Bitcoin and altcoins generally started the day on a positive note, with prices climbing as Asian investors wake up. If BlackRock (IBIT) sees a net inflow of over $31.3 million in the next few hours, the outflow streak that began on March 18 could end. This could trigger a rise across altcoins.

OP Coin Commentary

As this article is being prepared, the OP Coin price is lingering around $3.8 and continues to be in the green for the day. Bitcoin is at $70,200, and markets are currently green with the expectation that the ETF outflow streak will end. OP Coin’s price had increased by nearly 10% on March 25, which is not satisfying for investors.

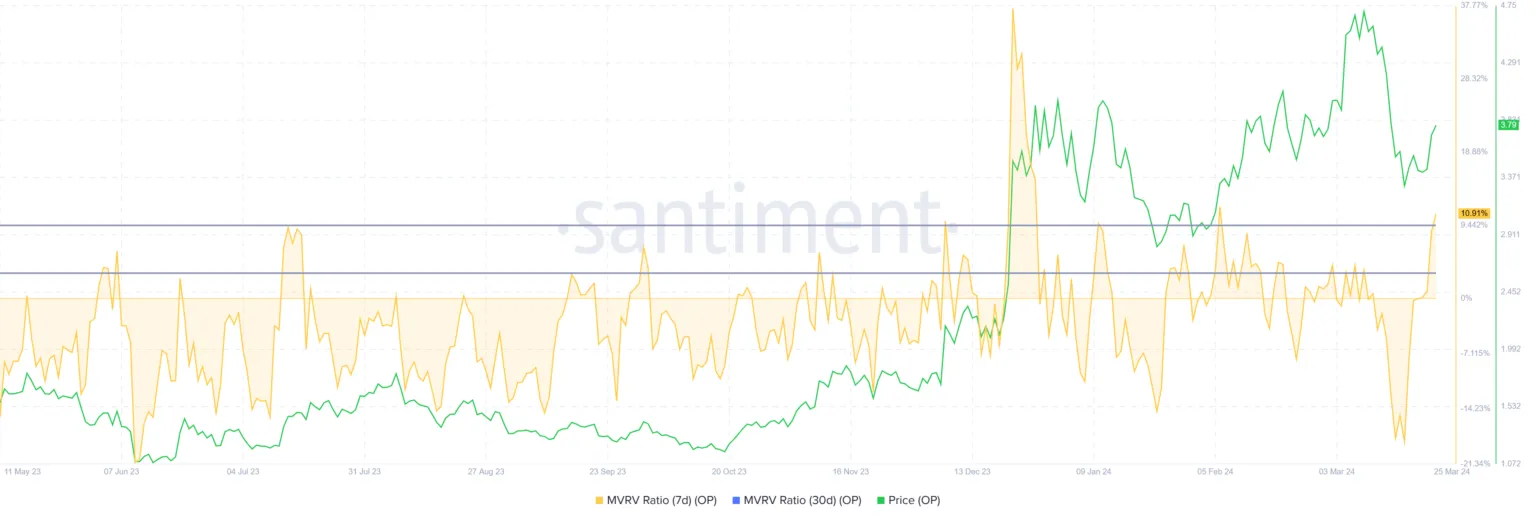

The MVRV ratio is above 10%, yet we cannot talk about the start of high-volume sales. This reflects investors’ expectations for the continuation of the rise. In previous periods, investor profitability between 3% and 9% had led to rapid sales.

The most significant barrier to an upward target is the 95 million OP Coins purchased in the price range of $3.87 to $4.85. If investors can maintain the asset, valued at $361 million, profitably during the rally, new peaks are possible with a BTC price increase.

OP Coin Price Prediction

Besides the optimistic scenario mentioned in the first section, there is also a possibility of a downturn. If BTC does not gain momentum as expected in the coming hours, OP Coin’s price could fall to $3.4. In a scenario where sales accelerate, dips to $3.2 would also be considered reasonable.

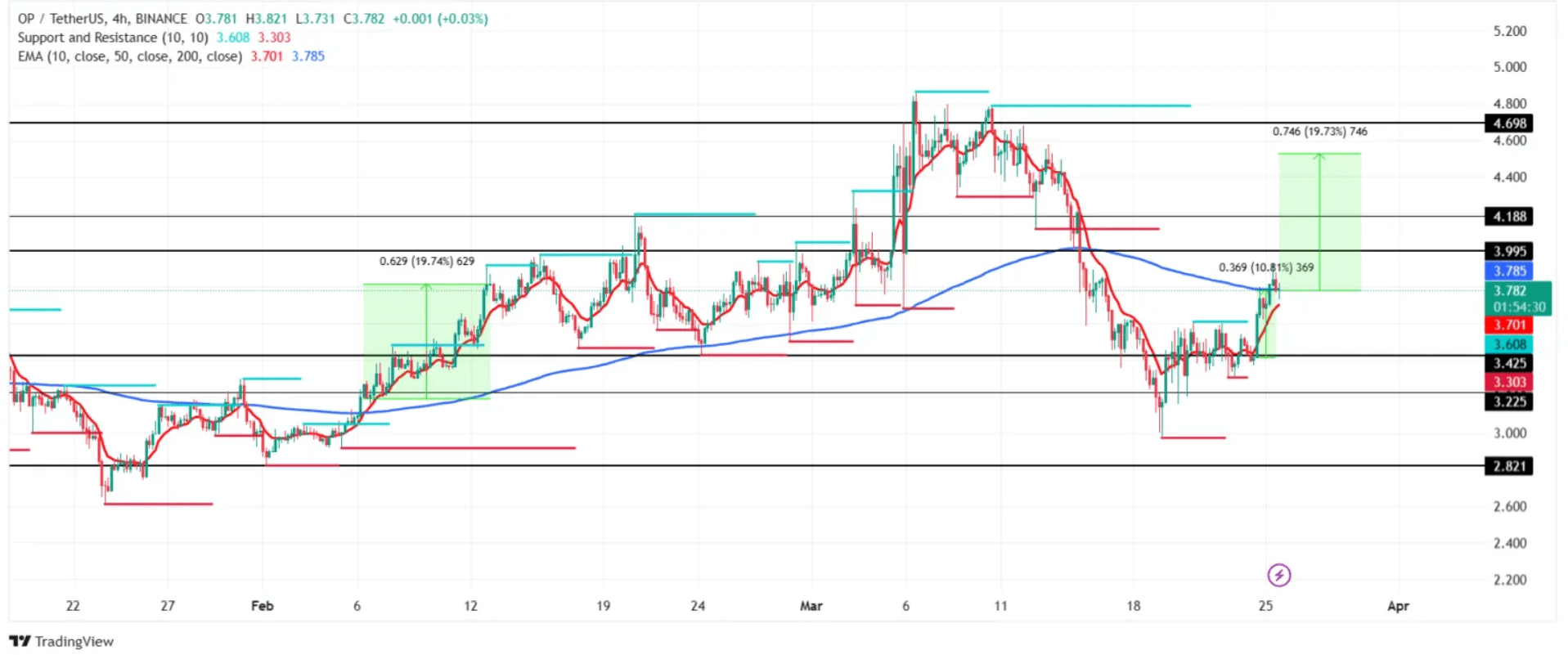

One of the most motivating details for those expecting a rise is the golden cross observed in the 4-hour chart. As we’ve known for years, this pattern is recognized as a harbinger of major rallies. A golden cross occurs when the 50-day Exponential Moving Average (EMA) crosses above the 200-day EMA.

The last time a golden cross was observed, the price of Optimism had increased by approximately 20%. If a similar move occurs this time, the price moving towards $4.5 could turn $4 into support. Since it’s been seen for the first time in two months, the optimistic scenario might deserve a bit more chance. And of course, no one can see the future, so investors should make their own assessments and form their strategies.

Türkçe

Türkçe Español

Español