In the cryptocurrency world, XRP has recently faced selling pressure. Despite a 2% increase in XRP price last week, the downward trend in the charts worried investors. This article examines indicators that could shape XRP’s price in the near future.

XRP’s Bearish Outlook Raised Concerns

Data shows that XRP‘s momentum has slowed. XRP price showed marginal movement in the last day. Currently, XRP is trading at $0.5236 with a market cap exceeding $29.3 billion. This price stagnation emerged as the bearish pennant formation, which appeared in mid-April, continued to be a significant feature on XRP’s daily chart.

A bearish pennant formation typically indicates the potential for further price declines. If XRP’s price falls below the lower trendline of this formation, it could signal a significant drop, potentially bringing the price down to $0.47.

Santiment Data Indicated Decline

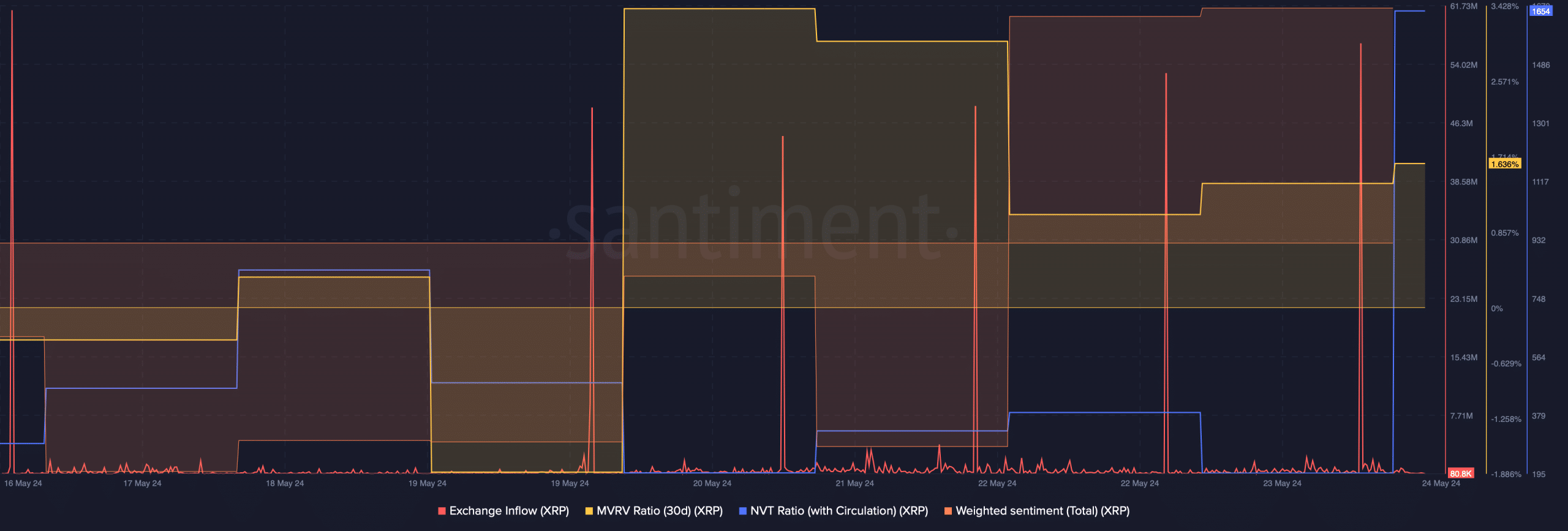

Santiment’s data highlighted several metrics that reinforced the bearish outlook. One of these metrics was the increase in XRP’s exchange inflow last week, indicating increased selling activity as investors moved their tokens to exchanges. This rising selling pressure shows that many investors are abandoning XRP, which usually signals an impending price drop.

Additionally, XRP’s NVT (Network Value to Transactions) ratio showed a sharp increase. A high NVT ratio typically indicates that the asset may be overvalued, suggesting a likely price correction. Similarly, the MVRV (Market Value to Realized Value) ratio also showed a downward trend, which is another bearish indicator.

Optimistic Metrics Also Present

Despite these bearish signals, some metrics pointed to a more optimistic outlook for XRP. For instance, the weighted sentiment for XRP increased, reflecting growing confidence among investors and a generally bullish trend in the market. This positive sentiment could somewhat counterbalance the bearish indicators.

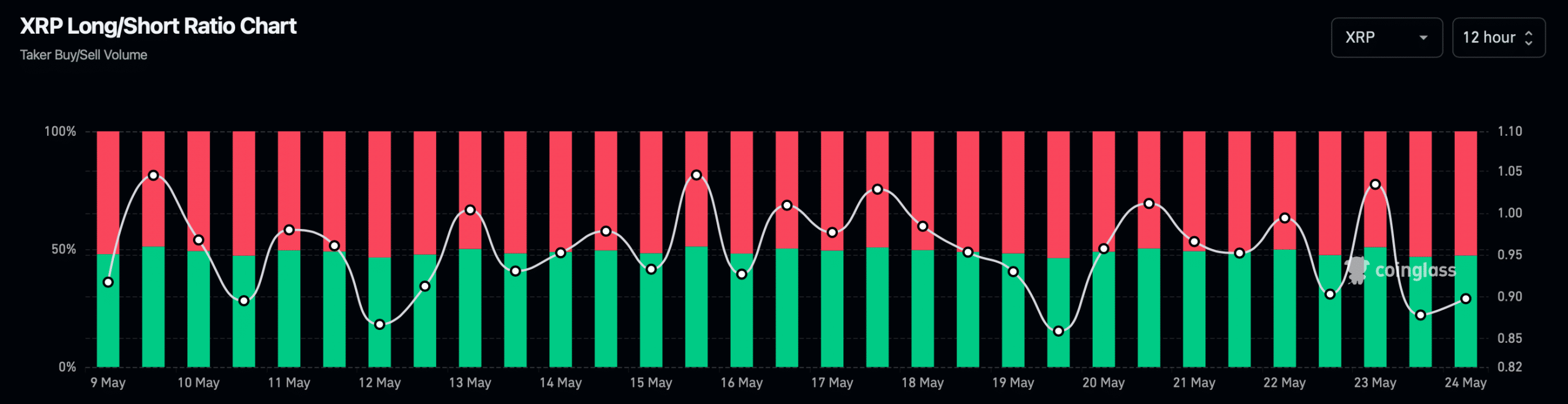

Moreover, data from Coinglass showed an increase in XRP’s long/short ratio in the last 12 hours. A higher long/short ratio indicates that more investors are betting on XRP’s price to rise, which can be seen as a bullish signal.

Market Uncertainty Could Affect XRP Price

Chaikin Money Flow (CMF) showed an upward trend following a recent decline, indicating capital inflow into XRP. Similarly, the Money Flow Index (MFI) showed a bullish trend, emphasizing buying pressure and a potential price increase.

If these bullish indicators persist, XRP might avoid testing the bearish pennant formation and continue its upward trajectory. In this case, the price could target $0.544, where liquidation levels would rise, potentially triggering a price correction due to high liquidation activity.