Ripple, today prepares to present an opposition summary against the SEC. The payment company will respond to the regulator’s demand for a $2 billion penalty. This development has drawn attention as XRP has risen above the $0.50 level it struggled with last week. The market is keenly anticipating how the company will respond to the SEC’s $2 billion penalty claim.

Ripple to Respond to SEC

On Monday, the price of XRP rose to $0.54 before Ripple presented its opposition summary to the SEC. This rise reflects expectations of how Ripple will defend against the regulator’s claims. Particularly, the allegations made by the SEC against the company and the potential penalty amount are of critical importance.

XRP holders are closely following the developments in Ripple’s legal battle with the SEC. These developments are among the significant factors that could directly affect the price of XRP. The opposition summary presented by the company will influence market players’ expectations for the future.

Ripple CEO Brad Garlinghouse, recently expressed optimism about the company’s expansion plans and the utility of XRP in an interview. However, uncertainties about how the SEC case might affect the company’s future continue.

XRP Prepares to Test $0.60 Resistance Level

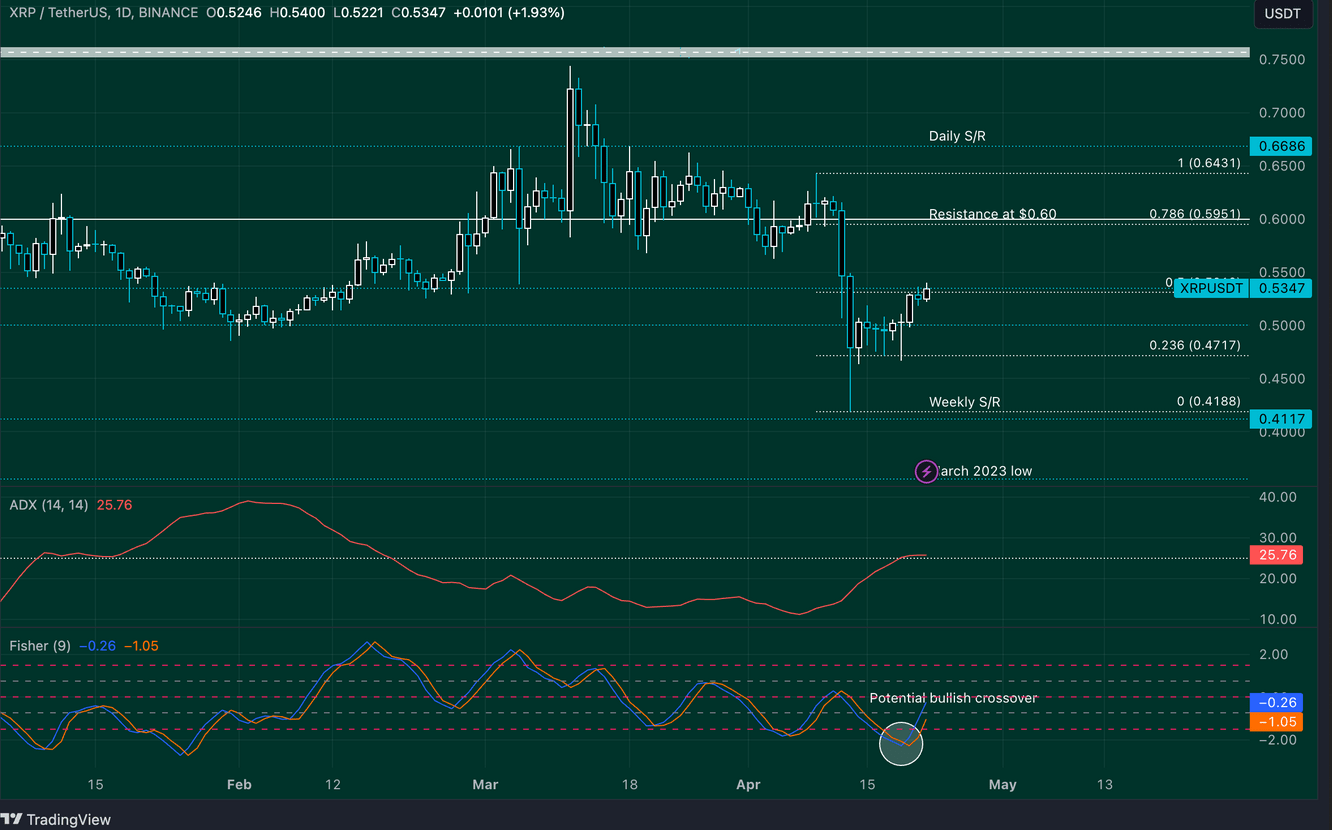

XRP has overcome the $0.50 resistance level after a week of broad consolidation. Altcoin, has gained 25% in value since April 13, recovering from its lowest level of $0.4188. The next key resistance will be the psychologically important levels of $0.60 and $0.6431 from April 9.

XRP reversal in the uptrend has been confirmed by the Fisher Transformation Indicator. This technical indicator highlights when prices are excessively volatile. It also helps investors identify turning points in the price of an asset. The move above the transformation signal line indicates a potential reversal in the uptrend and a good time for buyers on the sidelines to purchase XRP.

When Will the Bullish Thesis Be Invalidated?

The Average Direction Index (ADX), commonly used to determine the strength and direction of a trend, is at 25.76. An ADX above 25 indicates a strong trend. Both indicators support the recovery in XRP prices and the thesis of a reversal in the bullish trend.

However, a daily candlestick closing below the $0.50 level could invalidate the bullish thesis. XRP could find support at its lowest level of $0.4188 from April 13 or at a significant support level of $0.4117 on the weekly price chart, which has been strong since March 2023.

Türkçe

Türkçe Español

Español