Market uncertainty has caused a chain reaction on Bitcoin exchange-traded funds (ETFs), with net inflows plummeting by 80%. Two United States senators have written a letter to Gary Gensler at the Securities and Exchange Commission, urging him not to approve additional crypto ETF funds. Meanwhile, a United Kingdom judge has ruled that Craig Wright is not the creator of Bitcoin. Here are three developments that have marked the last 24 hours in the crypto market.

Notable Movement in ETF Funds

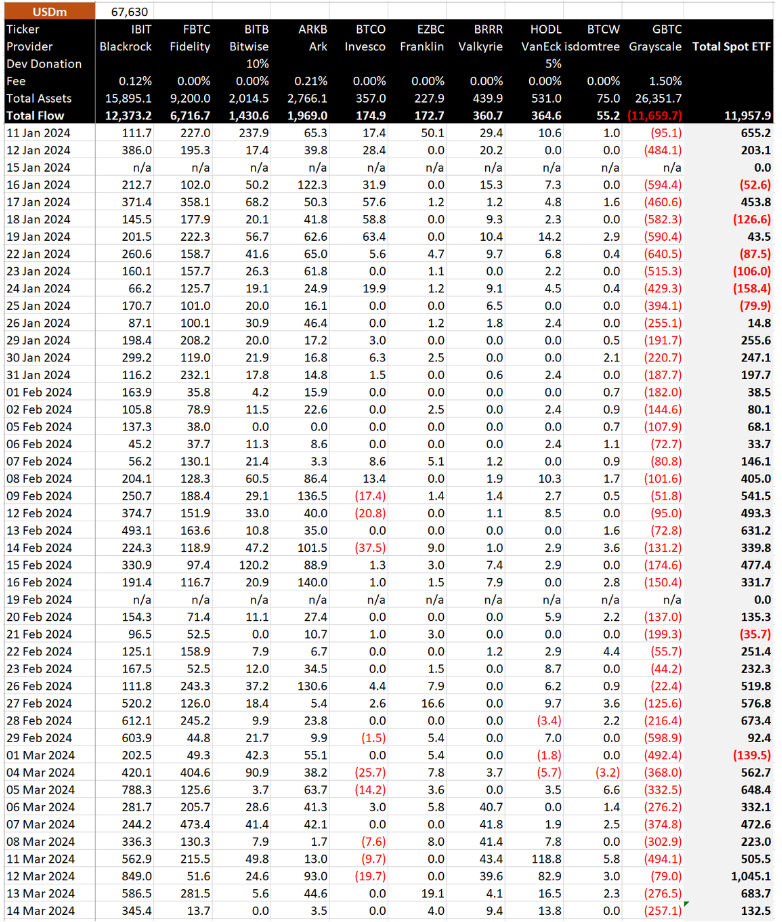

Spot Bitcoin exchange-traded funds based in the United States recorded one of their lowest net inflow days on March 14th, with just $132 million, indicating an 80% decrease from March 13th and the lowest level in the last eight trading days. The decline on March 14th marked the second consecutive day of decreases. On March 13th, inflows reached $684 million, a 38.3% decrease from March 12th, which had set a record for single-day inflows at $1.05 billion.

Total fund flows into ETFs were $390 million on March 14th, while Grayscale Bitcoin Trust ETF (GBTC) experienced an outflow of $257 million, bringing the net inflow down to $132 million. On the same day, VanEck Bitcoin Trust ETF and Fidelity’s Wise Origin Bitcoin Fund recorded inflows of $13.8 million and $13.7 million, respectively. Despite significant outflows from GBTC, net flows remained positive on March 14th.

Market experts suspect that current market volatility, regulatory uncertainties, and macroeconomic factors are making investors cautious. The current downturn is also linked to the upcoming Federal Open Market Committee meeting next week, which could shed light on the Federal Reserve’s future interest rate plans.

Senators’ Letter on ETFs

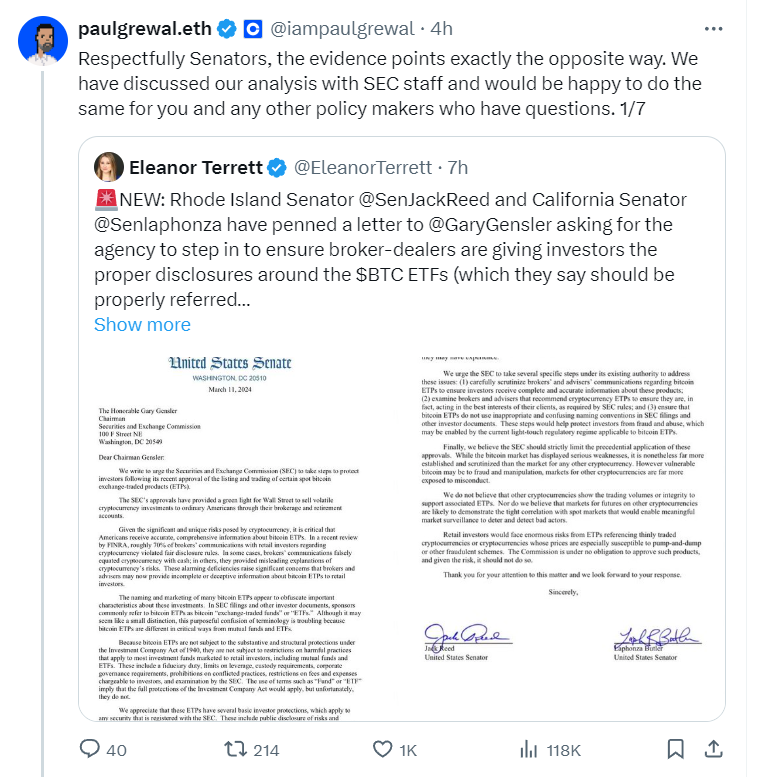

Two United States senators are calling for Gary Gensler to withdraw the process on more crypto exchange-traded funds, citing risks to individual investors. In a letter dated March 11th, Democratic senators Jack Reed and Laphonza Butler claimed that allowing further approval of crypto ETF funds by the Securities and Exchange Commission would expose investors to fraudulent and manipulative practices in volatile markets.

There are eight spot Ethereum ETF applications awaiting SEC approval, and there are hopes that other altcoin projects may eventually follow the same path. The letter included the following statement:

“Individual investors will face significant risks from ETP funds that reference thinly traded cryptocurrencies or those particularly susceptible to pump-and-dump schemes or other fraudulent plans.”

Coinbase‘s chief legal officer Paul Grewal criticized the claims in the letter, arguing that many cryptocurrencies have market data of a quality that even surpasses that of the biggest traded stocks.

Verdict Announced in Craig Wright Case

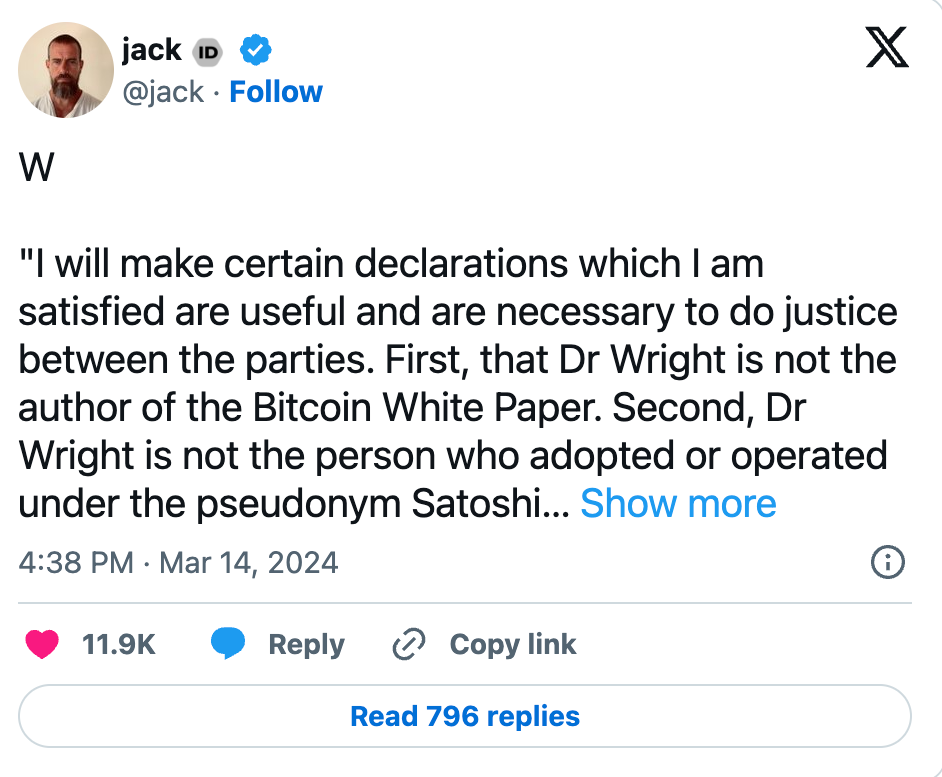

Reports indicate that a United Kingdom judge has ruled that Craig Wright is not the pseudonymous creator of the Bitcoin network, Satoshi Nakamoto, who disappeared in 2010. According to BitMEX Research, Judge James Mellor delivered his decision on March 14th as part of a case brought by the Crypto Open Patent Alliance (COPA) against the Australian computer scientist Wright, who has claimed to be Nakamoto since 2016.

COPA’s closing statement declared that Dr. Wright had been proven to lie on an extraordinary scale. According to the verdict, Wright invented an entire biographical history and produced one fake document after another to support it.

COPA, a 33-member organization, was established in 2020 with the aim of promoting the adoption and advancement of cryptocurrency technologies and removing patents as a barrier to growth and innovation. Some of its largest members include Coinbase, Block, Meta, Kraken, and MicroStrategy.

Türkçe

Türkçe Español

Español