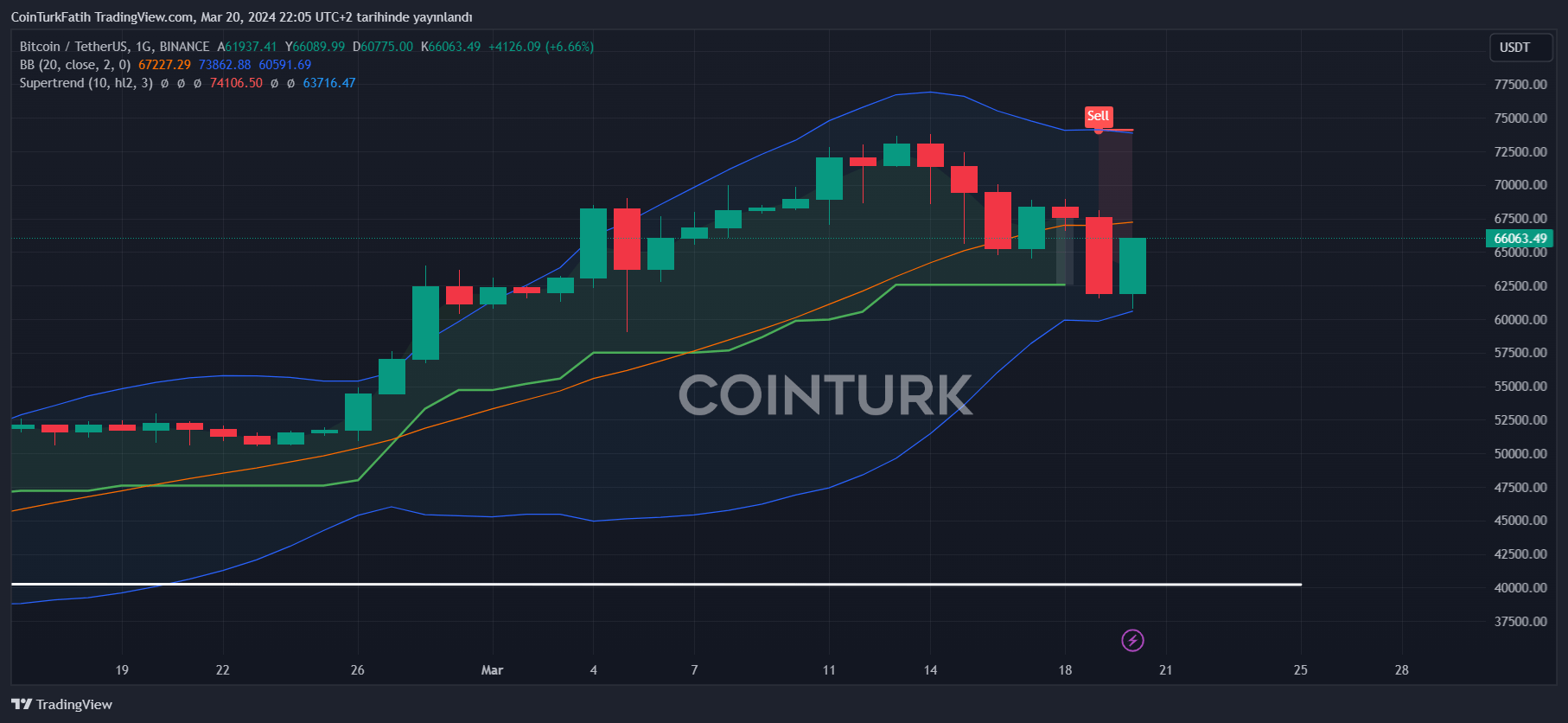

Fed Chairman’s statements have concluded, and interest rates were kept steady as anticipated. The main focus of this meeting was the perspective on inflation. Powell provided extensive evaluations related to the most recent data. Interest rate forecasts for the upcoming years by Fed members were shared. Bitcoin has now reached $66,000.

Why Are Bitcoin and Crypto Rising?

Firstly, the Fed members’ expectations for three interest rate cuts by 2024 are current. Only one member expects more rate cuts. There was no massive change in interest rate expectations for 2025 and 2026. Moreover, the Fed Chair believes that inflation data for the first two months of the year is connected to seasonality. He also mentions that the first half of this year could be a good period for cuts.

Following all these announcements, Bitcoin‘s price reached $66,000 while altcoins saw gains exceeding 5%. Additionally, if the upcoming March inflation data turns out to be positive, it could mark the beginning of a renewed period of optimism in the markets. This could also increase investor enthusiasm as we approach the halving.

For now, the dreaded scenario for the cryptocurrency markets has not materialized, and the pressure on investors has lessened in the short term. The US stock markets gained nearly 1% while the DXY fell. Tomorrow, significant entries into BTC ETFs are likely, and the rise is expected to continue.

Türkçe

Türkçe Español

Español