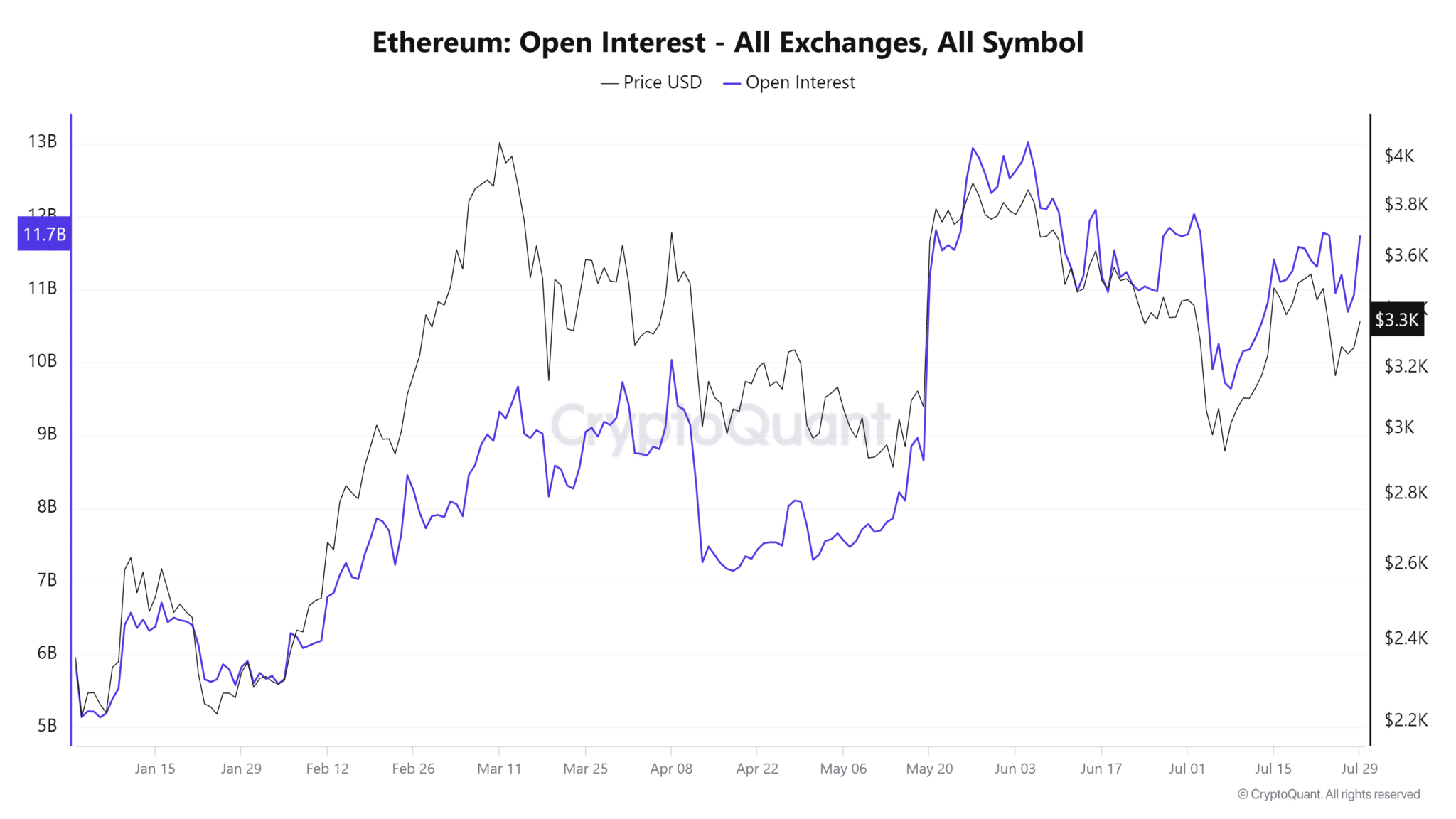

Recently, Ethereum’s open interest reflects increased investor confidence and market activity in the cryptocurrency market. Open interest measures the total value of derivative contracts such as futures and options and indicates the overall interest of market participants. At the beginning of July, Ethereum’s open interest fell from approximately $12 billion to $9 billion. This decline may be related to market fluctuations or temporary changes in investor sentiment. However, this drop was short-lived, and Ethereum’s open interest quickly recovered.

Open Interest Surpasses $11.8 Billion

In recent weeks, open interest increased by $1.5 billion, surpassing $11.8 billion. This significant increase indicates renewed interest in Ethereum and increased market confidence. Ethereum’s response to market developments signals positive prospects for the future of this cryptocurrency.

One of the factors playing a significant role in Ethereum’s recent rise is the approval of Ethereum exchange-traded funds (ETFs). The approval of ETFs brought a substantial amount of capital to the Ethereum market, which is reflected in the increase in open interest.

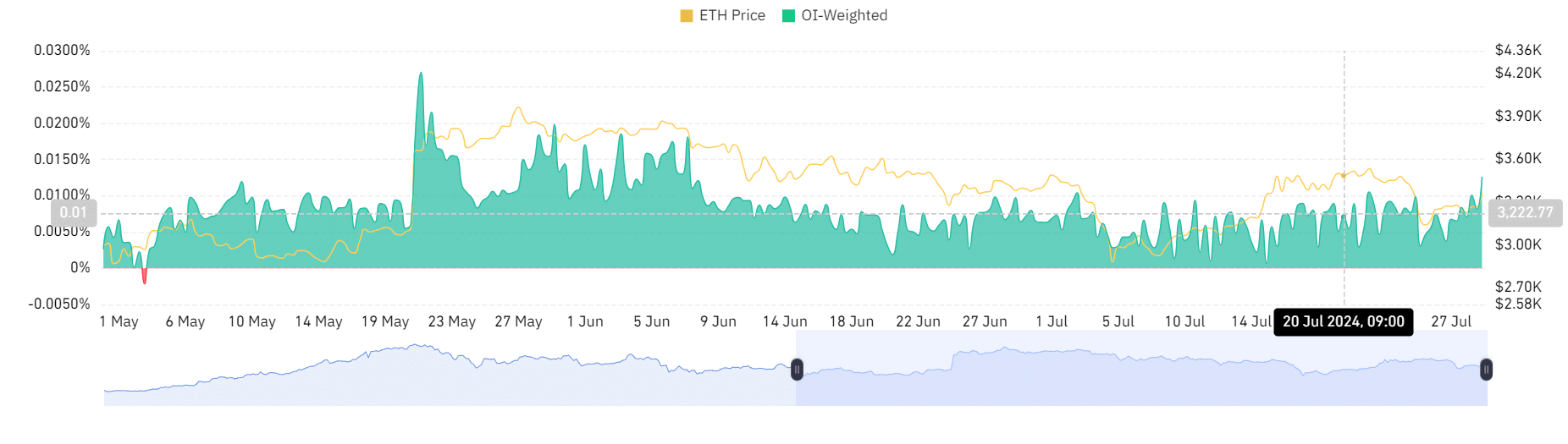

Funding rates are another notable factor. According to Coinglass data, Ethereum’s futures funding rate reached a record level of 0.0126%. This rate indicates strong demand for long positions and reflects investors‘ bullish expectations for Ethereum. A high funding rate is generally considered a positive sign as it shows that investors are willing to pay a premium to maintain their positions.

Ethereum Increased by 3%

Ethereum’s price performance has also shown a notable increase recently. The cryptocurrency’s price increased by over 3% in the last 24 hours, reaching approximately $3,375. This upward movement keeps Ethereum in a slight uptrend. The analysis of the Relative Strength Index (RSI) shows that Ethereum is above the neutral line, supporting bullish market sentiment.

Overall, the increase in Ethereum’s open interest and the rise in futures funding rates indicate a growing positive outlook for the cryptocurrency. The approval of ETFs and increased trading activities show that investors are optimistic about Ethereum’s future performance.

Türkçe

Türkçe Español

Español