Fantom’s (FTM) price has shown a tremendous increase in the last few days, but the altcoin is currently considering a potential correction. This is largely due to FTM holders showing potential to sell their assets for profit. Fantom’s price rallied 23% in two days to bring the altcoin to a critical resistance block.

What Is Happening on the Fantom Front?

While this process has encouraged many new investors to join the network, it may have triggered a different sentiment among existing holders. The Market Value to Realized Value (MVRV) ratio supports this. The MVRV ratio measures the investor’s profit and loss, and Fantom’s 30-day 14% MVRV indicates profitability, which could trigger sales. In the past, FTM corrections occurred in the MVRV range of 7% to 21%, known as the danger zone.

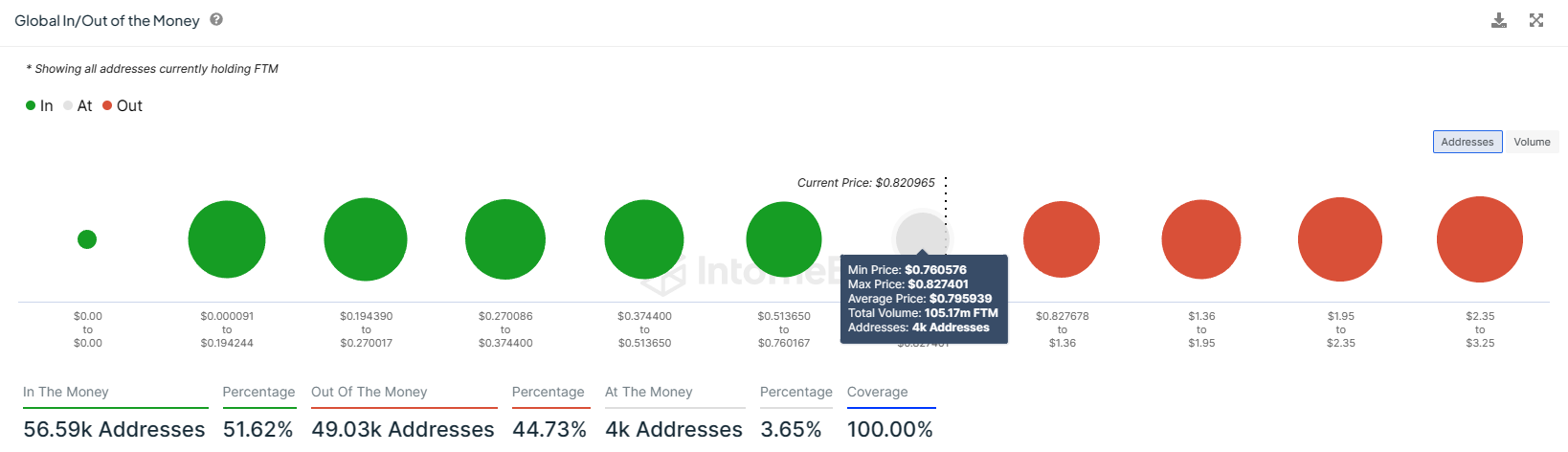

Fantom is vulnerable to this situation, and investors are already waiting for the opportunity to sell. The fact that approximately 105 million FTM is on the verge of becoming profitable also clearly shows this. According to the Global In/Out of the Money (GIOM) indicator, when Fantom’s price crosses the $0.82 threshold, there will be an increase in supply worth $84 million. This is because the supply was purchased between $0.76 and $0.82. Naturally, since FTM holders have been waiting for profit for about a month, they may soon turn to selling.

FTM Chart Analysis

Fantom’s price, trading at $0.80 at the time of writing, is in the resistance block between $0.80 and $0.88. This range has proven to be solid resistance and support in the past, and FTM failed to break through this range three times last month.

Currently, FTM is testing the lower limit as support, and a rise to $0.82 could trigger selling among investors. As a result, Fantom’s price may take a hit and potentially be based on $0.80 as support. This process will send the altcoin back to consolidation between $0.63 and $0.80.

However, if investors prefer to hold the asset and not sell, Fantom’s price may continue to rise and potentially break through the resistance block completely. Turning this into support will invalidate the bearish thesis and result in an increase above $0.90.

Türkçe

Türkçe Español

Español