Bitcoin (BTC), has often been labeled a failure by skeptics and even declared dead. Interestingly, since the last time such a comment was made in 2024, Bitcoin‘s price has increased by $21,000. A large investor base has interpreted Bitcoin as “dead” 476 times since 2010, highlighting the skepticism towards the cryptocurrency. These data have been presented by 99Bitcoins.

Was Bitcoin Ever Really Dead?

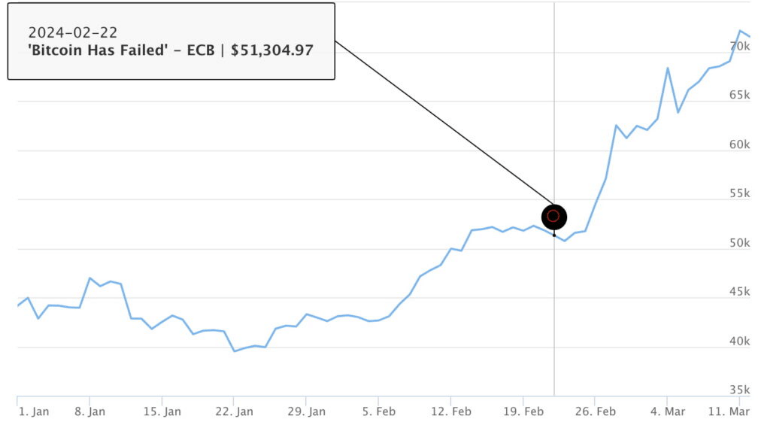

The leading cryptocurrency has only been declared dead once in 2024. This happened following a blog post by the European Central Bank (ECB) claiming “Bitcoin has failed”.

At the time of this event, BTC was trading at $51,304. As of today, at the time of writing, it has seen an increase of over 40%, trading above the $73,000 mark.

The year 2023 marked a period with eight death notices for Bitcoin. The last of these incidents occurred on December 27. At that time, Forbes had stated that BlackRock would completely destroy Bitcoin.

Notably, BlackRock Inc (NYSE: BLK) has continued to invest steadily in the cryptocurrency ecosystem, especially after the ETF. The investment giant continues to operate the largest Bitcoin spot ETF in the market and appears to have significant stakes in all mining companies in the United States.

99Bitcoins defines the information regarding Bitcoin’s death as follows:

The content itself (not just the title) must clearly state that Bitcoin is or will be worthless (“maybe” or “could be” are not included).

The content must be produced by a person with a significant following or a site with significant traffic.

Commentaries on Bitcoin

Despite the exaggerated appearance of the “Bitcoin is dead” statements, many of these claims are thought to have thoughtful and valid reasons.

During this process, it is observed that those supporting cryptocurrency create memes against critics of Bitcoin, rather than evaluating the fundamental thesis behind Bitcoin’s emergence and examining the comments made, leading to personal attacks.

For example, BlackRock’s position in the cryptocurrency market could bring higher centralization risks, which may lead to future problems.

On the other hand, the Bitcoin network itself continues to reflect a trend of centralization that is often overlooked by “Bitcoin maximalists,” which could also lead to problems in the future.