Bitcoin ETF funds’ insatiable appetite far exceeds the new Bitcoin supply slated for 2024. Compared to the approximately 65,500 Bitcoins mined in 2024, the two largest Bitcoin ETF funds hold over 330,000 Bitcoins. A strong demand is likely to limit any downward trends in the near term. Bernstein analysts estimate that Bitcoin could reach $150,000 by mid-2025.

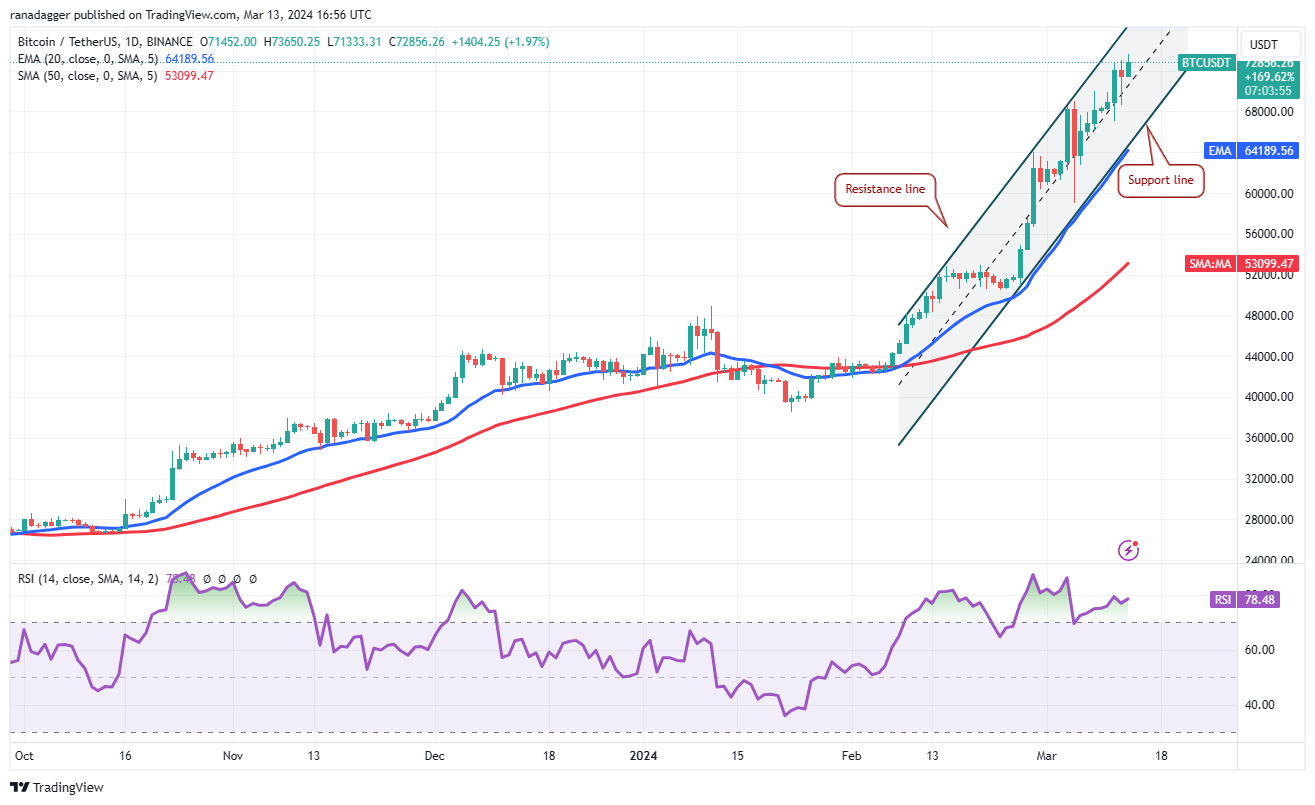

Bitcoin Chart Analysis

Bears attempted a pullback from $73,000, but the long wick on Bitcoin’s March 12 candlestick indicates solid buying on intraday dips. The BTC/USDT pair has been rising in the upper half of an ascending channel formation for a few days, but bears have prevented the price from breaking above the resistance line. However, if bulls manage to push the price above the channel, the upward momentum could increase, and the pair could rise to $80,000.

Conversely, if the price falls and goes below $70,000, the pair could drop to the channel’s support line. If bears pull the price below the channel, selling could accelerate. The pair could fall to $59,000 and then to the 50-day simple moving average at $53,099.

Ethereum Chart Analysis

Bears pulled Ethereum below the $4,000 psychological level on March 12, but the long wick on the day’s candlestick indicates each dip is seen as a buying opportunity. Buyers are trying to lift the price above the immediate resistance of $4,100. If successful, the ETH/USDT pair could start the next leg of its uptrend. The pair could rise to $4,372 and eventually to $4,868.

A minor risk to the rally’s continuation is the RSI trading in the overbought zone for the past few days. This indicates the rally might be overheated and a small correction or consolidation could be possible. The critical support to watch on the downside is at the $3,600 level.

BNB Chart Analysis

BNB gained momentum after breaking above $460 and has been on an uptrend since. This indicates strong demand at higher levels. A minor resistance is at $617, but if buyers do not give ground to bears, it could indicate positions are held in anticipation of a continued uptrend. The BNB/USDT pair could then rise to $670.

Vertical rallies are rarely sustainable and often followed by sharp declines. The first sign of weakness could be falling below the psychological level of $500. This could accelerate selling, potentially dropping the pair to $460.