Bitcoin price is frustrating, and today’s US Producer Inflation data indicates the Fed‘s job is still tough. Even though BTC reached ATH with the ETF approval as crypto investors dreamed, things got complicated afterward. The halt in the decline of inflation and the SEC becoming more aggressive on crypto set the stage for the ongoing dull environment. So, what are the predictions for Solana (SOL)?

Solana (SOL)

At the time of writing, the SOL Coin price is at $146, and Bitcoin has dropped below $62,000 again. Although the price spiked to $61,151 with the PPI data, it returned to its starting point, and if tomorrow’s data is also bad, recovery might not be easy.

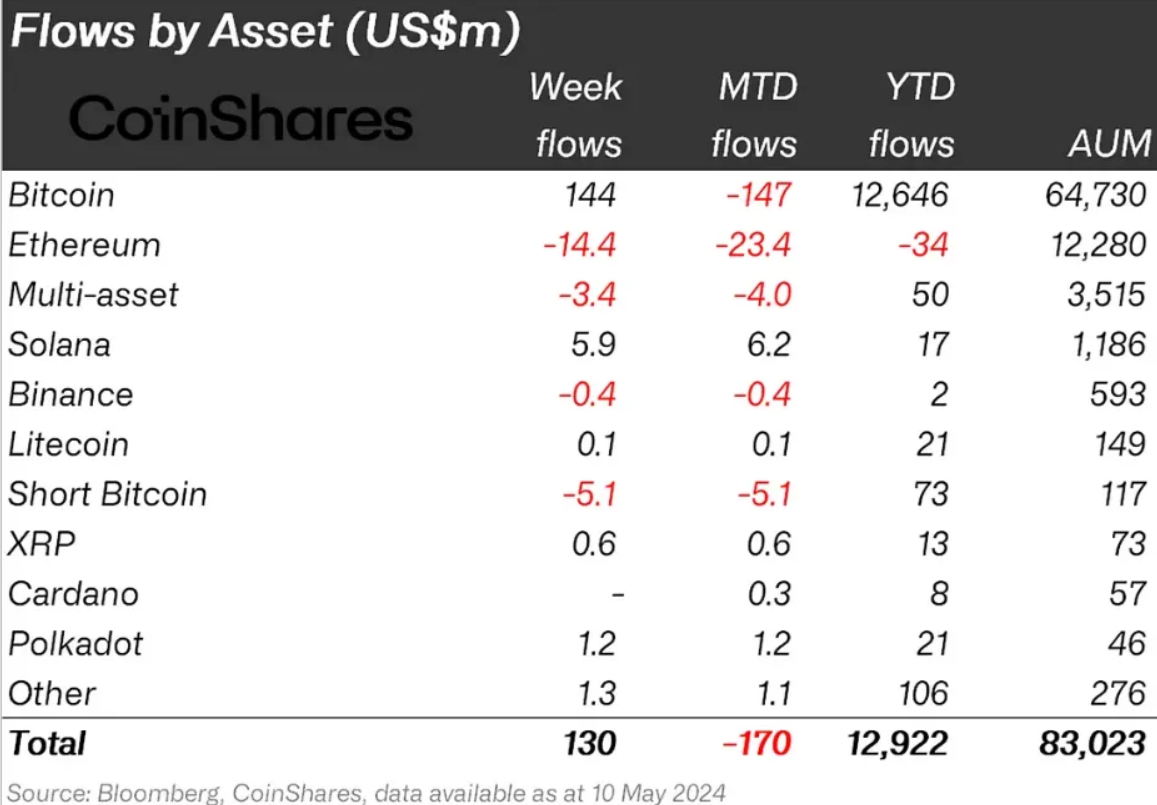

So, what is the situation on the Solana front? The year 2023 and the first quarter of 2024 were quite good for SOL Coin. The price was even very eager for a new ATH level, but BTC sales prevented this. The latest CoinShares report shows that institutional interest in SOL Coin increased with the recent drop.

Institutional investors, taking advantage of the falling price, bought $6 million worth of SOL Coin ETP last week. SOL Coin, which saw the highest weekly inflow, increased its net flow from $11 million to around $17 million. Although other assets have recorded much larger flows since the beginning of the year, they have not performed as well as SOL Coin.

SOL Coin Price Prediction

Solana (SOL)’s RSI is also above the neutral zone, which is promising for a rebound. If the expected jump occurs after testing the 50 level, we might see a new rally supported by the increase in institutional demand. The SOL Coin price, which has been fluctuating between $126 and $156 for roughly a month, has made three attempts to surpass the peak point. It should also be noted that the fourth attempt in such scenarios often brings a breakout.

In a positive scenario, SOL Coin could turn $160 into support and extend its move towards the peak points beyond $169. However, if the attempt fails or tomorrow’s inflation data is bad and triggers sales, a drop to $126 is likely.

Türkçe

Türkçe Español

Español