Recently, Australia and New Zealand Banking Group (ANZ) and Chainlink Labs have disclosed the outcomes of their close collaboration aimed at connecting blockchain ecosystems for the global movement and contractual process of tokenized assets. In this process, Avalanche and Ethereum have emerged as prominent platforms. ANZ offers banking products and services to more than 8.5 million individual and corporate customers in approximately 30 markets.

Noteworthy Details on the Collaboration

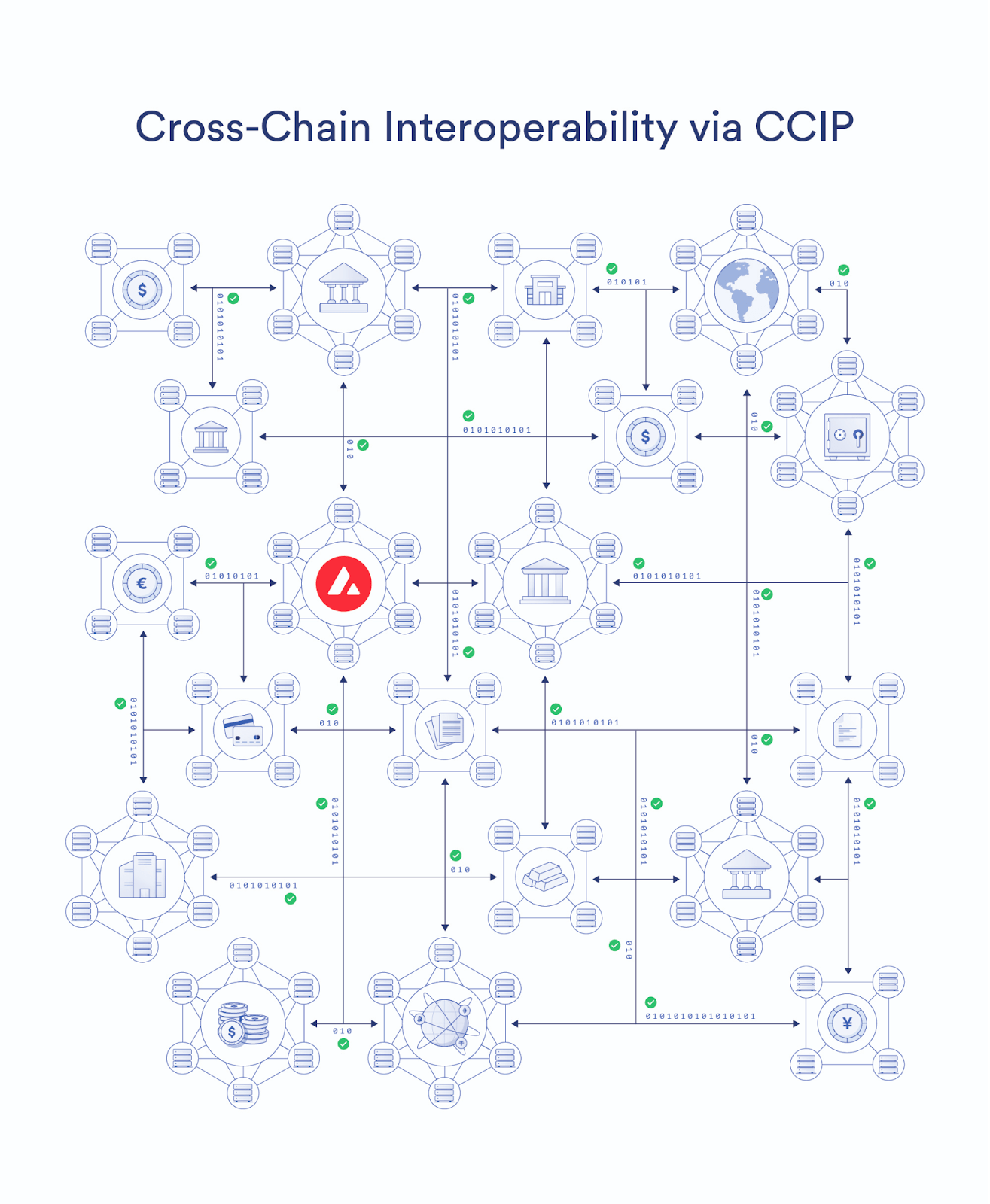

Exploring the possibilities of crypto assets on the ecosystem, ANZ demonstrated how customers can access, trade, and make seamless payments in different currencies for tokenized assets during a process called Delivery versus Payment (DvP) by utilizing Chainlink‘s Cross-Chain Interoperability Protocol (CCIP), a solution for blockchain network interoperability.

DvP stands out as a common contract and risk management standard that requires payment to be made before or simultaneously with the delivery of securities. Blockchain networks and specialized smart contract logic offer the chance to modernize old DvP processes with tokenized assets and payments on the same infrastructure, enabling atomic, intermediary-free DvP contracts. ANZ’s Technology Area Leader Lee Ross commented on the matter:

“Chainlink CCIP played a significant role in eliminating the complexity of blockchain network transfers of tokenized assets and in providing atomic cross-chain DvP.”

Significant Details on Avalanche

For this project, ANZ announced it would benefit from its own Avalanche Evergreen Subnet, which offers features including Ethereum Virtual Machine compatibility, permissioning, and customized transaction fees. ANZ’s Digital Added Services Product Leader Anurag Soin stated:

“Avalanche’s Evergreen Subnets have enabled ANZ to join the list of institutions exploring new use cases and business models while benefiting from customizable networks like Avalanche. We look forward to continuing to test how blockchain networks, smart contracts, and tokenization can improve the rails of the global financial system.”

Through Avalanche’s Evergreen Subnets, institutions can pursue blockchain network and crypto asset strategies in customized blockchain environments with approved counterparts, while also benefiting from public blockchain network development, innovation, developer communities, and network interoperability through Avalanche Warp Messaging (AWM).

Türkçe

Türkçe Español

Español