Bitcoin and altcoins have caught a favorable wind. The sentiment for growth remains strong and vibrant. Investors’ appetite is increasing day by day, triggering significant developments in some cryptocurrencies. A notable development occurred today for DOT, as Polkadot has surpassed the $10 mark for the first time in 21 months. Let’s take a look at our analysis of DOT.

DOT Breaks Through a Significant Threshold

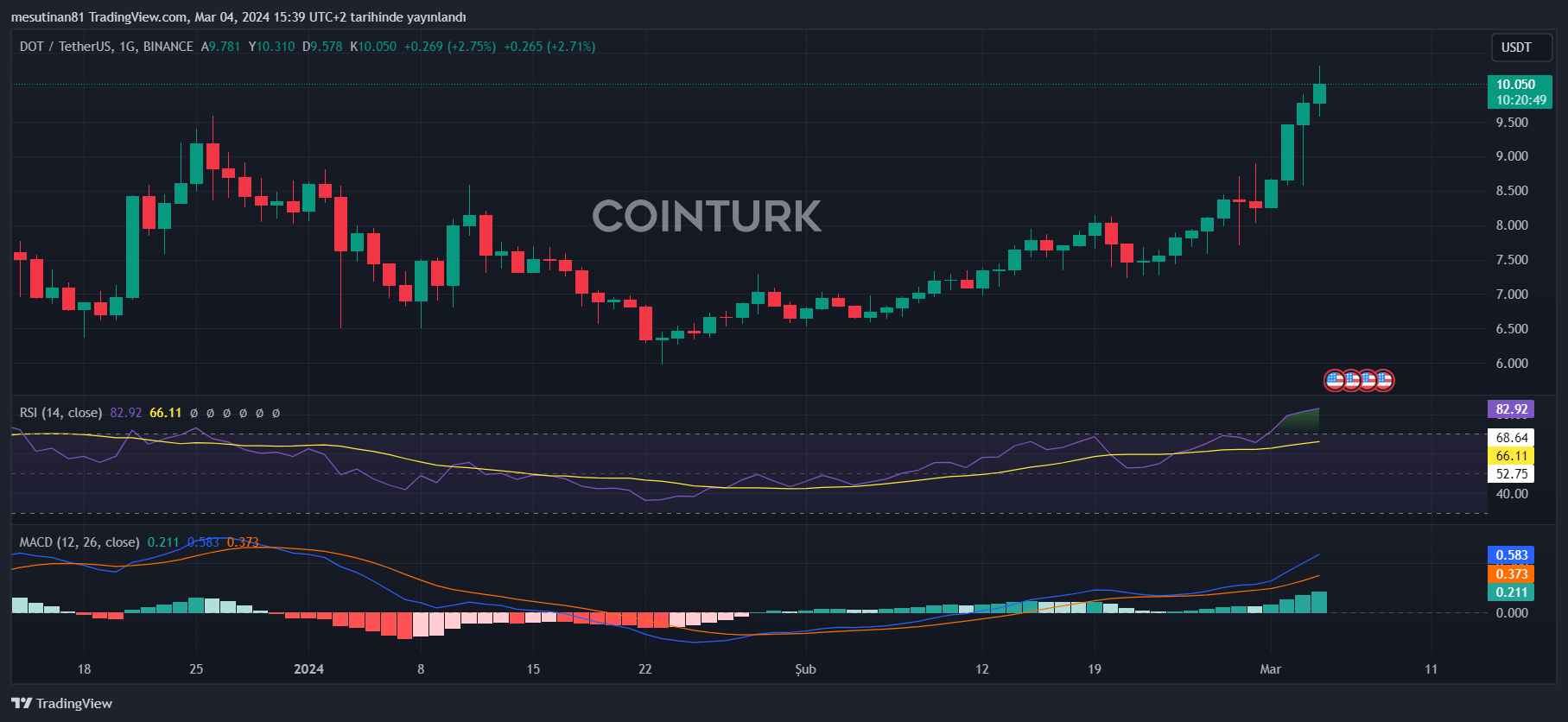

The cryptocurrency market has been showing significant activity recently, and one of the notable movements is seen in the performance of Polkadot (DOT). DOT gained momentum after breaking the $8.80 resistance and as a result, it climbed above the critical level of $10.

Recently, DOT has recorded a noteworthy increase after establishing a base above the $7.50 level. The over 35% increase in its value, even outperforming Ethereum and Bitcoin at times, has caught attention.

Particularly for DOT, a solid movement occurred above the resistance levels of $9.20 and $9.50, and the price exceeded the $10 level. Now, a critical resistance for DOT is at the $10.1 level. However, if these levels cannot be surpassed, a downward correction could be possible.

What’s Expected for DOT?

Currently, DOT is trading above the $9.50 region and above the 100 simple moving average. Additionally, an important rising trend line is observed at the $10.02 level on the daily chart of the DOT/USD pair. This trend line is helping to support the upward movement.

However, in the near term, it is necessary to surpass the $10.50 level, which could signal the start of a new strong rally. Yet, if price consolidation occurs below the $10.50 level, correction movements could follow.

What Do Technical Indicators Suggest?

Looking at the technical indicators, we see that the MACD is gaining momentum in the bullish zone and the RSI is above the 50 level. These indicators suggest that the current bullish trend could continue.

In line with crypto investors’ expectations, it seems beneficial to closely monitor Polkadot’s price performance. Especially, the $10.50 level holds critical importance, and surpassing this level could lead to the start of a new rally. However, the possibility of a correction should not be overlooked.

Türkçe

Türkçe Español

Español