Ethereum price today increased by 4.25%, reaching approximately $3200 on April 21. The cryptocurrency’s gains reflect upward movements in the crypto market, with the latter’s total market value increasing by 3.5% during the same period. We are exploring the main reasons behind Ethereum‘s superior performance today compared to the broader crypto market.

Why Is Ethereum Rising?

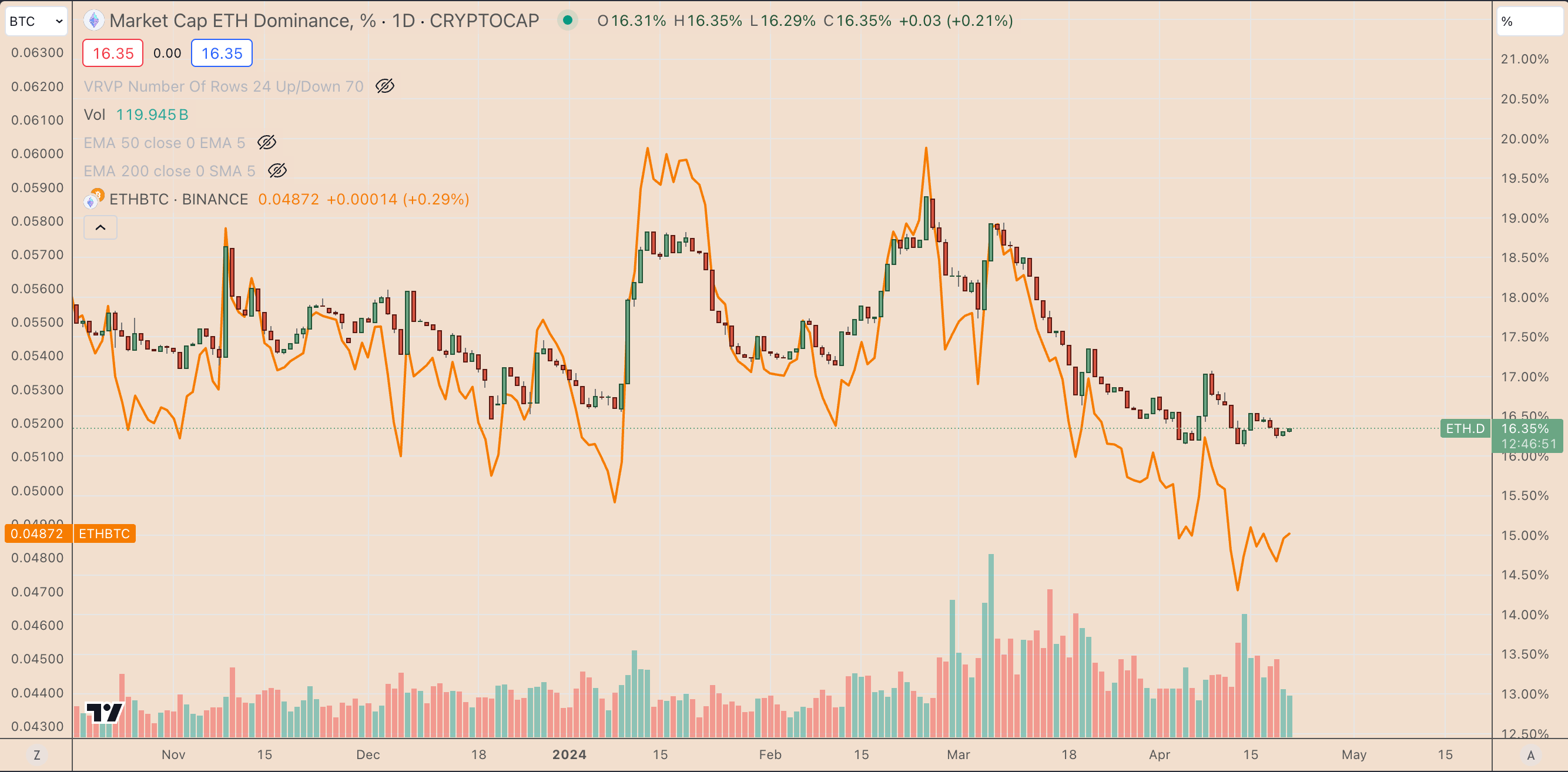

Ethereum’s gains against the US dollar today are largely due to capital inflows from the Bitcoin market. Notably, the ETH/BTC ratio has increased by about 2.5% in the last 24 hours, reaching 0.048 Bitcoin on April 21. Consequently, the Ethereum Dominance Index (ETH.D), which tracks Ethereum’s market strength against the rest of the crypto market, grew by over 1% in the same period.

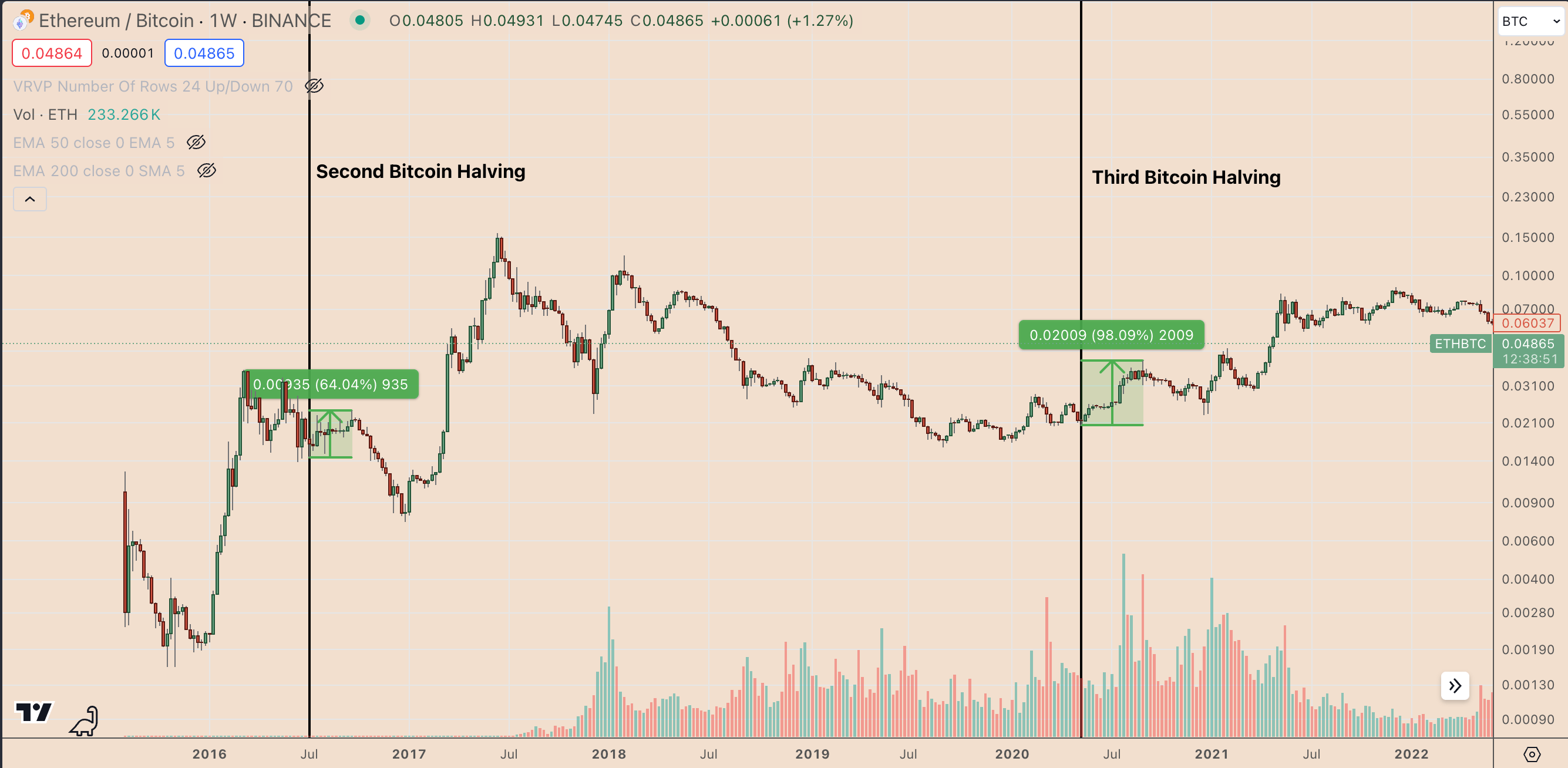

These gains are part of a recovery coinciding with Bitcoin’s fourth halving event on April 19. Since this significant event, the ETH/BTC ratio and ETH Dominance (ETH.D) have increased by approximately 3% and 0.75%, respectively. Historically, the Ethereum market has witnessed increased capital inflows from the Bitcoin market shortly after every Bitcoin halving event. For instance, after the second halving event in July 2016, the ETH/BTC ratio rose up to 64%. Similarly, following the third halving event in May 2020, this ratio saw nearly a 100% increase.

This pattern indicates that investors tend to either sell their Bitcoin assets or reduce their Bitcoin demand when a halving event occurs, as the anticipated price increase is often already reflected in the market. As a result, capital directed from Bitcoin searches for new growth opportunities in other parts of the crypto market, benefiting alternative cryptocurrencies like Ethereum from this shift in investor focus.

Significant Data Points for Ethereum

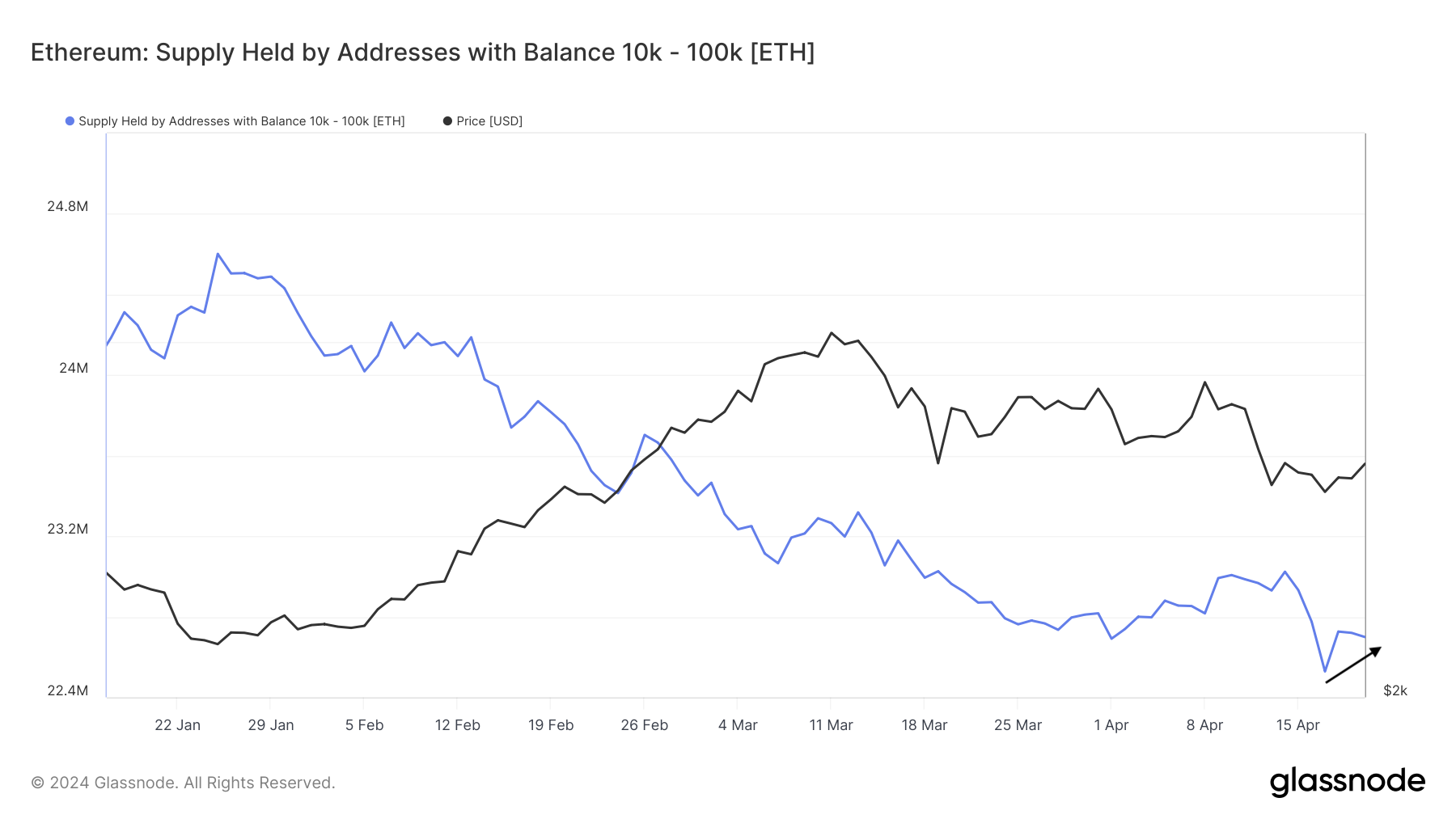

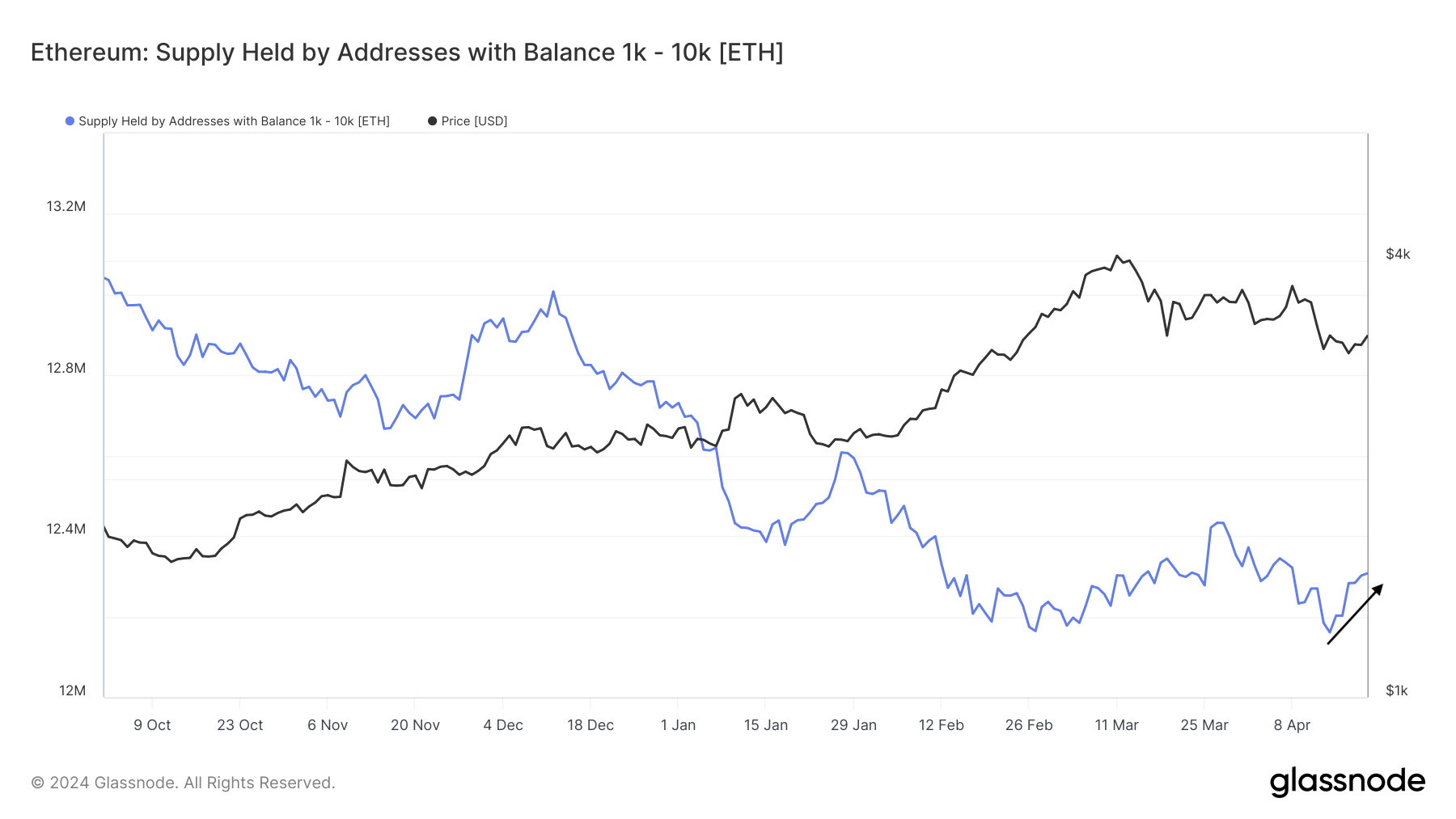

Ethereum’s recent gains occurred just before a period of accumulation among the wealthiest investors, known as whales. According to blockchain data analysis platform Glassnode, the supply of Ethereum held by addresses owning between 1,000 and 10,000 Ethereum increased in the last two weeks.

Similarly, the supply of Ethereum held by institutions with balances of 10,000 to 100,000 Ethereum has also recently rebounded, indicating that whales are returning to the Ethereum market. Interestingly, this accumulation pattern often precedes significant price increases, as witnessed by Ethereum today.