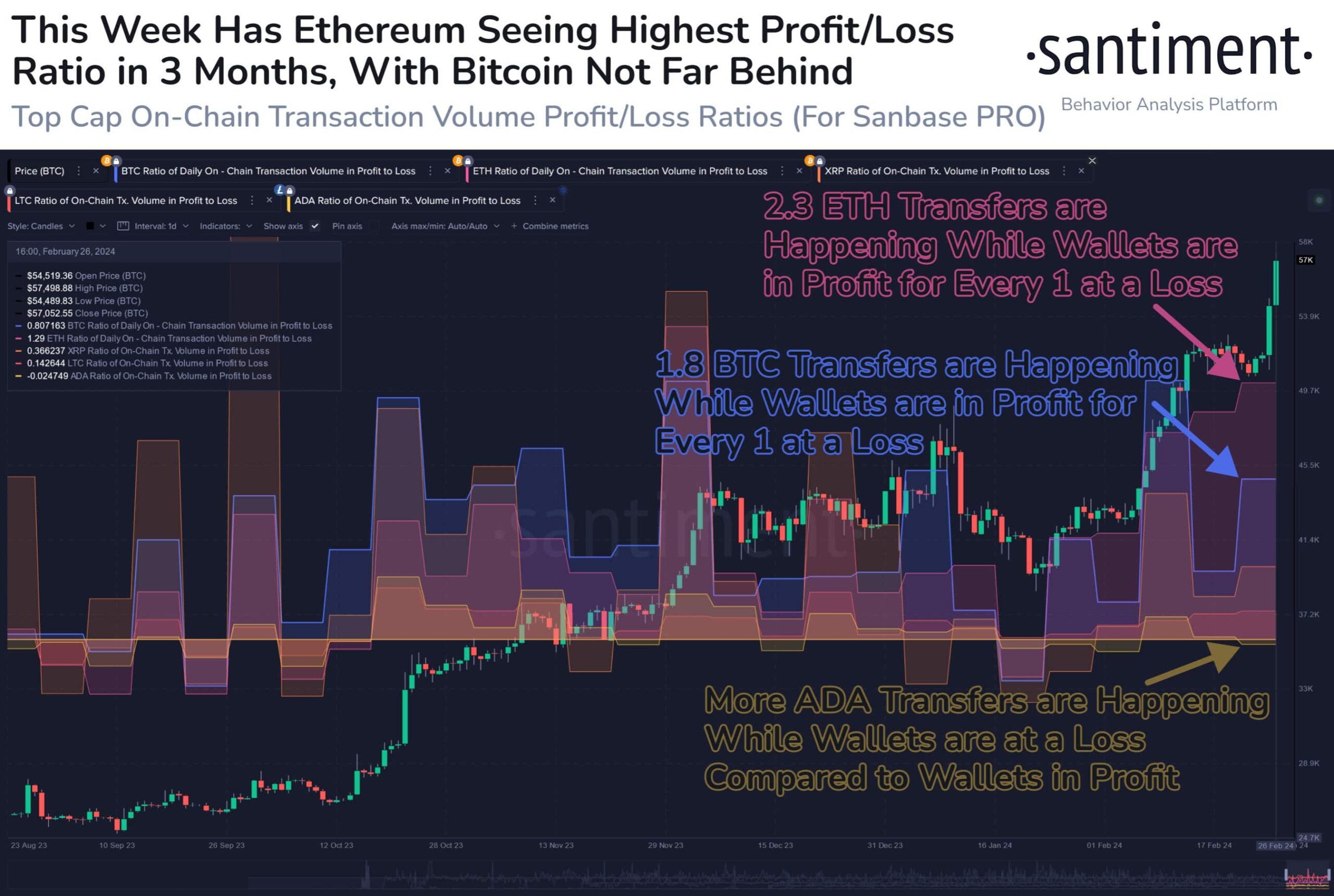

The latest on-chain data provided by the crypto data platform Santiment shows that Ethereum is facing the highest profit/loss ratio in about three months, even surpassing Bitcoin (BTC). Throughout this week, a high number of profitable on-chain transfers were recorded on the Ethereum network, with a ratio of 2.3 to 1 for ETHs in profit compared to those at a loss. This trend indicates the presence of positive sentiment among Ethereum investors.

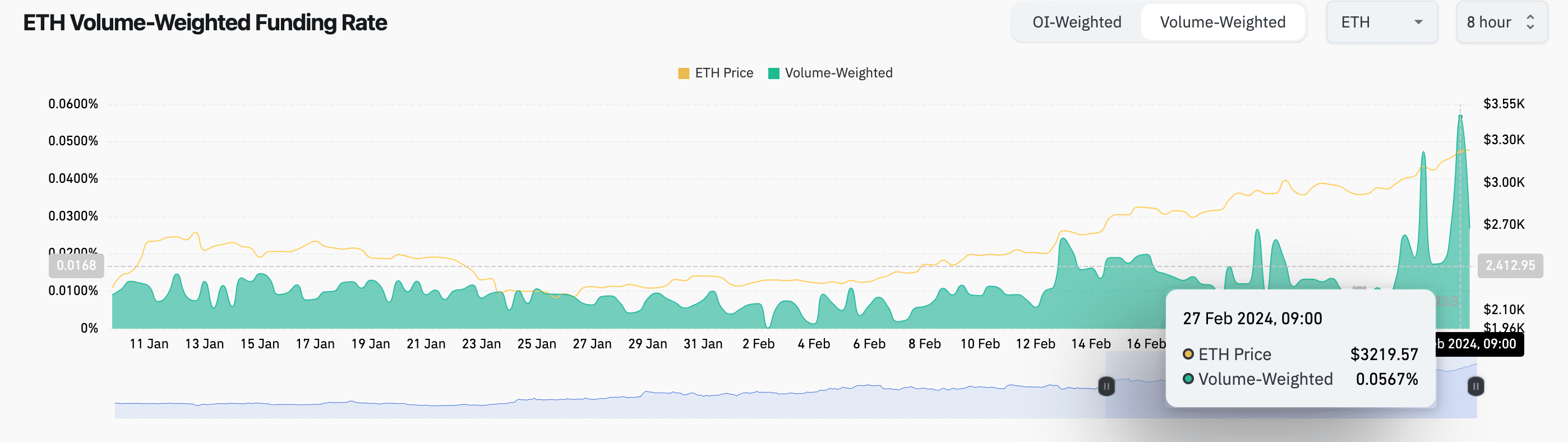

Ethereum’s current price rally coincides with the planned Dencun update next month, which seems to contribute to the positive momentum surrounding the altcoin. Additionally, a significant drop in Ethereum’s funding rate on February 26th and a rapid increase to 0.06% the following day indicate a renewed confidence in the altcoin among futures traders. This renewed confidence among traders suggests a bullish expectation and the potential for ETH‘s spot price to surpass the pivotal $3,500 mark.

IntoTheBlock‘s global inflow/outflow data supports a bullish outlook for Ethereum, showing that approximately 80% of current ETH investors are in a profitable position with Ethereum trading at $3,250. This suggests that many investors prefer to hold their ETH rather than sell, contributing to the ongoing rally. However, the data also points to a significant resistance level at an average price of $3,300, with 1.03 million wallet addresses holding 218,650 ETH at this price point.

Despite Positive Outlook, Warnings of a Potential Decline Begin

Despite the bullish momentum, analysts warn of potential downside risks, especially if the price of ETH falls below $3,000. The prevalence of over-leveraged positions could leave ETH investors vulnerable to significant losses, particularly if a wave of margin calls triggers a long squeeze.

In light of the data, seasoned cryptocurrency analyst Michael van de Poppe suggests that a 10-20% correction could be on the table following the current price increase, urging investors and traders to exercise caution.

Türkçe

Türkçe Español

Español