Today at 02:30 TSİ, as Bitcoin‘s (BTC) fourth halving approaches, industry experts evaluated the potential outcomes for miners with the block reward dropping from 6.25 BTC to 3.125 BTC per block. The effects of the block reward halving are drawing significant attention in the cryptocurrency world, with ongoing analyses and predictions regarding its impact on mining operations and broader network dynamics.

Bitcoin Halving Comments

CleanSpark’s Chief Communications Officer Isaac Holyoak summarized the sentiment surrounding the block reward halving most clearly, likening it to a transformative seasonal change. Holyoak highlighted the high excitement surrounding the halving, but emphasized that the practical outcomes will gradually emerge in the coming months, marking a period dominated by strategic adaptation and potential industry consolidation.

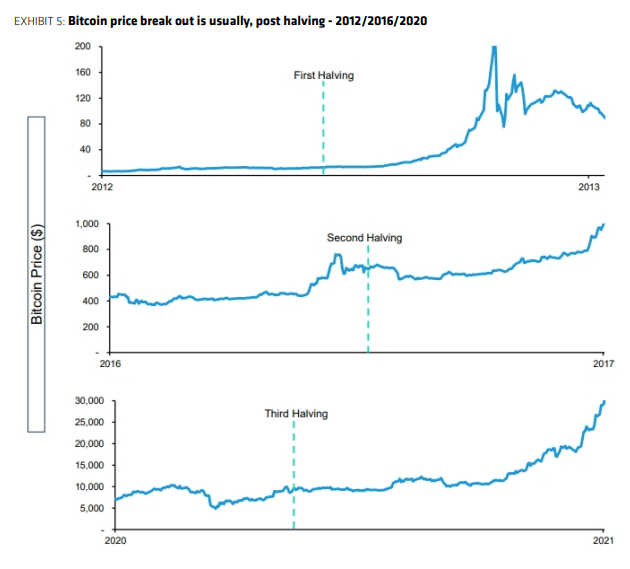

Particularly, Galaxy Mining Co-Chair Brian Wright pointed out the stark contrast between the current block reward halving and the previous one in May 2020. Unlike previous halvings which occurred amidst a market crash due to COVID, Wright noted that Bitcoin’s recent price increase has positioned miners optimally. According to data, the price of the leading cryptocurrency has increased by about 120% in the last six months, with most miners operating near marginal profitability, thus not needing to cease operations post-halving.

Blockstream’s Business Development Manager Adolfo Contreras emphasized that the industry, especially miners who have survived multiple block reward halvings, is prepared for this halving. He highlighted that the significant price increase before the fourth block reward halving has enhanced liquidity planning and operational flexibility in the mining sector.

Despite the preparedness and flexibility shown by some Bitcoin miners, questions remain about the fate of less efficient operations as the block reward decreases. The increase in mining difficulty, a sign of rising competition, underscores the need for operational efficiency and cost management in the post-halving environment.

Including Marathon Digital’s Vice President of Corporate Communications Charlie Schumacher, many industry experts foresee a continuing trend of industry consolidation, with more efficient and well-capitalized miners being ready for the halving. According to Schumacher, less efficient miners facing challenges may see mergers and acquisitions as a way to optimize operations and benefit from economies of scale.

Increasing Importance of Network Activity

Finally, discussions on the revenue impact of mining and expected fluctuations in the network’s hashrate have shifted attention to the changing role of transaction fees in the miner economy. Following the decrease in block rewards, analysts expect increased Blockchain activity and innovative protocols like Bitcoin Ordinals to boost transaction fee revenues and support miners.

Türkçe

Türkçe Español

Español