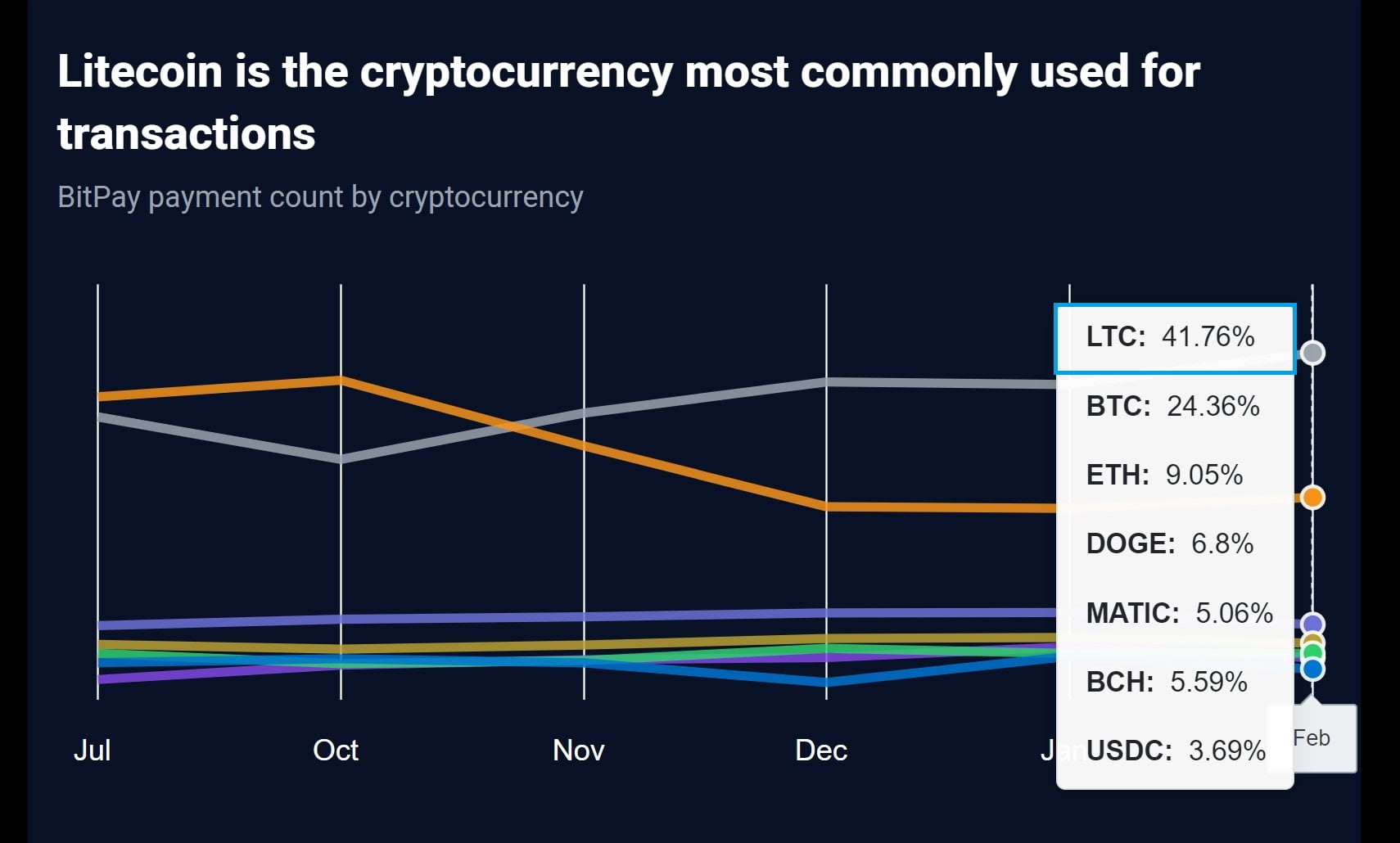

Litecoin (LTC) came under the spotlight this week as it showcased its dominance over its biggest rivals, including Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOGE), in crypto payment processing via Bitpay. Bitpay data indicates that Litecoin commands a 41.76% share of total transaction volume, which could signify an all-time high (ATH) score.

New Developments in LTC

Bitpay facilitates this by incorporating investors or businesses, thus providing easier access for crypto holders to pay for goods and services. Despite Bitcoin‘s popularity and overall market dominance, it only captures 24.36% of the total transaction volume as measured by Bitpay.

While the strong decentralized finance (DeFi) ecosystem Ethereum registers a 9.05% dominance, the leading meme token protocol Dogecoin (DOGE) sees its dominance level moving sideways at 6.8%. Among other cryptocurrencies, Polygon (MATIC) holds a 5.06% dominance, Bitcoin Cash (BCH) has 5.59%, and USDC has the lowest drop at 3.69%.

Price Analysis of LTC

Litecoin, while sliding down in the rankings as new protocols emerge and being seen as a weak project for a while, views this payment dominance as a significant milestone that could help refocus attention on what it offers. Litecoin’s price outlook remains one of the leading cryptocurrencies and has been at the top of the crypto market for a long time.

At the time of writing, Litecoin has seen a 2.07% increase in the last 24 hours, trading at $87.75. Litecoin has not been able to capitalize on the Bitcoin-led surge since the beginning of the year. Since the start of the year, Litecoin has only managed to rise by 19.71% compared to Bitcoin’s 58%. Litecoin may benefit from the renewed interest in LTC as a payment cryptocurrency and the increased transaction volume, hoping to rekindle growth momentum following its last halving event in August 2023.