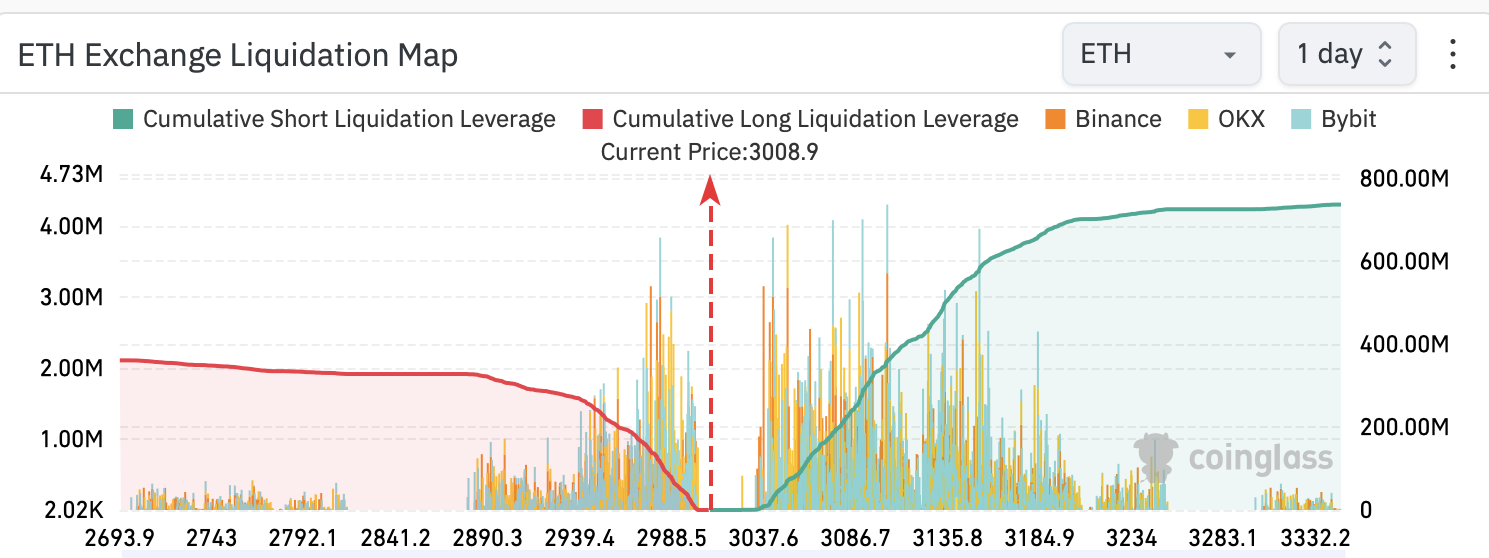

Following Grayscale Investments’ withdrawal of its Ethereum futures exchange-traded fund (ETF) application, investors have begun to heavily short, or sell off, Ethereum (ETH). Data indicates that a mere 3% recovery in ETH’s price would result in the liquidation of $345 million in short positions.

Surge in Short Selling of ETH

Ethereum investors have increased their short positions in the last 24 hours after Grayscale’s withdrawal of its Ethereum futures ETF application. According to CoinMarketCap, ETH has fallen by 1.85% in the last 24 hours, trading at $3,010, which is close to a critical support level at $3,000.

Moreover, the liquidation map shows that investors believe the price will drop in the short term. A 3% price increase would liquidate $345 million in short positions, while a 3% drop would liquidate $237 million in long positions at $2,920.

The increase in short sellers of ETH came just three weeks before Grayscale’s decision to withdraw its Ethereum futures ETF application on May 7th, ahead of the SEC’s decision. Additionally, whether Ethereum will be classified as a security and the fate of spot Ethereum ETFs will be determined by the end of this month.

SEC Expected to Reject Spot Ethereum ETFs

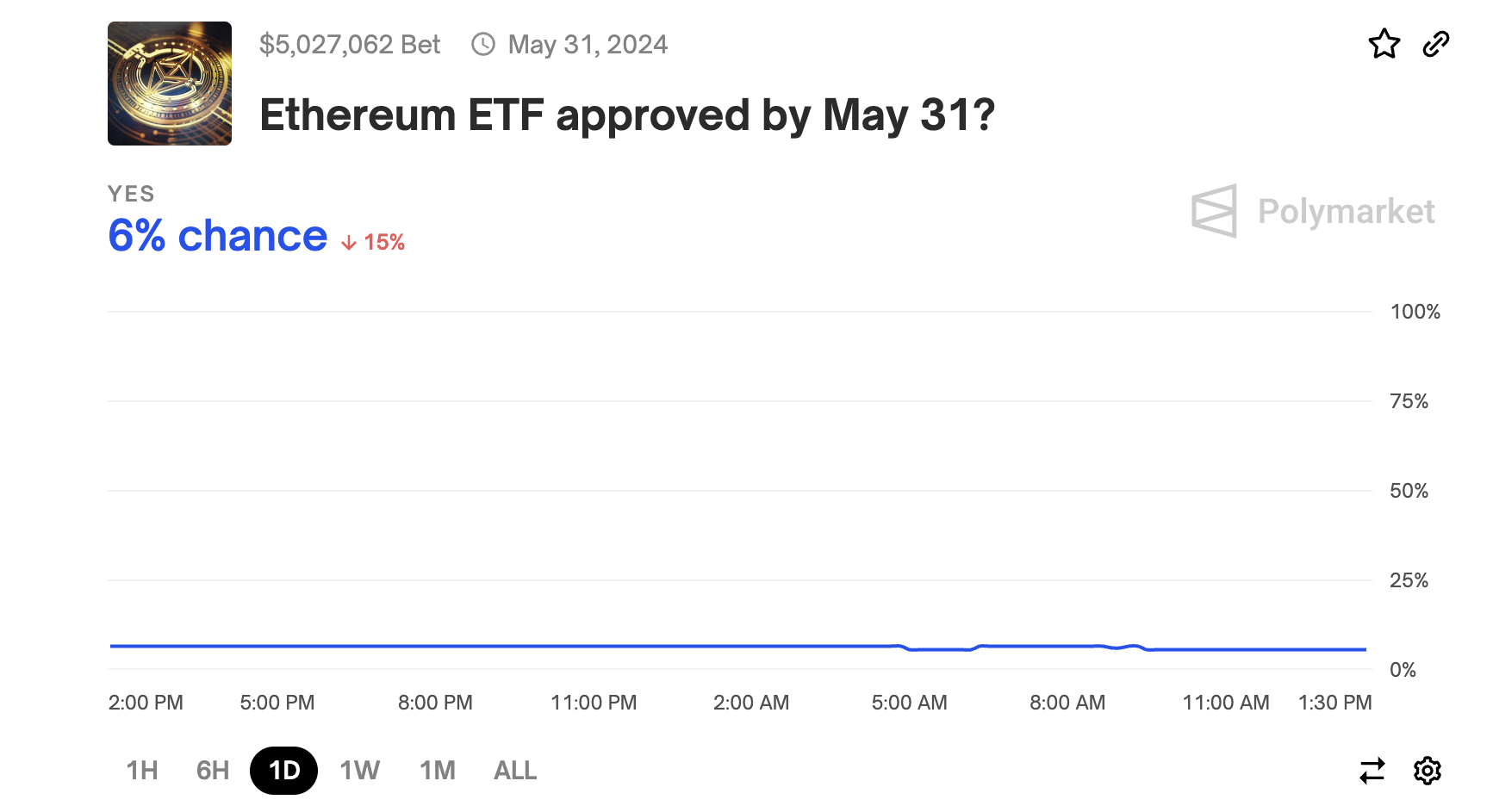

Although expectations were high at the beginning of the year, analysts are becoming increasingly skeptical about the approval of spot Ethereum ETFs in the US as the May 23rd date approaches. The sentiment in the cryptocurrency world is similar. Participants on the New York-based crypto prediction platform Polymarket believe with 92% certainty that the SEC will reject the spot Ethereum ETFs.

Additionally, there is general concern about Ethereum’s overall usage and the lack of speculative interest from short-term investors (STH). On-chain analyst James Check, also known as Checkmatey, stated on social media platform X on May 7th, “The usage of the Ethereum network is currently so low that token burning mechanisms cannot meet the issuances to validators.”

Crypto data platform Glassnode reported on May 8th that Ethereum’s underperformance this cycle compared to Bitcoin is due to a “measurable delay in speculative interest from the STH cohort.” However, just a few days before the news, some investors were optimistic that ETH’s price could break out by the end of the year. Anonymous crypto analyst Ash Crypto told his followers on May 6th, “A similar fractal from the fourth quarter of 2020, according to the historical model, could break out in the third quarter of 2024.”

Another anonymous crypto analyst, TheCryptoPalace, commented on ETH, stating, “Ethereum is currently moving within a falling wedge pattern and is testing a significant support area. Horizontal movement around this support area can be expected,” emphasizing consolidation.