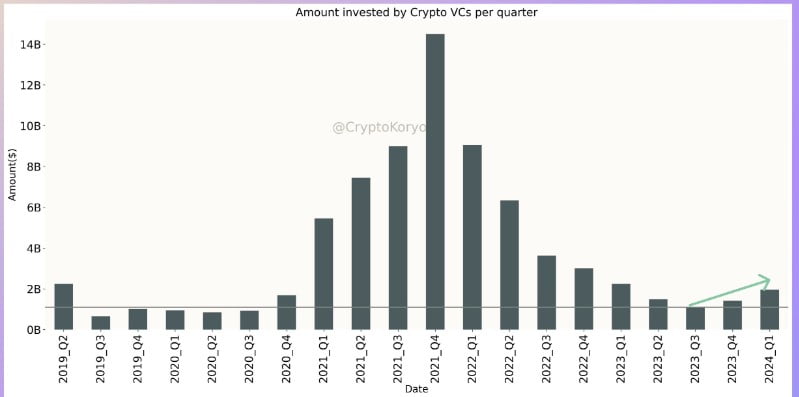

Venture capital (VC) funding directed towards the crypto space has shown a positive change, breaking a two-year decline in the first quarter of 2024. Data analysis platform Crypto Koryo published a report through social media platform X, highlighting that the total amount invested and the number of VC-funded projects have increased since the fourth quarter of 2023. The platform noted a 38% increase in funds invested during the quarter.

Intense Interest from Capital Firms in Cryptocurrency

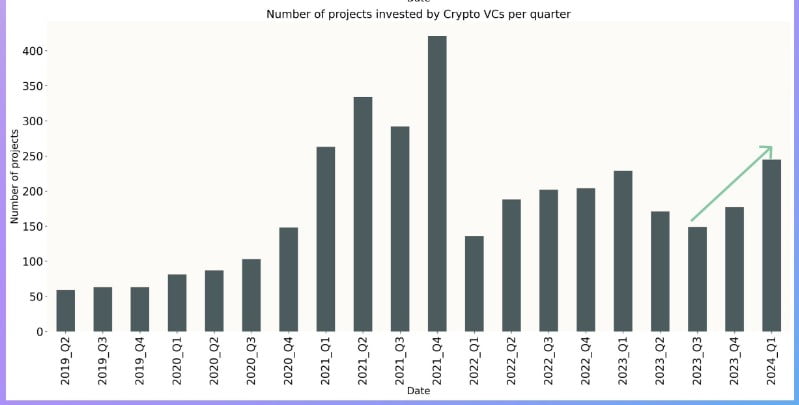

In the related announcement, it was revealed that there was a 49% increase in the number of projects receiving funding. The number of funded projects has not been seen since the fourth quarter of 2021. This indicates that crypto VC funding is on an upward trajectory.

Crypto Koryo believes this could be the beginning of a new process. The analysis platform stated that the recent uptrend shows patterns similar to those before the major VC investments shifted towards the field in the fourth quarter of 2020.

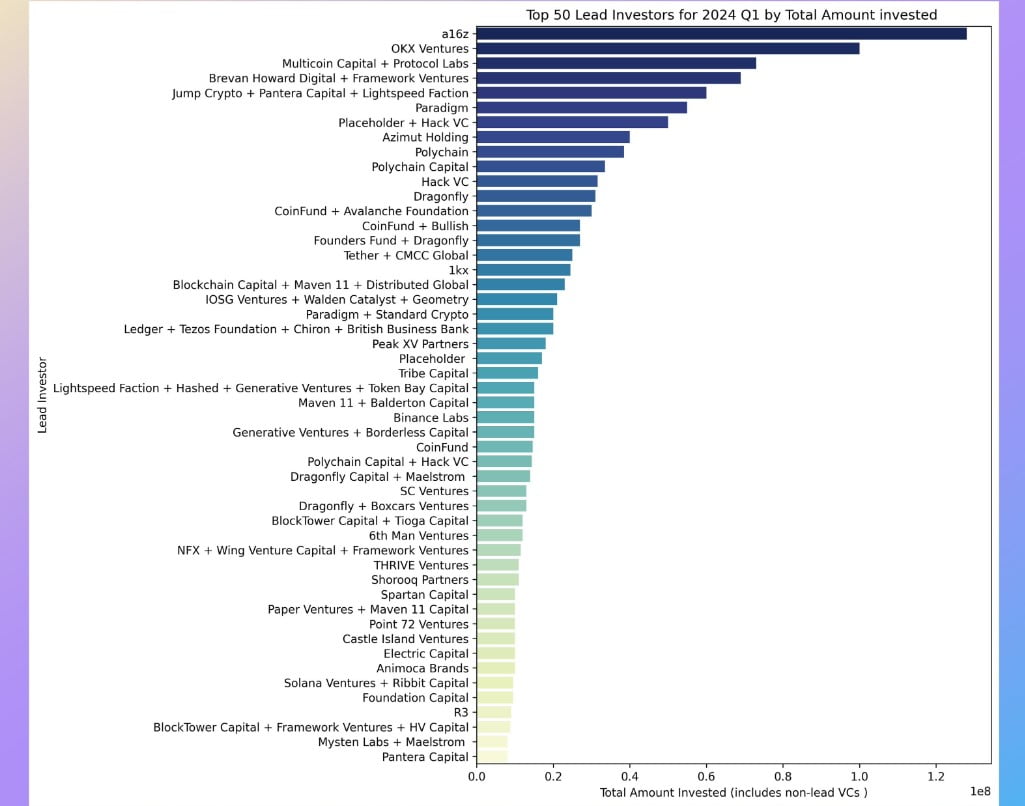

Crypto Koryo also emphasized that, unlike previous quarters where banks and non-crypto VC firms led investments, this quarter saw more interest from crypto-focused venture firms.

What’s Happening in the Crypto Space?

Crypto-focused VC firms like Andreessen Horowitz Crypto, OKX Ventures, Multicoin Capital, Paradigm, and Polychain dominated the funds invested in the quarter. In March alone, crypto VC funds made over $1.1 billion in investments with 180 deals. VC financing in crypto, with investments flowing into infrastructure and decentralized finance projects, increased by 52.5% in March compared to the previous month.

The increase in funding in the first quarter of 2024 follows the upward momentum from the fourth quarter of 2023. Crypto VC investments in the first quarter of 2023 showed a 2.5% increase compared to the third quarter of 2023. This marked the first VC investments in rising crypto projects since March 2022.

Crypto faced a challenging year in 2022, with a decline in venture capital funds flowing into the sector accompanied by bleak market conditions. The year showed consecutive quarterly declines in terms of venture capital investments. However, the recent investment moves are attracting investor attention to various altcoin projects, leading to rallies in the altcoin market.

Türkçe

Türkçe Español

Español