The United States Securities and Exchange Commission (SEC), accused two brothers of operating a $60 million crypto Ponzi scheme involving a non-existent crypto trade bot. In a complaint filed on August 26 in the United States District Court for the Northern District of Georgia, Atlanta, the SEC alleges that Jonathan Adam and his brother Tanner Adam deceived over 80 investors with claims of a crypto bot that could provide a 13.5% monthly return.

SEC Issues Ponzi Warning

The government agency claims that from January 2023 to June 2024, the brothers told investors that their bot identified arbitrage trading opportunities on crypto platforms and could simultaneously buy and sell assets to profit from small price differences in different markets.

Investors were told their funds would go into a lending pool to finance instant loans and complete transactions, with assets being borrowed and returned within the same blockchain transaction. Justin Jeffries, Deputy Chief of Enforcement at the SEC’s Atlanta Regional Office, states that the trading plan was entirely fraudulent and the bot did not exist.

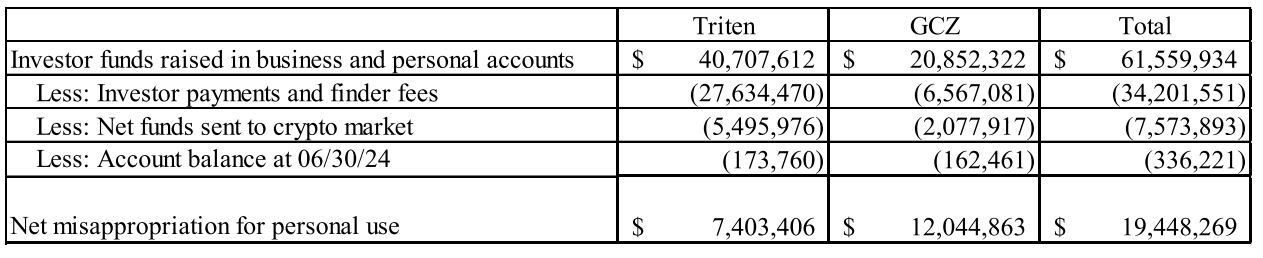

Instead, the brothers are accused of misappropriating $53.9 million out of the $61.5 million collected. Investors received some money back, but the majority was used to finance a luxurious lifestyle, including purchasing cars and trucks and constructing a $30 million apartment complex.

Details on the Matter

To halt the scheme, the SEC obtained emergency asset freezes for Jonathan and Tanner Adams’ companies GCZ Global, LLC, and Triten Financial Group LLC. According to the SEC, the brothers told investors that there was almost no investment risk except for a global market collapse. The government agency also alleges that Jonathan Adam misrepresented his background to gain investors’ trust and failed to disclose three previous convictions for securities fraud.

The SEC accused Jonathan Adam and Tanner Adam of violating the anti-fraud provisions of federal securities laws. The agency seeks permanent injunctions against the brothers’ companies, the disgorgement of all funds taken from investors, and civil penalties. In June, blockchain data analysis platform TRM Labs reported that $7.8 billion was paid to crypto pyramid and Ponzi schemes worldwide in 2022.

Türkçe

Türkçe Español

Español