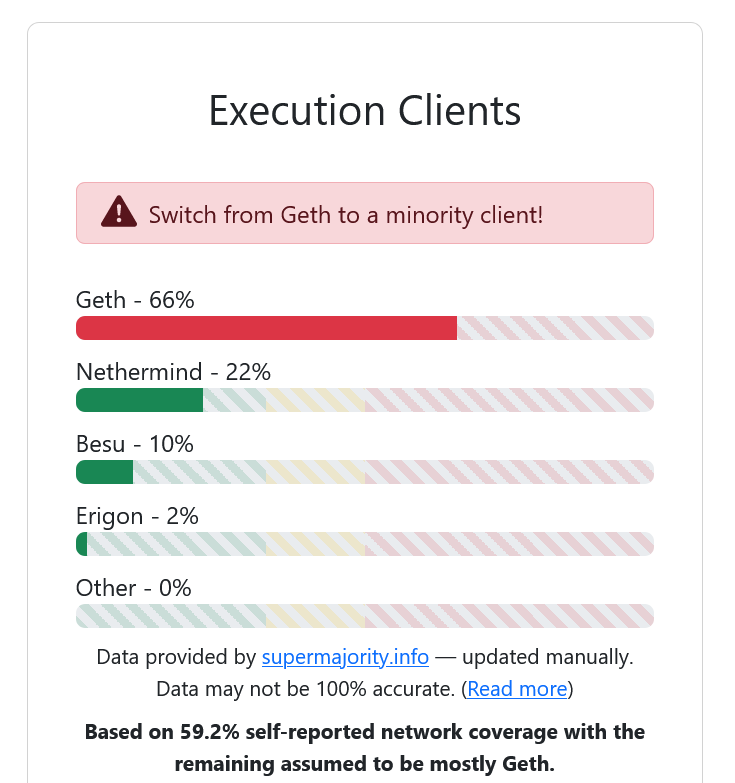

Geth, a major Ethereum execution client, has seen its market share fall from the high of 84% at the end of January to 66% following Coinbase‘s move to transition about half of its validators to Nethermind. However, a commentator suggests the struggle for decentralization is not over yet. The reduction in dependence on Geth helps address the long-feared risk of centralization in Ethereum, while there are concerns that a critical flaw in an execution client with a 66% or greater share could halt the completion of the chain.

What’s Happening in the Ethereum Ecosystem?

Client Diversity reported on March 22 that Coinbase Cloud had moved about 50% of its validators to Nethermind, which helped the execution client’s share rise to 22%. Besu holds a 10% share among Ethereum validators, while Erigon, also supported by Coinbase, has a 2% share, bringing the total minority client share to approximately 34%.

Ethereum’s execution clients play a crucial role in processing transactions and executing smart contracts within the blockchain ecosystem. Geth is widely regarded as the most advanced client. However, its strong preference among Ethereum validators has led to an imbalance in client diversity over the past few years.

Noteworthy Details on the Issue

Lachlan Feeney, founder and CEO of Ethereum infrastructure firm Labrys, commented on the issue, stating that it’s too early to declare victory. Feeney argues that the methodology used by Client Diversity to obtain its figures is flawed and that it’s necessary to move “a reasonable amount” below the 66% threshold before being certain that a supermajority flaw in Geth is impossible.

Feeney added that true victory can’t be declared until no single client holds more than 33% of the share. He emphasized the importance of solo staking in diversifying execution clients, which would also prevent these stakers from being exposed to a supermajority flaw in Geth.

Ethereum decentralization advocate Superphiz recently expressed that a critical flaw in Geth could potentially erase more than 80% of the Ethereum staked on the network. According to Beaconchain data, there are currently 31.5 million Ethereum staked, which is worth approximately 113.5 billion dollars at current prices.

Türkçe

Türkçe Español

Español