Cryptocurrency analysts and researchers, despite a 11.39% decrease in the last 30 days, provide optimistic analyses for the upcoming months based on historical trends for the price of Ethereum‘s ETH. Some researchers believe that even the potential rejection of a spot Ethereum exchange-traded fund (ETF) in the US may not necessarily lead to a price drop.

Spot ETF Rejection May Not Trigger a Downturn

According to Jupiter Zheng, Research Director at Hashkey Capital, the rejection of the anticipated spot Ethereum ETF in the US might not have a downward effect because the market has not yet factored in an ETF approval, and traditional funds have ways to enter the market through spot Bitcoin ETFs. Moreover, Zheng emphasized that the approval of a spot Ethereum ETF could cause a significant short position liquidation, potentially driving the price up.

Data provided by CoinGlass shows that the recent price drop of ETH has led to significant liquidations in both long and short positions. In the last 24 hours, $39.13 million in long positions and $15.66 million in short positions were liquidated. Additionally, a drop in ETH’s price to just $3,250 would trigger approximately $70.96 million in liquidations. Zheng mentioned that this would not significantly affect the current open interest (OI) of $12.89 billion in Ethereum futures.

Furthermore, recent developments, particularly the US Securities and Exchange Commission’s (SEC) investigation into the Ethereum Foundation, have diminished confidence in the approval of a spot Ethereum ETF in May. The SEC’s efforts to classify ETH as a security in 2022 and the subpoenas sent to companies collaborating with the Ethereum Foundation have increased the obstacles to approval.

Post-Bitcoin Halving Could Ignite Rockets

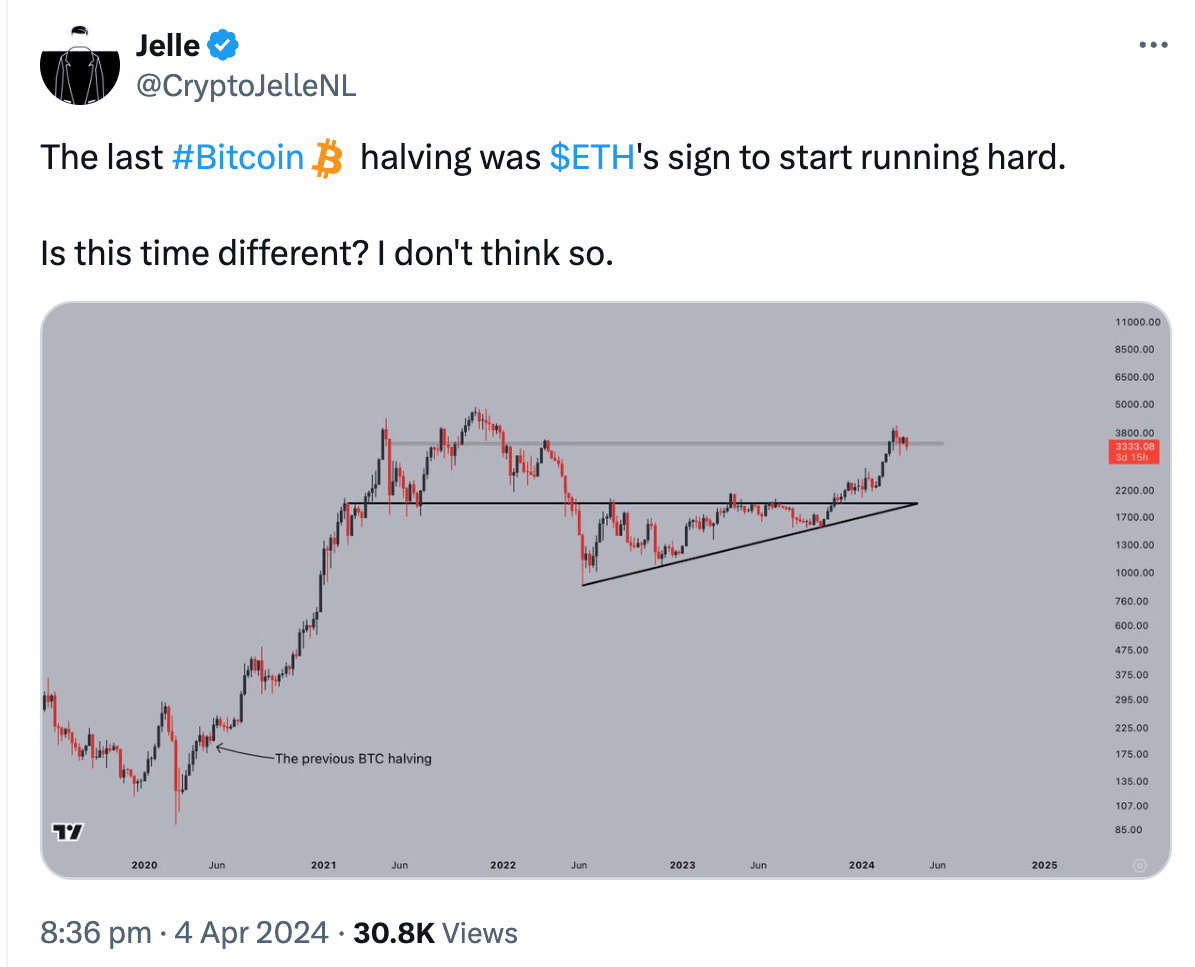

Currently, some analysts have identified patterns in ETH’s price chart that resemble the behavior before the previous Bitcoin block reward halving, leading up to the expected 4th Bitcoin block reward halving on April 20th.

According to experienced cryptocurrency analyst Jelle, the last Bitcoin block reward halving in May 2020 served as a signal for the start of a significant price increase for ETH, which saw a 106% rise in just three months. Jelle added that a clear ascending triangle formation has been forming on ETH’s price chart since June 2023, indicating potential for a rise.