Recent on-chain data reveals that a large amount of Bitcoin (BTC) mined in 2010 has been sold, potentially contributing to the recent price correction observed in the market. The transfer of these long-held Bitcoin rewards from old to new hands has caught the attention of analysts and traders, shedding light on the dynamics of the cryptocurrency market.

A Miner Sold 1,000 BTC Mined in 2010 After 14 Years

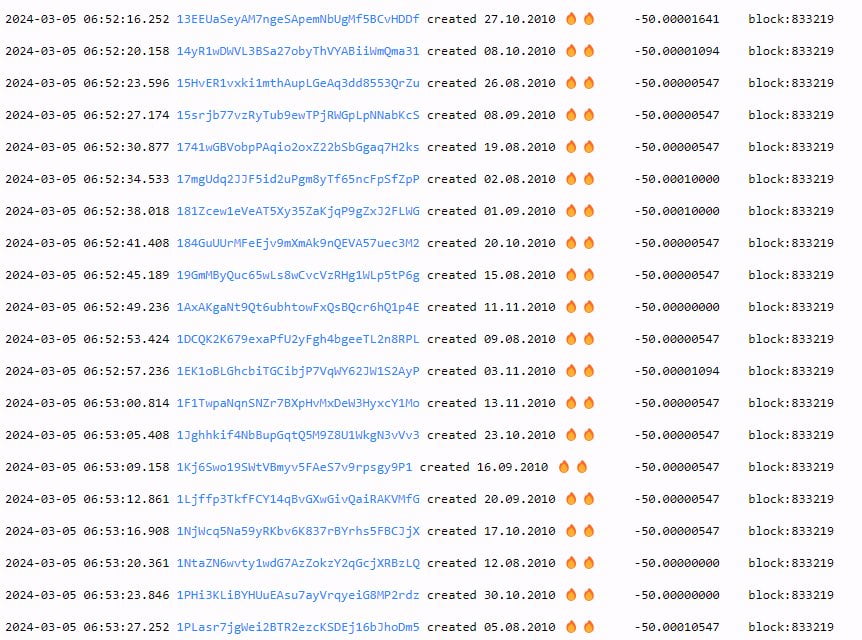

According to identified on-chain data, a Bitcoin miner sold 1,000 BTC, worth $65.79 million, mined in 2010 when the block reward was 50 BTC, after a 14-year wait. Experts note that these block rewards were obtained using relatively low-powered mining devices in the early days of Bitcoin.

The revelation that block rewards from 14 years ago have been sold adds an interesting dimension to the ongoing market dynamics. This situation demonstrates the changing ownership of block rewards accumulated in the early days of Bitcoin and now changing hands in the current market environment.

An Important Example of Bitcoin’s Investor Evolution

Although the exact motivation behind the sale of BTC mined in 2010 remains unclear, the movements represent a significant example of ownership change in the world of cryptocurrency.

The sale of block rewards mined with basic equipment since the beginning of 2010 indicates a serious shift in ownership models within the world of Bitcoin. The movement of BTC from old wallet addresses to new ones could potentially affect market sentiment and price movement, contributing to the recent price correction observed in Bitcoin.

At this point, it is important to emphasize that the sale of these long-held block rewards is a significant part of the broader maturation trend in the cryptocurrency market. As Bitcoin continues to gain mainstream acceptance and attract various investors, supply and demand dynamics are subject to changing patterns and behaviors.

Türkçe

Türkçe Español

Español