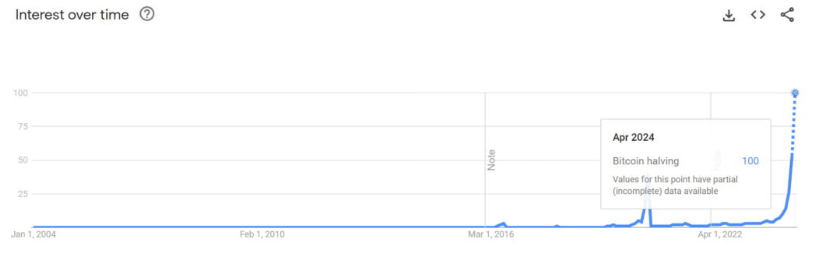

According to Google Trends data, interest in the upcoming Bitcoin (BTC) halving has reached all-time high levels, and the crypto community appears eagerly awaiting this development.

Current Status of Halving Searches

Searches related to the Bitcoin halving on April 14, 2024, have reached a popularity score of 100, the highest level of interest recorded by Google data in Bitcoin’s 11-year history.

This peak level reveals the community’s expectation for a significant event expected to drastically change the supply of Bitcoin.

Despite a 37% drop in search interest since reaching peak levels, current levels continue to show an exceptionally high interest, even surpassing activity recorded at the end of March 2024.

Growing Interest in Halving

Looking back at the historical view of Bitcoin halving events, each halving process has brought about a noticeable increase in price. After the first halving in 2012, the block reward was reduced from 50 BTC to 25 BTC, followed by a significant price increase over the next year.

The second halving in July 2016, which reduced the reward from 25 BTC to 12.5 BTC, coincided with increased popularity and media attention, reflecting investors’ expectations from past halvings and encouraging a price increase in the following year.

Similarly, the 2020 halving reward was reduced to 6.25 BTC, bringing speculative expectations, increased investor interest, and significant price fluctuations. This pattern highlights the major impact of halvings on Bitcoin’s market behavior.

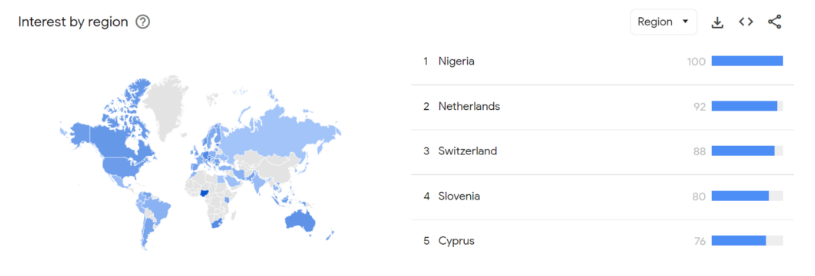

Countries Curious About Bitcoin Halving

Looking at regional interest, Nigeria and the Netherlands stand out with popularity scores of 100 and 92, respectively.

They are followed by Switzerland with 88 points, then Slovenia with 80 points, and Austria and Cyprus with 76 points each.

Bitcoin Price Analysis

Bitcoin reached a daily high of $63,700 before experiencing a strong pullback to $61,500. However, it later recovered and is currently trading at $63,562.

Over the past week, Bitcoin has seen significant declines, experiencing a sharp pullback of 13% and dropping to a level of $60,500.