Apollo’s Co-Founder made a captivating prediction that Bitcoin (BTC) could rise to $5 million. This bold forecast came amid increasing institutional interest and significant market developments poised to elevate Bitcoin’s value to unprecedented levels. Reflecting the bullish sentiments recently expressed by Michael Saylor, Apollo’s Co-Founder identified the “holy trinity of bullish catalysts” nearing completion, which he believes sets the stage for the most remarkable price surge in Bitcoin’s history.

The Holy Trinity of Bullish Catalysts

Apollo’s Co-Founder reiterated MicroStrategy CEO Michael Saylor’s recent emphasis on increasing institutional interest in Bitcoin, repeating his bold prediction that Bitcoin could rise to $5 million. Leading Bitcoin advocate Saylor described the convergence of the “holy trinity of bullish catalysts” as an indication that the necessary conditions for such a remarkable price surge are almost in place.

Saylor highlighted the growing institutional interest in Bitcoin by stating, “Wall Street wants Bitcoin, the House of Representatives wants Bitcoin, and now the Senate wants Bitcoin.” These comments reflect a significant shift in the acceptance and adoption of Bitcoin among major financial and governmental institutions, supporting the mainstream asset narrative for the largest cryptocurrency.

The first critical factor summarized by Apollo’s Co-Founder is the approval of spot Bitcoin Exchange Traded Funds (ETFs). Such approval offers investors a simple and regulated way to invest in Bitcoin, likely bringing a substantial influx of capital into the cryptocurrency market. According to him, the increased accessibility and legitimacy provided by spot Bitcoin ETFs could attract a wide range of investors, from individual to institutional, significantly boosting Bitcoin’s market value.

The second factor is the Financial Accounting Standards Board’s (FASB) work on implementing fair value accounting rules for digital assets. These rules will allow companies to report their Bitcoin holdings at fair value, reflecting real-time market prices. This transparency will reduce the risk of holding digital assets on balance sheets and provide a clearer picture of financial health, potentially encouraging more institutions to invest in Bitcoin.

Lastly, Apollo’s Co-Founder emphasized that major financial institutions offering custodial services and lending against Bitcoin as collateral will further legitimize Bitcoin as a valuable asset class. This development will increase liquidity and provide a more robust financial infrastructure for Bitcoin investors. These services will integrate Bitcoin into traditional financial systems, facilitating institutional adoption and investment in Bitcoin, thereby increasing demand and driving up the price.

Current Status and Technical Indicators of Bitcoin

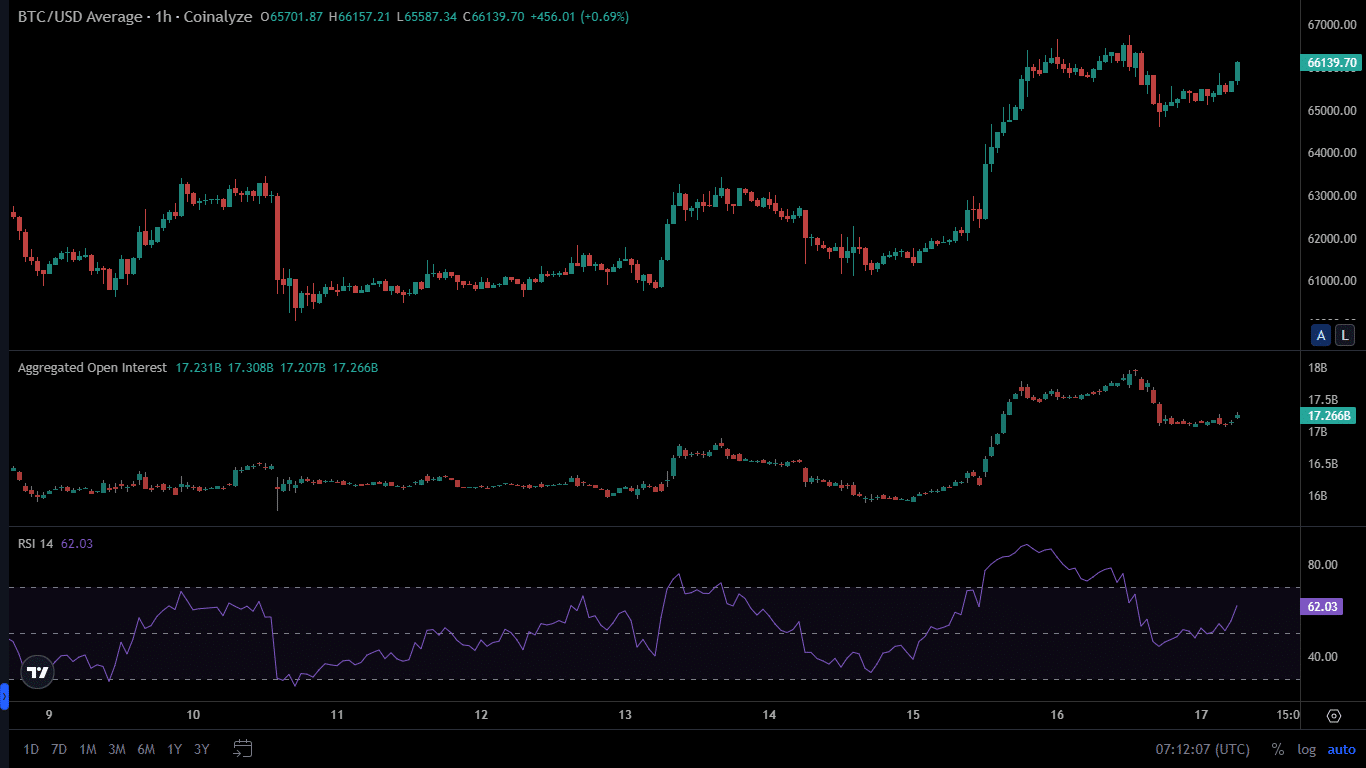

Bitcoin has shown an upward trend in recent weeks, consistently finding strong support above the $60,000 level. This strong foundation has set the stage for the anticipated upward movement towards the resistance level at $70,000. BTC is currently trading at $65,666 following a slight correction from the resistance level around $66,700, with a market value of $1.2 trillion.

Technical indicators further reinforce the optimistic outlook for Bitcoin. The Relative Strength Index (RSI) shows above-average values at 62.04, indicating potential buying pressure in the market. On the other hand, the Moving Average Convergence/Divergence (MACD) indicator showed a bearish trend last week, signaling the potential start of a new bear market phase. However, the 20-SMA and 50-SMA are showing an upward trend, with the 20-SMA providing strong support for Bitcoin’s price.

Türkçe

Türkçe Español

Español