Ethereum could face over half a billion dollars in liquidations of long positions in the futures market if it experiences the same price volatility as last weekend. This development comes at a time when concerns are increasing that the U.S. Securities and Exchange Commission (SEC) might reject an application for an Ethereum spot ETF fund next month.

Pay Attention to This Process for Ethereum

CoinMarketCap data shows that at the time of writing, Ethereum is trading at $3,134. Over the past few weekends, there has been an increase in volatility in Ethereum’s price, followed by a quick rebound to fundamental support levels.

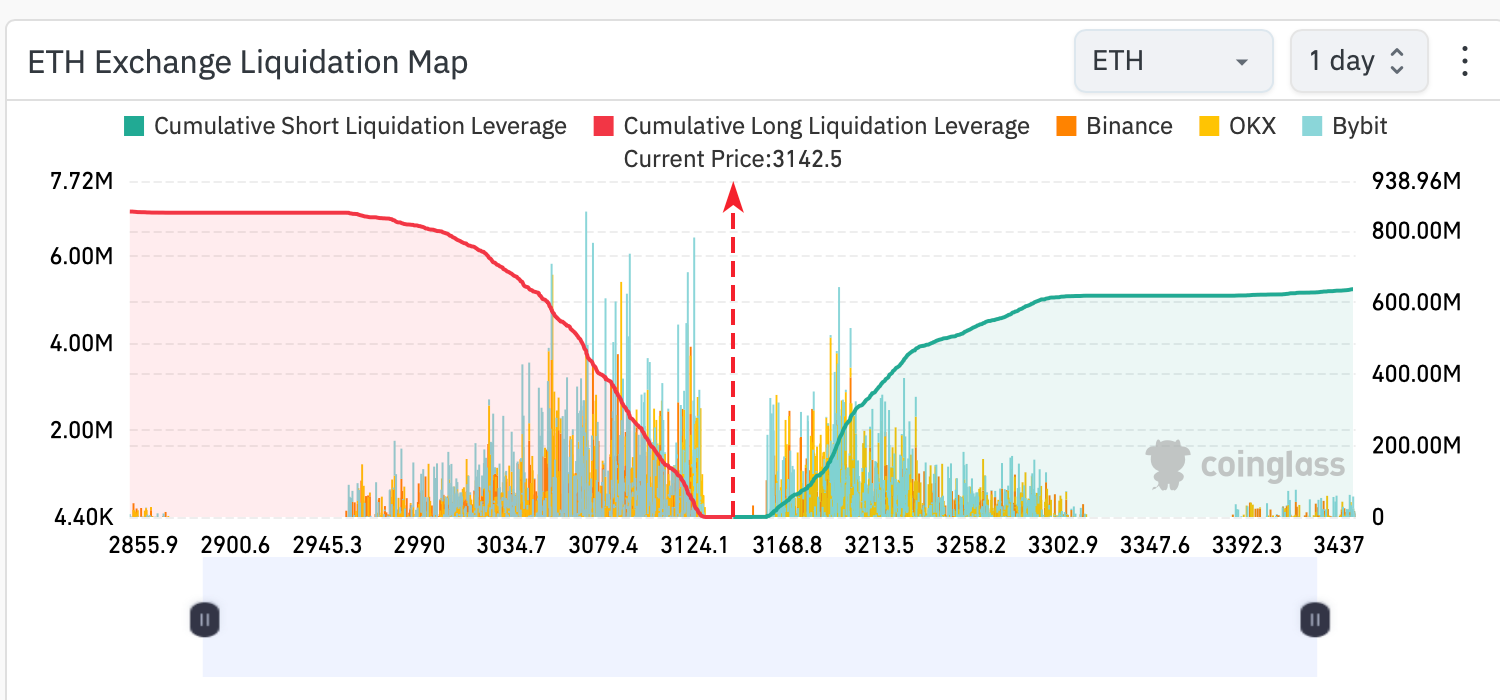

On April 20th, the price briefly fell by 2.25% to $3,036 and on the previous Saturday, April 13th, it fell by about 9% to $2,950 before rising to $3,075. If this process repeats this weekend, it could face a significant amount of liquidation risk.

According to data from blockchain data analytics firm CoinGlass, a similar 2.25% drop at current prices could lead to $510 million in losses from long position liquidations in the futures market. Meanwhile, a sharper drop similar to the previous weekend’s 9% could erase $853 million from the market.

What’s Happening with the Ethereum ETF Process?

The high volume of potential liquidations in the futures market emerges amid broader uncertainties concerning Ethereum’s legal challenges and the status of spot ETF applications. As of April 24th, U.S. issuers and other firms attending recent meetings expect the SEC to reject spot Ethereum ETF applications next month.

The recent meetings between issuers and the SEC were one-sided, and the agency’s staff did not address significant details of the proposed products. Meanwhile, on April 25th, it was revealed that software development company Consensys sued the SEC and its five commissioners, alleging plans to regulate Ethereum as a security.

Türkçe

Türkçe Español

Español