The leading cryptocurrency, Bitcoin (BTC), continues to face corrections as it has fallen below the $66,000 level. Although there are many factors contributing to the decline, miners’ behaviors could have had a more negative effect on cryptocurrency prices than investors initially thought.

Current State of Bitcoin Miners

BTC has shown a downward trend in recent days, falling by more than 5% over the last week. In just the past 24 hours, BTC’s price experienced another 5% correction. At the time of writing, according to the website 21milyon.com, BTC was trading at $68,000 with a market value exceeding $1.2 trillion.

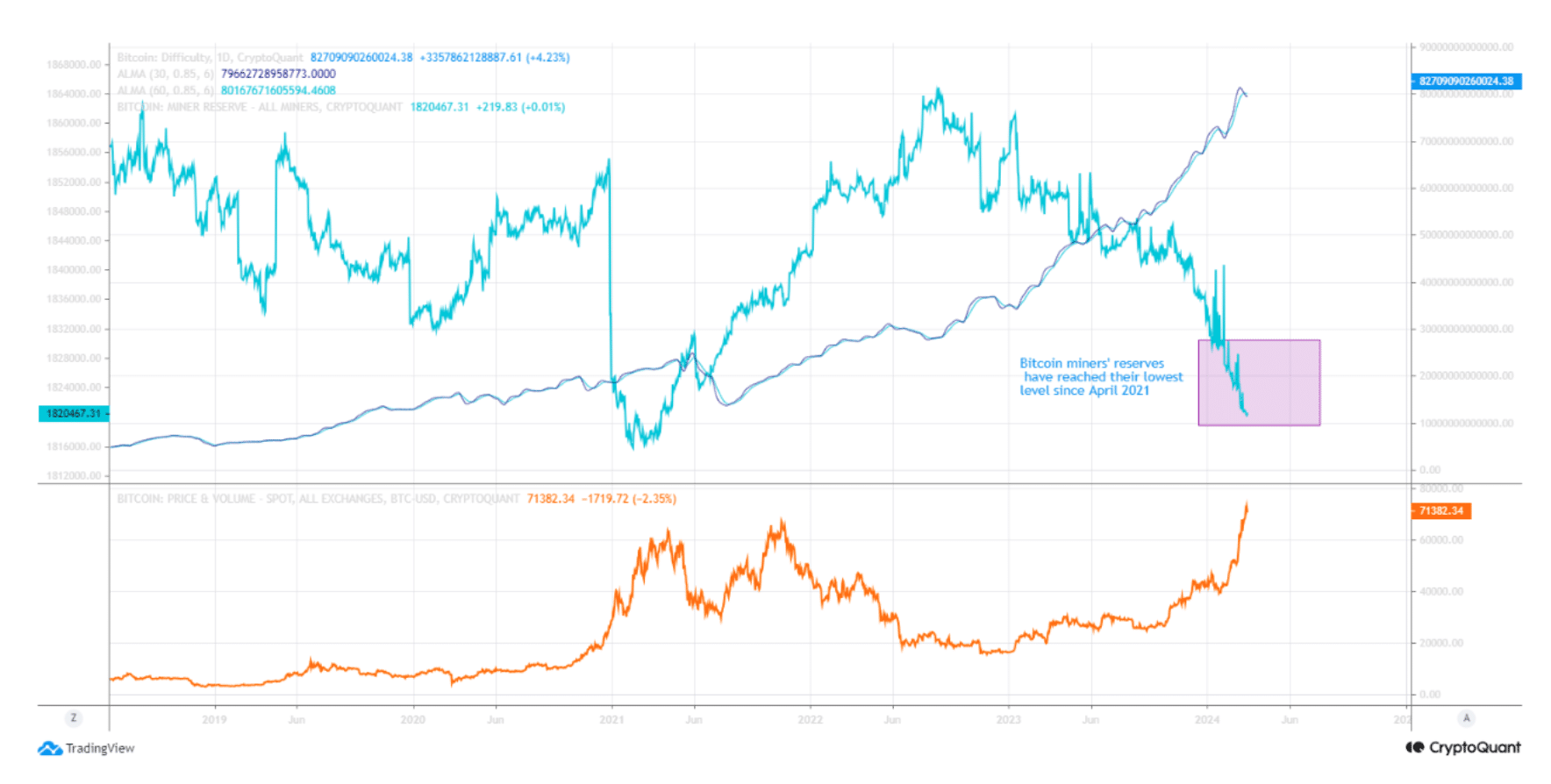

CryptoOnchain, a writer and analyst at CryptoQuant, published a report indicating that BTC miners’ reserves have decreased. The reserves of miners have reached their lowest level since April 2021, suggesting that miners are selling their accumulations. The report highlighted that this decline has followed a much steeper trend since the beginning of November, which could be one of the reasons for the increased selling pressure in the market. It also revealed that BTC’s net deposits on exchanges were high compared to the seven-day average, which could indicate high selling pressure.

Metrics Indicating a Downtrend in BTC

BTC’s aSOPR is on a downward trajectory. This data suggests that more investors are selling at a profit at the time of writing. The leading cryptocurrency’s binary CDD is also on a decline, indicating that the movements of long-term holders have been above average in the past seven days. The Coinbase Premium also shows a bearish market sentiment, particularly indicating a dominant selling sentiment among US investors.

Cryptocurrency experts’ analysis of Bitcoin‘s daily chart suggests that there is a high probability of further price declines. According to the Bollinger Bands, BTC’s price has fallen below the 20-day simple moving average (SMA). The Relative Strength Index (RSI) recorded a sharp decline, which could signal a continuation of the downward price movement.

Türkçe

Türkçe Español

Español