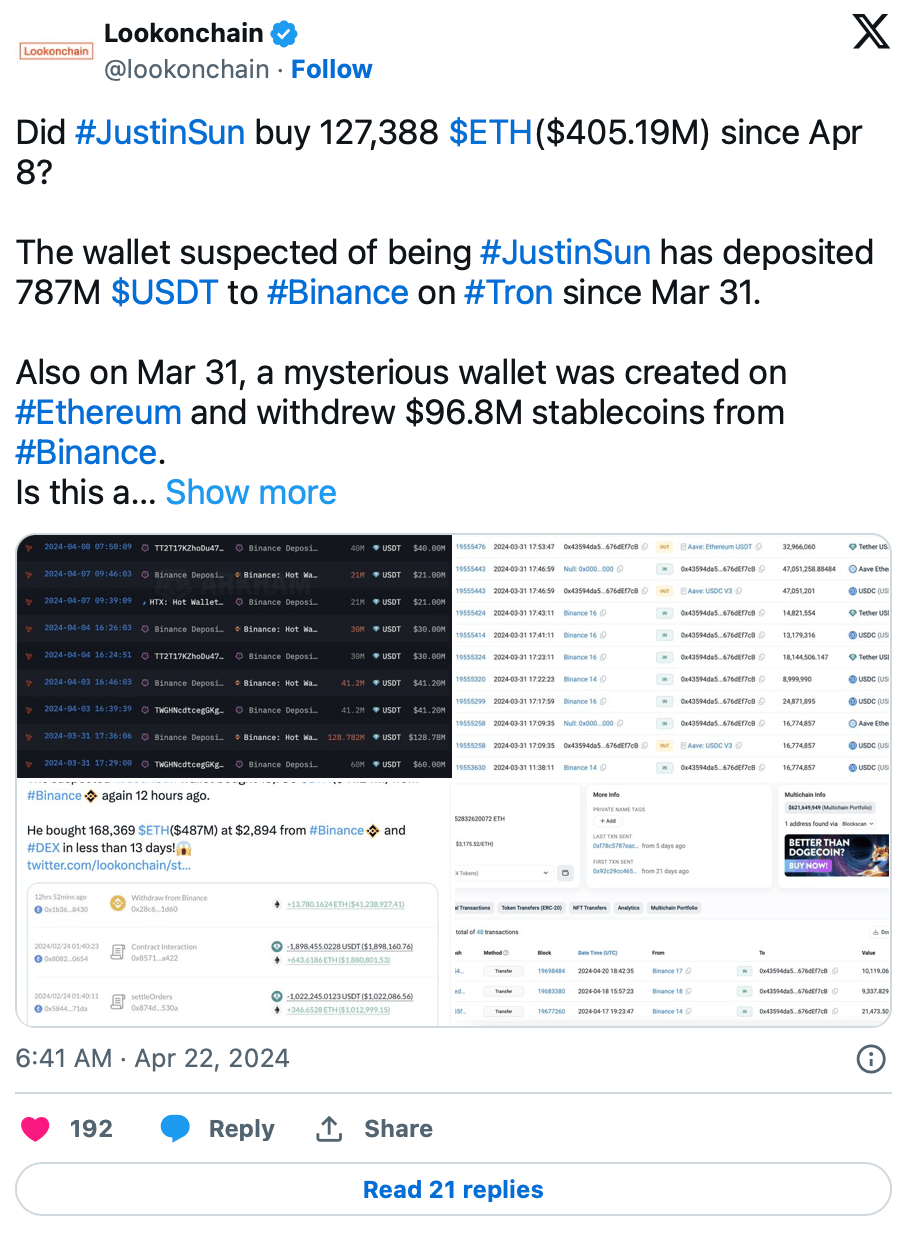

One of the leading figures in the cryptocurrency world, Justin Sun, and his substantial purchase of Ethereum (ETH) has sparked speculation. The on-chain data provider Lookonchain highlighted intriguing transactions in a wallet suspected to be associated with Sun. According to the data, since April 8, Sun has accumulated approximately 127,388 ETH, valued at around $405.19 million.

Collected 295,757 ETH at an Average Price of $3,014 Each

The flow of 787 million USDT from the Tron network to Binance starting on March 31 from this wallet is particularly noteworthy. Simultaneously, on the same date, a mysterious wallet appeared on the Ethereum Blockchain, withdrawing $96.8 million worth of stablecoins from Binance. Subsequently, this wallet began purchasing ETH from both Binance and decentralized exchanges, accumulating a total of 127,388 ETH valued at $405.19 million, at an average price of $3,172 per ETH.

These actions show significant similarities to transactions carried out in a wallet previously associated with Sun, which started holding 168,369 ETH worth $487 million between February 12 and February 24. If these wallets are indeed connected to Sun, the total ETH holdings from purchases made since February 12 from Binance and decentralized exchanges at an average price of $3,014 would amount to $891 million worth of 295,757 ETH.

ETH Price Analysis

Current observations of ETH’s price movement suggest an upward trajectory. Currently, ETH is trading at $3,226, with a market cap of $387 billion, marking a 1.58% increase over the last 24 hours. The analysis of the hourly chart for the ETH/USD trading pair indicates a significant breakthrough due to surpassing two interconnected declining trend lines at $3,070 and $3,150.

Currently, ETH indicates a bullish trend as it maintains its position above the 100-hour Simple Moving Average. While a significant resistance level exists at $3,200, key barriers at $3,250 and $3,280 could propel ETH’s price to $3,350 and potentially higher levels.

Conversely, failure to surpass the resistance at $3,250 could lead to a downward trend. In such a scenario, support around $3,150 is expected, while further declines could potentially increase selling pressure, driving the price down to $3,020 and possibly to $2,965.

Türkçe

Türkçe Español

Español