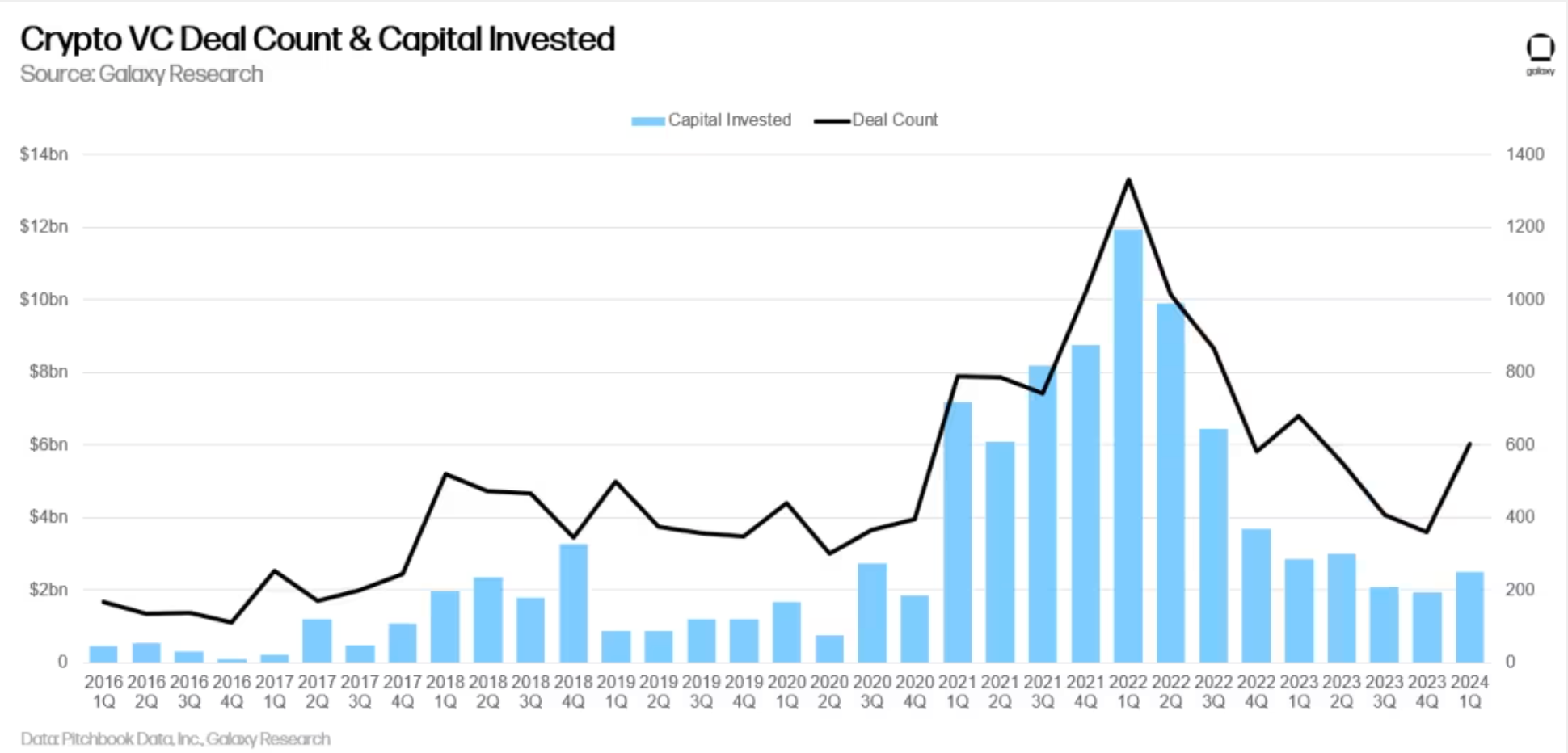

After three consecutive quarters of decline, crypto and blockchain ventures witnessed a significant rise in venture capital investments. According to data compiled by Galaxy Research, investors participated in 603 deals amounting to $2.49 billion in the first quarter of 2024; this represents a 29% increase in financing and a 68% increase in the number of transactions compared to the previous quarter.

Investments in Crypto Companies Continue

The report indicates that a sustainable recovery needs to be confirmed by growth in subsequent quarters, adding:

“This was the first increase in both capital invested and the number of transactions in the last three quarters; it might have indicated that the fourth quarter of 2023 was the bottom, but continued quarterly increases and a more significant rise in the coming quarters will confirm this.”

Various factors influenced this quarter’s investment dynamics, including the introduction of Bitcoin exchange-traded funds, buybacks, modularity, and Bitcoin Layer-2 solutions, as well as macroeconomic factors like interest rates.

The historical correlation between Bitcoin prices and venture capital investments in crypto weakened last year. The report mentions that despite significant price increases in Bitcoin, venture capital activity remained sluggish until the recent rise at the beginning of 2024. However, investment levels are still not comparable to those reached when Bitcoin previously exceeded $60,000.

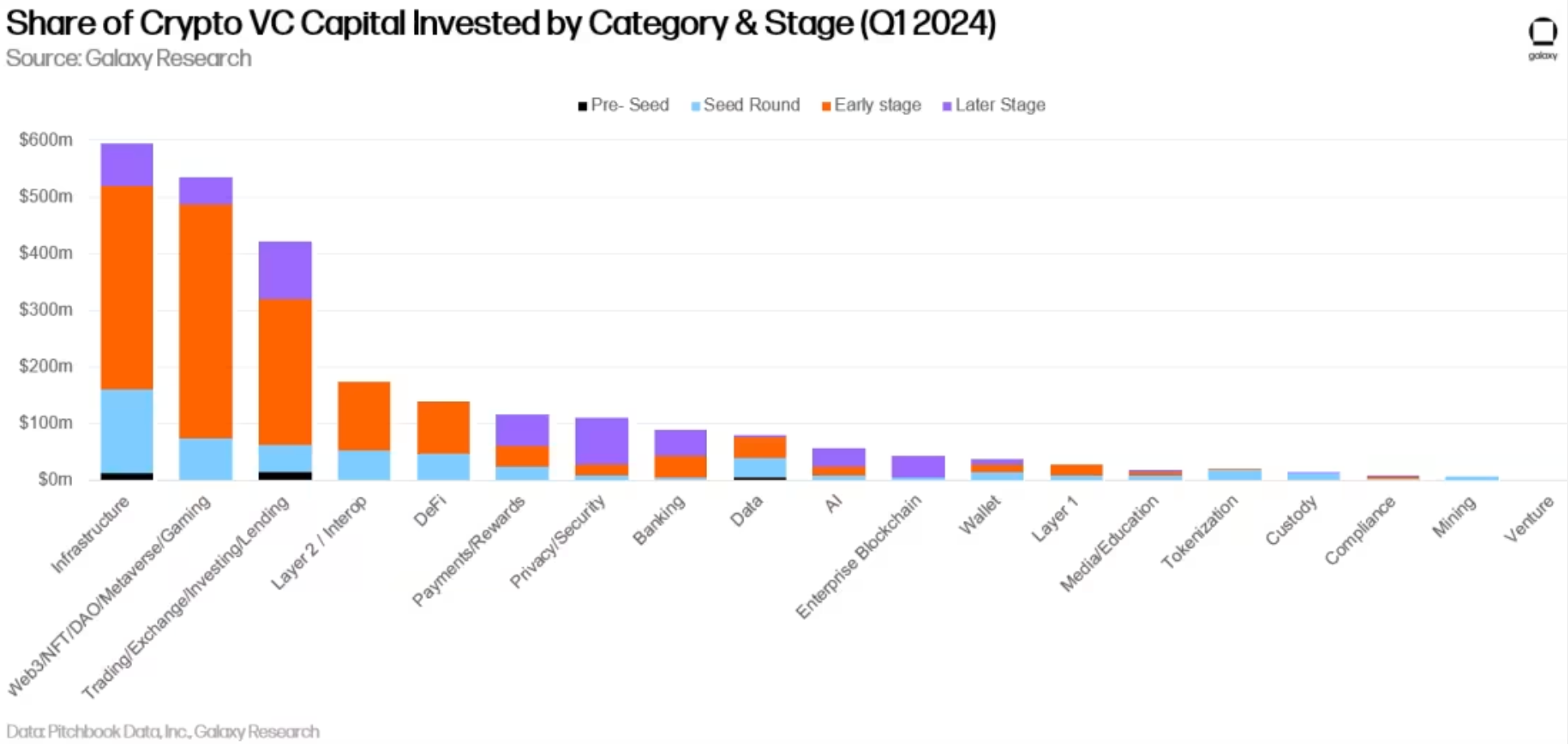

Additionally, 80% of the capital invested this quarter was allocated to early-stage ventures. In contrast, Galaxy noted that companies in later stages faced more challenging conditions because most of the larger general venture capital firms either left the sector or significantly reduced their investments.

Noteworthy Details

The infrastructure sector, including a $100 million financing round by EigenLayer, dominated the quarter’s total capital, accounting for 24% of it. Additionally, Web3 and other sectors captured 21% and 17% of the total capital, respectively.

Geographically, the U.S. continued to be a dominant force in the crypto venture space; American startups were involved in 37.3% of all deals and captured 42.9% of the invested capital. Singapore, the UK, Switzerland, and Hong Kong followed with 10.8%, 10.2%, 3.5%, and 3.2% of the total deal count, respectively. Furthermore, Galaxy noted that macroeconomic conditions and regulatory uncertainties continued to create a challenging fundraising environment:

“At the start of 2024, investors generally believed that rates would significantly decrease throughout the year, but strong inflation data during the first quarter softened expectations for rate cuts this year, helping to maintain a challenging fundraising environment for venture capitalists.”

Türkçe

Türkçe Español

Español