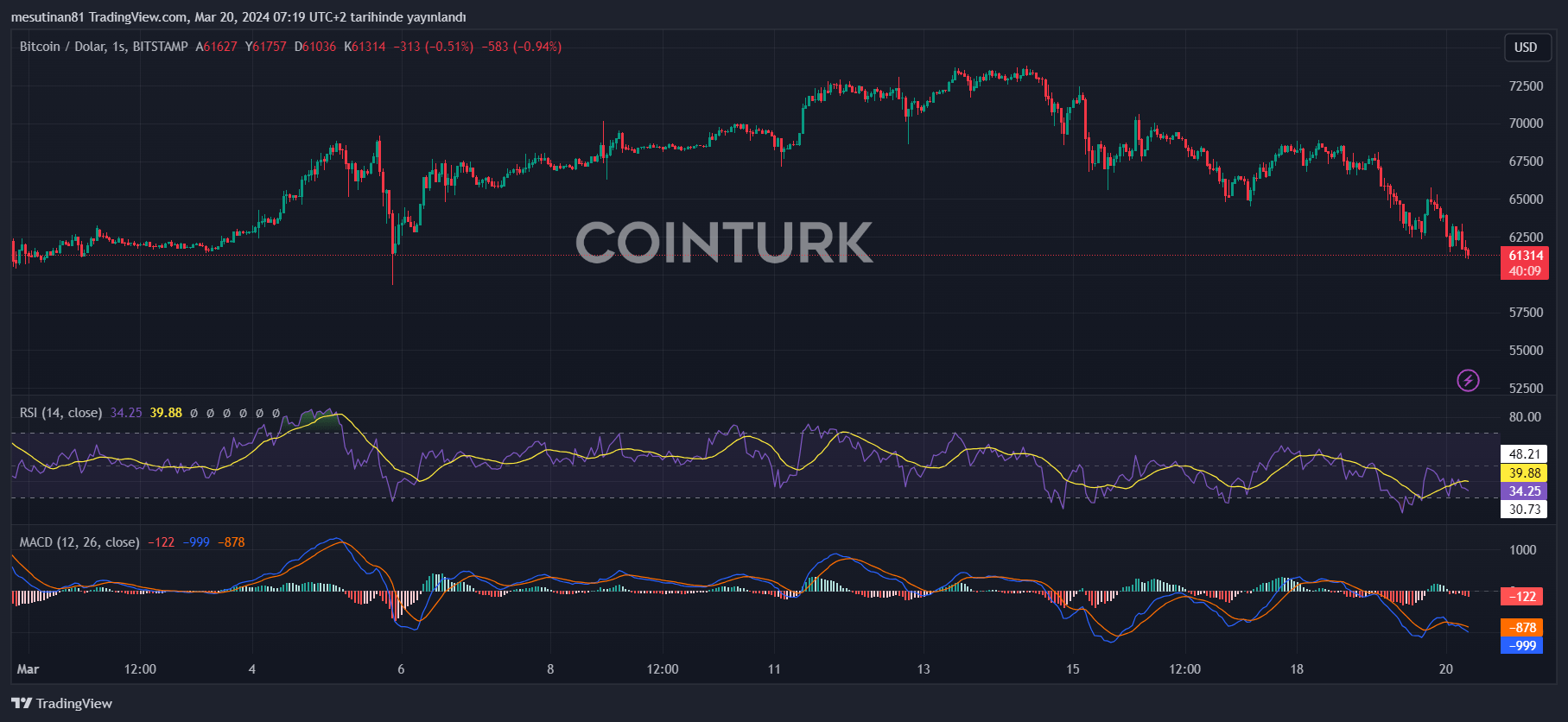

According to Farside investor data, a total of 326 million dollars was withdrawn from nine Bitcoin ETFs. This means that the outflows were more than double the previous day’s. For the second consecutive day, changes in market sentiment seem to be observed. There is also a decline in the Bitcoin price. BTC has fallen to $61,035.

Investors Exercise Caution Ahead of FOMC Meeting

While BlackRock’s Bitcoin ETF IBIT received a net inflow of 75 million dollars, Fidelity‘s FBTC was second with 39.6 million dollars. According to Farside data, almost all other Bitcoin ETFs had virtually no inflows. Institutional investors seem to be adopting a cautious stance ahead of the FOMC decision on Wednesday, March 20th.

On the other hand, Grayscale Bitcoin ETF GBTC continues to increase its losses with a surprising net outflow of 444 million dollars on Tuesday. Grayscale reported that there was an additional outflow of 6,860 Bitcoins today, which constitutes 1.9% of their total portfolio.

Interestingly, despite Grayscale CEO Michael Sonneshien’s recent announcement of lowering GBTC fees, this outflow occurred. It seems that this move has not played a significant role in affecting investors differently.

Bitcoin Price Under Pressure

Uncertainty in the cryptocurrency markets is increasing ahead of tonight’s Federal Open Market Committee (FOMC) meeting. Leading cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) are experiencing significant declines. BTC has fallen below $61,100, while ETH has dropped to around $3,089.

While BTC is expected to balance the fall below the $60,000 level, demand from spot BTC ETFs is emphasized by analysts as playing a critical role in maintaining this level.

According to a recent analysis by CryptoQuant, doubts about the ongoing bull market in cryptocurrency are increasing. However, there is no definitive indication that the bull market has ended.

Optimism Still Prevails

Looking at historical Bitcoin cycles, it is observed that previous bull markets did not stop at all-time highs (ATH). The current momentum and the upcoming halving event are expected to continue the positive expectations surrounding exchange-traded funds (ETFs).

According to past trends, it took about two months to surpass the previous ATH range in 2020. This signals that an upward movement in the market could continue. The movements in the crypto markets following the FOMC meeting are eagerly awaited.

Türkçe

Türkçe Español

Español