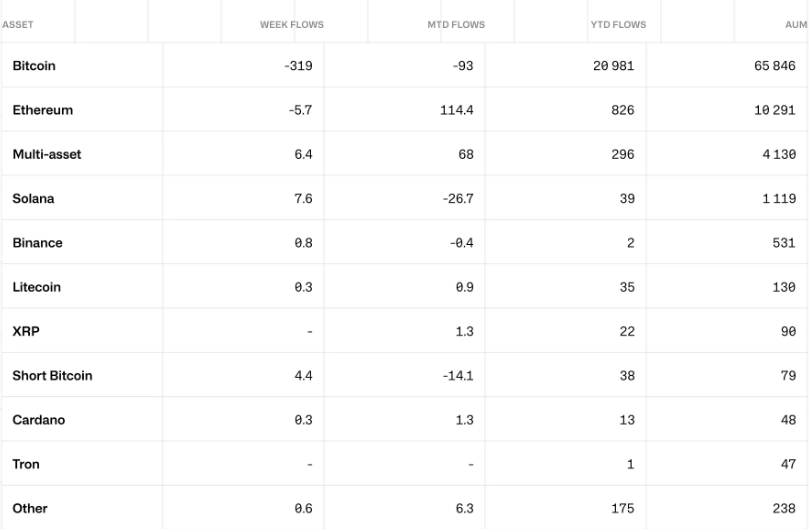

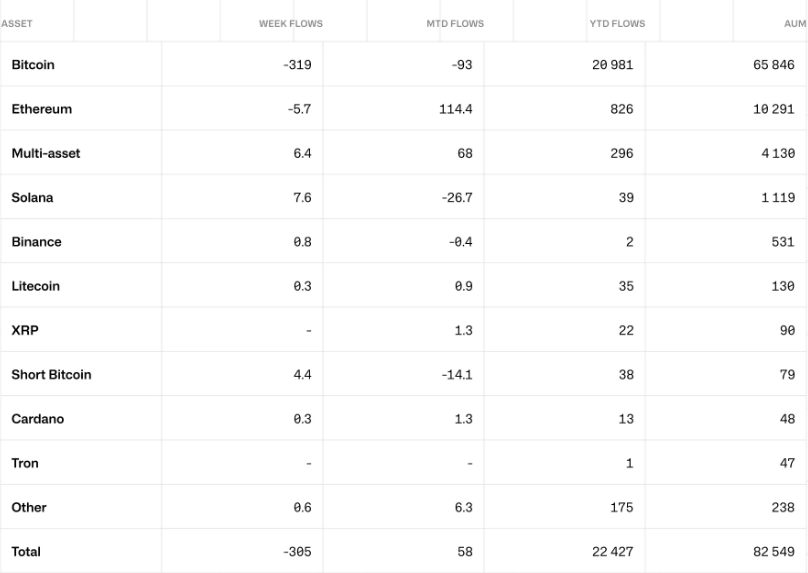

In recent months, after notable weekly entries, cryptocurrency investment products began seeing significant exits due to strong economic reports in the United States. Crypto asset investment products saw total outflows of $305 million, driven by stronger-than-expected economic data in the US, as stated in the latest Crypto Asset Fund Flow Report published on September 2 by Coinshares.

What is Happening in the Crypto Market?

The report shows that between August 24 and August 31, US investors led the world in the number of sold crypto investment products, with total outflows of $318 million. Germany and Sweden had smaller outflows of $7.3 million and $4.3 million, respectively. On the other hand, Switzerland and Canada saw slight inflows of $5.5 million and $13.2 million, respectively.

On August 30, the US Department of Commerce reported that the Personal Consumption Expenditures (PCE) price index increased by 0.2% month-over-month and 2.5% year-over-year. As consumer spending is seen as a key driver of economic growth in the US, the PCE is considered one of the inflation measures preferred by the US Federal Reserve, which is expected to reduce interest rates for the first time in over four years.

The report came with expected market rate cuts in September. The PCE report implied a 24 basis point cut and reduced the likelihood of a 50 basis point cut. Coinshares shared the following statement in their latest report:

“As the Fed approaches a pivot, we expect the asset class to become increasingly sensitive to interest rate expectations.”

Details on the Subject

According to Coinshares’ latest report, Bitcoin-focused investment products experienced the largest outflows last week, totaling $319 million. At the same time, short Bitcoin investment products saw a second weekly inflow of $4.4 million, the largest since March 2024.

Crypto investment products in Ethereum saw outflows of $5.7 million, continuing a downward trend despite the launch of the Ethereum ETF in the US on July 23, 2024. The report included the following statement on the subject:

“Blockchain equities influenced the trend and saw inflows of $11 million, particularly notable in investment products specific to Bitcoin miners.”

Türkçe

Türkçe Español

Español