Ethereum (ETH) investors were excited last week as the leading smart contract platform’s price once again exceeded $3.9k. However, ETH couldn’t maintain its momentum and quickly fell from this level. Additionally, whales took the opportunity to accumulate more ETH.

Expert Opinion on ETH

ETH experienced a rapid rise last week, surpassing $3.9k on May 27. However, as its value dropped, bears took advantage of the situation. The approval of the ETH ETF last week did not provide significant growth for the cryptocurrency. According to CoinMarketCap, ETH fell by over 1% in the past seven days. At the time of writing, the token was trading at $3,759.66 with a market cap of over $451 billion.

A popular cryptocurrency analyst, Ali, shared a tweet highlighting a notable increase in Ethereum addresses holding over 10,000 ETH recently. This increase in address numbers may indicate that whales are moving from the distribution phase to the accumulation phase. A look at Glassnode data pointed to another metric indicating an increase in accumulation.

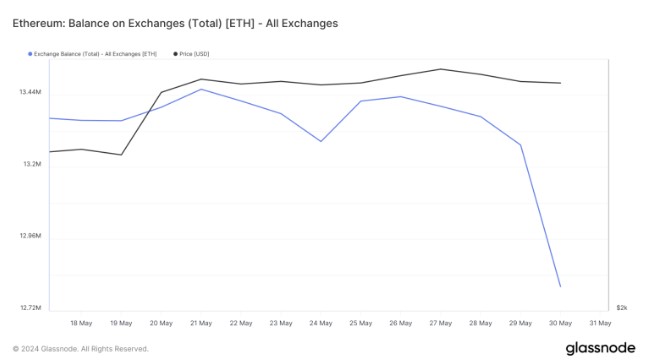

Ethereum Exchange Reserves

Ethereum’s balance on exchanges saw a significant drop on May 30, which could indicate high buying pressure. Although the mentioned data suggests that investors are buying ETH, CryptoQuant data does not show the same situation. According to analyses, Ethereum’s net deposits on exchanges were high compared to the seven-day average, indicating an increase in selling pressure. Moreover, ETH’s Coinbase Premium was on a downward trend. This clearly suggests a dominant selling tendency among US investors.

The possible reason behind this could be the overbuying of ETH. Both ETH’s relative strength index (RSI) and stochastic were in overbought positions. The MACD technical indicator suggested a likelihood of a bearish trend. The money flow index (MFI) recorded a slight decline. According to the Bollinger Bands, ETH’s price was in a highly volatile region and was still trading well above the 20-day simple moving average (SMA).

Türkçe

Türkçe Español

Español