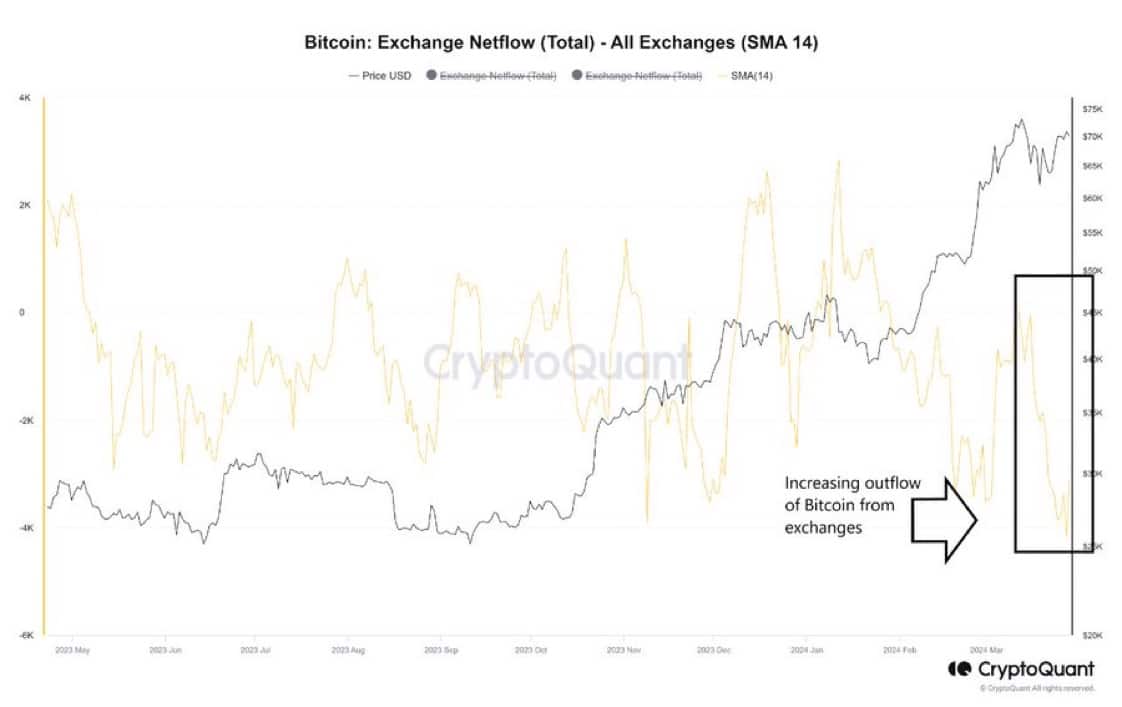

Crypto data platform CryptoQuant recently reported that Bitcoin (BTC) withdrawals from cryptocurrency exchanges have reached record levels. This trend indicates a significant shift in investor behavior and points to a major accumulation phase in the crypto market. Notably, this activity coincides with a recent 10% market downturn, suggesting a potential cooling-off period following previous volatility.

Intensified BTC Withdrawals from Crypto Exchanges

Analysts and industry observers attribute the increased BTC withdrawal transactions from crypto exchanges to various factors, with a prominent theory being the upcoming block reward halving. Historically, before block reward halvings, investors tend to accumulate Bitcoin in anticipation of future price increases. This observed pattern is supported by data from CryptoOnChain, which shows a correlation between increased BTC withdrawal activity and upcoming block reward halvings.

Furthermore, the rise in BTC withdrawals from crypto exchanges underscores an increasing sensitivity among investors regarding Bitcoin’s long-term potential. The ongoing market fluctuations and the accumulation trend highlight the resilience and future expectations of the largest cryptocurrency. As investors position themselves against potential market changes, the rise in BTC withdrawals serves as a significant indicator of evolving market dynamics.

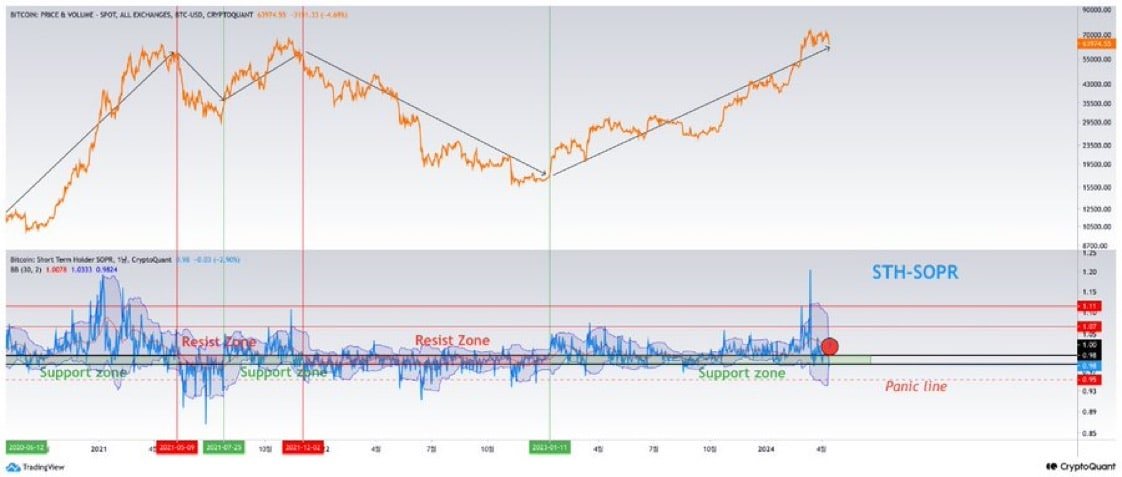

OI and STH SOPR Signal Uptrend

In addition to the increase in BTC withdrawals from crypto exchanges, there is also a notable decrease in leveraged trading activities in the crypto market. Open interest (OI) in derivative exchanges has dropped from 18 billion dollars to 14.2 billion dollars, indicating a significant decline. This reduction in leveraged trading activity suggests a shift towards a more stable market environment.

Analysts view this decrease in leveraged trading activities as a positive sign for market stabilization. After a period of increased volatility and trading activity, the decrease in leveraged positions indicates a rebalancing and stabilization of market dynamics. Additionally, Bitcoin’s Short-Term Holder Spent Output Profit Ratio (STH SOPR) reaching the support zone also strengthens the idea of a potential buying opportunity.

Historically, movements within the STH SOPR have served as leading indicators of market sentiment and price movements. When short-term investors begin to sell their positions, it often precedes periods of price increases and signals potential changes in market dynamics.

Despite positive data flows, Bitcoin’s price struggles to maintain above the $63,000 threshold, with the largest cryptocurrency trading at $62,922, up 0.75% in the last 24 hours.

Türkçe

Türkçe Español

Español