Bitcoin price is fluctuating due to many factors and has recently been under more pressure on the macroeconomic front. It is also important not to forget the SEC’s anti-crypto moves. The SEC is making it extremely difficult for crypto companies as it seeks to lay the groundwork for rejecting an Ethereum ETF. So, what are the current predictions for BTC, DXY, and SPX?

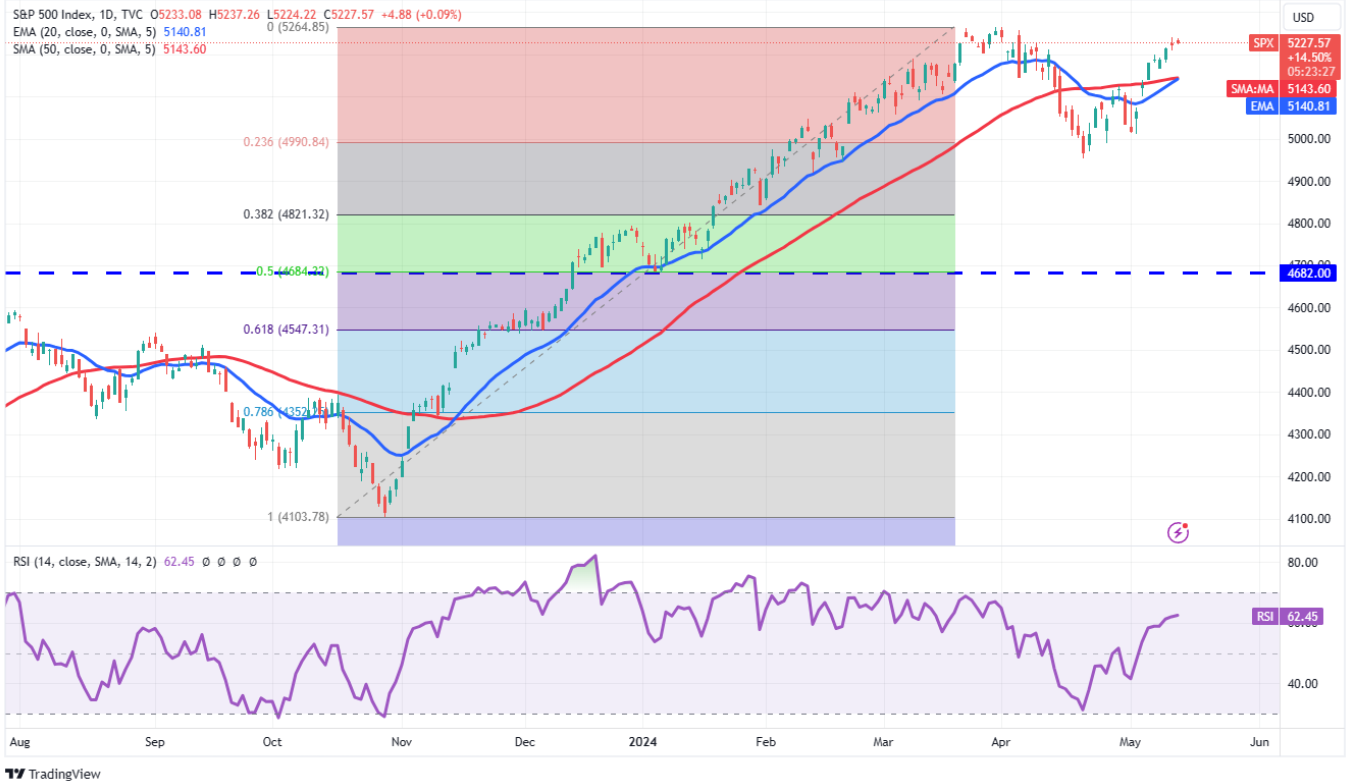

S&P 500 Index Commentary

The 20-day exponential moving average (5,140) is upward sloping and RSI is positive. If the 5,265 level is exceeded, we could see the index running towards 5,500. This is of course supportive for cryptocurrencies as there is a positive correlation. Bears will likely try to stop the rise at the resistance level and if successful, they will target the 4,950 level.

DXY Chart Commentary

The Dollar Index has a motivating outlook. When the index exceeds 105, pressure increases and rallies do not last long. If the inflation data on Wednesday also comes out positive, it could open up a bit more play area for risk markets. A strengthening dollar is quite risky for Bitcoin and other risk assets.

The target for the index is the 104 level and with closures below that, 103 will be targeted. A bounce from the 104 level, representing the 50-day SMA, could push the dollar index to 106.5 and beyond. Still, despite predictions of the Fed‘s interest rate cuts dropping to as low as 2 annually, the index has not reached feared levels.

Bitcoin (BTC)

Bitcoin‘s recovery at the $60,000 level is motivating, but more is needed. As mentioned above, inflation data could play a key role here. Even if temporary, market expectations of 3 or more rate cuts this year would be highly supportive for Bitcoin.

Bulls have been unable to consistently keep Bitcoin above the 20-day EMA ($62,671) and at the time of writing, the price is at this threshold. If successful, we could see the BTC price moving to $65,456 and from there to $73,777. If inflation has not decreased in April, then it’s time to prepare for new lows after $59,600 and $56,500.

Türkçe

Türkçe Español

Español