The popular meme token Shiba Inu (SHIB) has been in a phase of pullback and consolidation for the past six weeks. The price movement chart of the cryptocurrency unit does not show any reason for investors to panic. On the contrary, experts believe that a further 15% drop in SHIB’s price could present a good buying opportunity.

SHIB Sees Lower Transaction Fees

A recent report about Shibarium revealed that transaction fees on the network have decreased. This could be concerning as it may indicate a decrease in user activity and a potential drop in demand. The meme token’s 12-hour price chart has shown that the $0.00003 level has been significant since March 15. The bulls in the cryptocurrency made a brief return to support in the last week of March but failed to hold.

The latest jump in the altcoin also stopped just below the $0.00000295 level. The Relative Strength Index (RSI) highlights the indecision in momentum with a reading of 47. The Chaikin Money Flow is similarly uncertain, showing no significant progress above +0.05 or below -0.05 since mid-March. The price movement and indicators of the cryptocurrency suggest that SHIB is in a consolidation phase. The CMF movement could be an early signal of increasing buying (or selling) pressure and an impending SHIB movement in that direction.

What Do the SHIB Data Indicate?

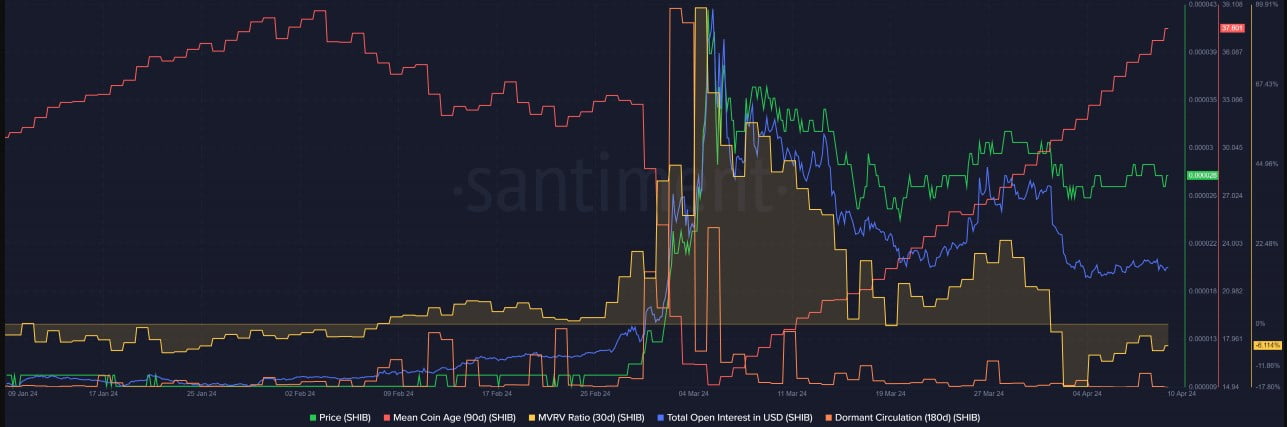

The 30-day MVRV ratio dropped into negative territory earlier this month, which could indicate that the token is undervalued. On the other hand, the average age of the cryptocurrency has shown a strong upward trend since the beginning of March. This could be a strong buy signal, especially as the token strengthens below resistance.

Open interest has also dropped significantly in the last ten days. At the beginning of March, when the average cryptocurrency age was rapidly decreasing, there was a large increase in dormant circulation. Since the mentioned period, dormant circulation has remained quieter. This could be another sign of a lack of significant selling pressure and token movement in recent weeks.

Türkçe

Türkçe Español

Español