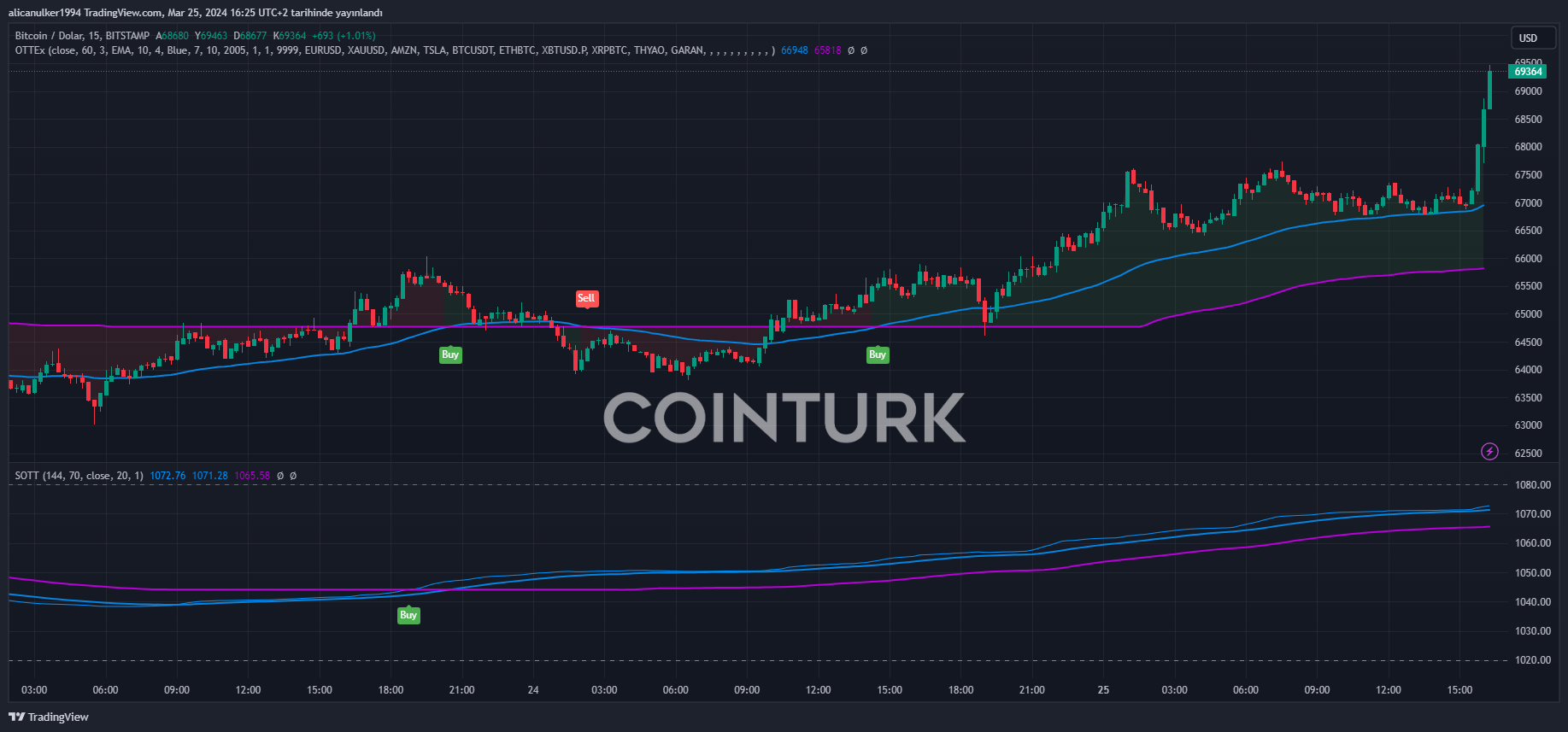

Bitcoin and the cryptocurrency market seem to be going through a volatile period with fluctuations driven by a series of rises and falls. Last week was marked by a full-fledged downturn, while this week started with high recovery expectations from investors, reflecting their hopes. As of the time of writing, Bitcoin has once again made a move on the first day of the week, surpassing its 2021 all-time high (ATH). So, what is happening in the cryptocurrency market?

How Much is Bitcoin in Dollars?

Throughout March, a series of ATHs in cryptocurrencies had captured the full attention of investors, but the subsequent pullback in Bitcoin created great disappointment. The decrease in entries and increase in exits in ETFs, along with the fading excitement of the halving event, led to sharp price retractions.

At the time of writing, on the first day of the week, Bitcoin has just made a significant price move and, after a 3.41% increase in the last hour, climbed to $69,300.

Subsequently, Bitcoin pulled back slightly and continues to trade around the $69,000 level. Meanwhile, with the rise, BTC’s market cap also increased to $1.360 trillion, flirting with the $1.4 trillion mark.

Following the price increase, there was also a rise in the 24-hour trading volume. After the surge, the 24-hour volume stood at $34.3 billion, a 44% increase from before.

Current State of Altcoins

According to Coinmarketcap data, when looking at the top 10 by market volume, excluding stablecoins, Solana (SOL) was seen to have the best performance with a 10% increase over the last 24 hours, rising back to the $192 level.

Following Solana, Binance‘s native token BNB saw a 4.88% increase in the last 24 hours, climbing back to the $590 level.

The weakest performer in the top 10 was XRP. XRP’s price, after a less than 1% increase in the last 24 hours, is at $0.63. Despite the weak increase, XRP’s move away from the critical $0.60 level continues to offer hope to investors.

Another noteworthy event was the price movements of AVAX and TON, which are ranked 10th and 11th in the market. These altcoins performed better than their top 10 counterparts, except for SOL, which had a worse performance.

Türkçe

Türkçe Español

Español