Peter Brandt, a highly regarded analyst with over 40 years of experience in financial markets, highlighted a significant breakout for Bitcoin (BTC) following the sharp decline earlier this week. According to the analyst, Bitcoin might be on the verge of a strong upward trend.

Just Like 2015-2017…

Sharing his views on his X account, Brandt noted that Bitcoin’s current price movement mirrors a pattern from two cycles ago, indicating a significant rally.

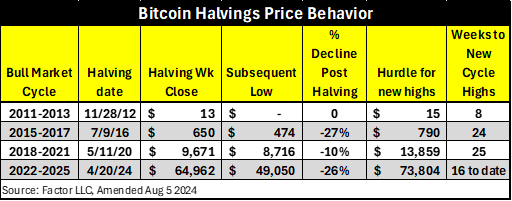

Brandt emphasized that Bitcoin’s recent drop to the $49,000 range is reminiscent of the 2015-2017 bull market cycle. During that period, Bitcoin experienced a similar decline before embarking on a historic rally to reach an all-time high. Brandt’s analysis is based on a chart comparing Bitcoin’s current trajectory to the 2015-2017 cycle, where a 26% drop post-block reward halving set the stage for a major rise.

The concept of block reward halving, highlighted in Brandt’s analysis, is crucial. For those unfamiliar, block reward halving is an event where the rewards given to miners for each block mined are halved. This event occurs approximately every four years and has historically preceded significant bull runs. Brandt pointed out that the recent 26% decline following the latest and fourth block reward halving resembles the drop seen in the previous cycle, potentially signaling the start of a new upward trend.

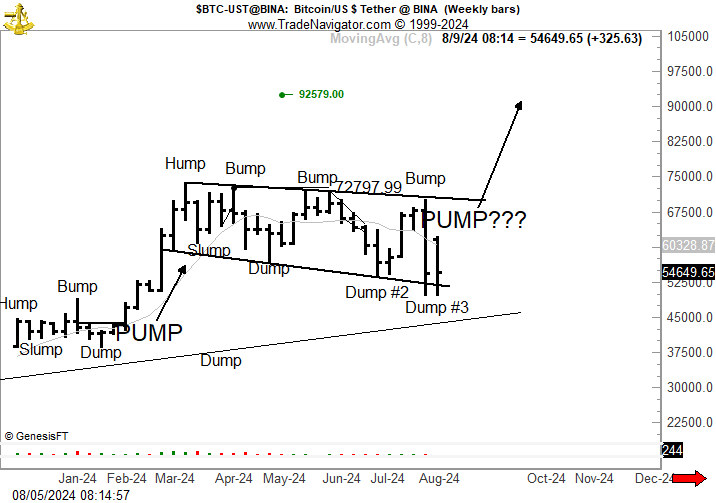

“Bump, Hump, Slump, and Dump” Chart

According to Brandt’s chart, described with the terms bump, hump, slump, and dump, BTC’s recent “dump” might have set the stage for a “pump” to levels exceeding $90,000. The analyst’s analysis follows a historical pattern where Bitcoin has strongly rebounded after similar declines.

On the other hand, Brandt advised investors to consider probabilities rather than certainties. Alongside his highly optimistic analysis, he emphasized the importance of caution and considering multiple scenarios in the highly volatile cryptocurrency market.

Türkçe

Türkçe Español

Español