Cryptocurrency markets make investors quickly accustomed to price peaks, and subsequent pullbacks trigger pessimism. Today, the drop to the once unimaginable level of $65,000 has somewhat dampened the excitement among BTC investors. So, what caused the downturn and what will happen now?

Bitcoin (BTC)

At the time of writing, the BTC price fell from $70,600 back to $67,800. The battle to stay above $68,000 is commendable, but with the daily low at $65,600, investors have more reason to be cautious. High volatility necessitates even more caution from altcoin investors.

According to a report by IntoTheBlock, the crypto market is “overheated.” We have long been saying that BTC price has been lingering in extreme territories according to various metrics. This made a price correction inevitable, as historical data suggested. Indeed, a rapid decline from $73,000 to $65,600 occurred.

Crypto expert TOBTC, CryptoQuant analysts, and many others had been saying that this overheated market would lead to a downturn. IntoTheBlock wrote in their latest On-chain Insights newsletter;

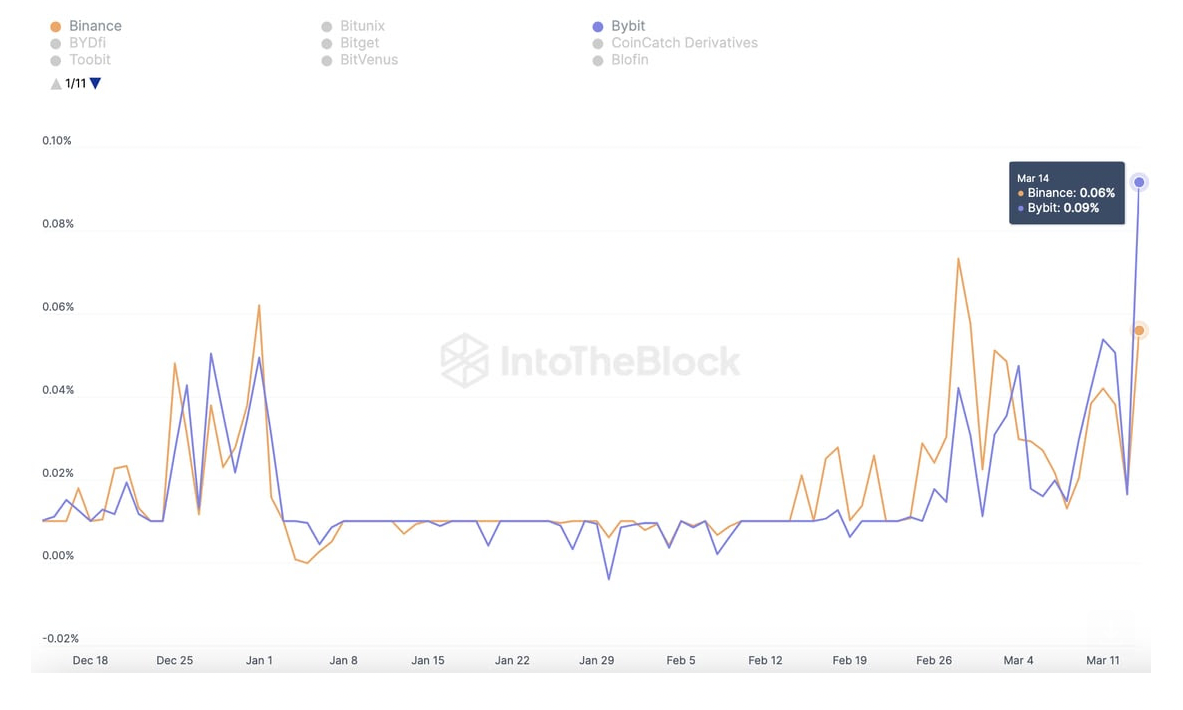

“We see that the amount paid by Bitcoin perpetual swap buyers to short sellers is at its highest level since October 2021. We observed that the funding rates on Binance and Bybit reached levels of %0.06 and %0.09 paid every eight hours yesterday. All these are the result of excessive long positions. Those wanting to long Bitcoin are facing costs between %93 and %168 annually.”

Has the Crypto Rally Ended?

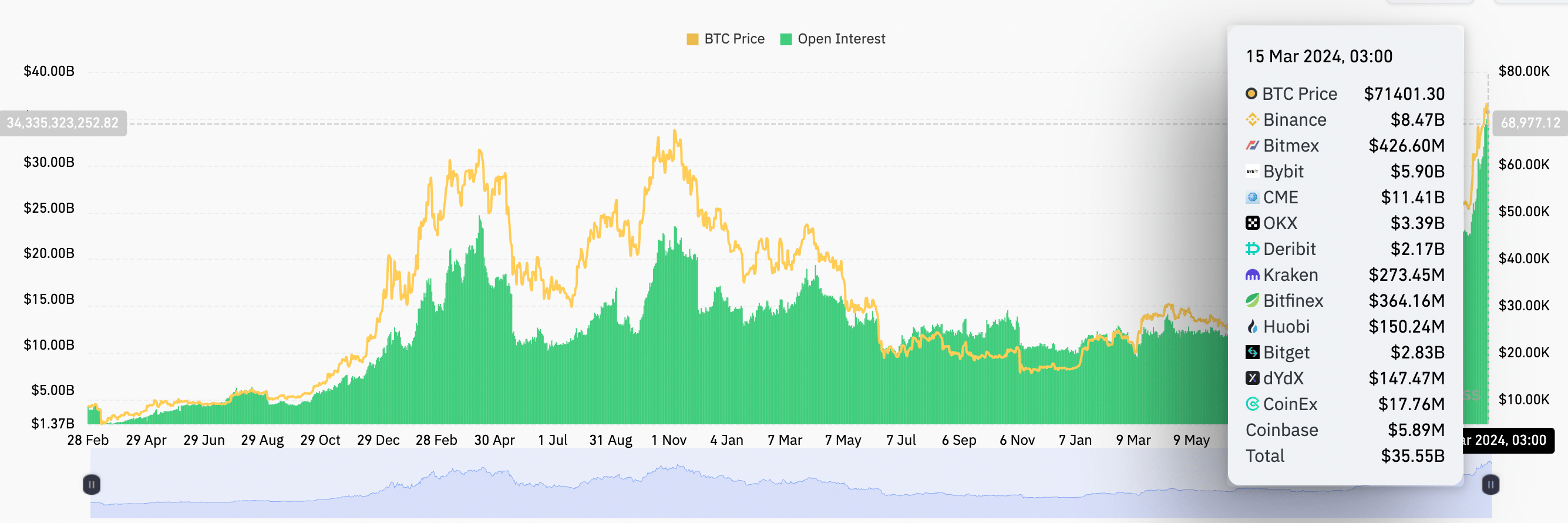

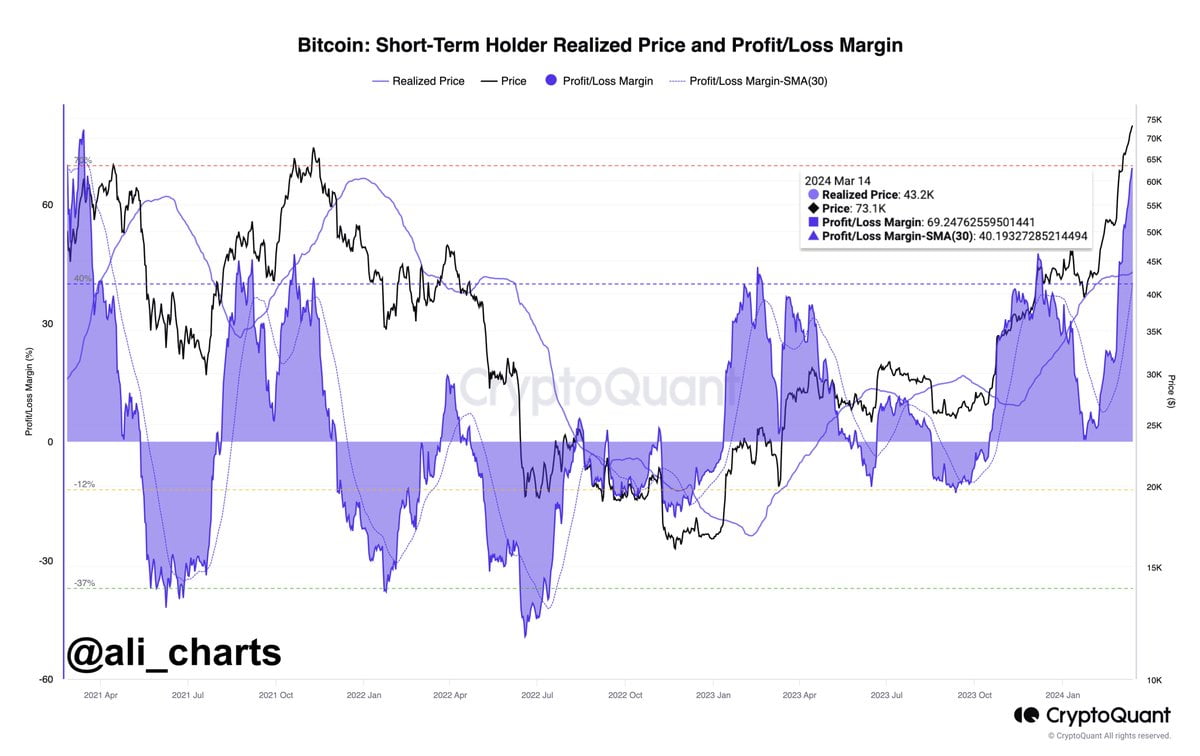

According to Coinglass data, the size of Bitcoin open positions has reached $35.55 billion. Excessive demand triggered by Spot Bitcoin ETF entries also prompted excessive leverage in the DeFi sector. Considering the top 20 cryptocurrencies provided an average return of %103 over three months, investors reaching %70 profitability are suggesting one thing. Sell.

Unrealized BTC profitability is at a three-year high, and data from IntoTheBlock indicates that %86 of BTC investors are in profit at current prices, suggesting that profit-taking could continue. This could mean a continued downturn for BTC and, indirectly, altcoins.

As always said, there is no perpetual rise or fall in cryptocurrencies, and corrections of up to 30% are normal even in bull markets, especially with the Federal Reserve’s hawkish stance on interest rates.