According to a report released today by the prominent cryptocurrency financial services platform Matrixport, Bitcoin’s recent rally may not be as weak as many investors anticipated for September. Despite the month’s historical reputation for sluggish performance, the largest cryptocurrency’s upward trend suggests a potential deviation from historical patterns.

September Holds Surprises with Fed Rate Cuts

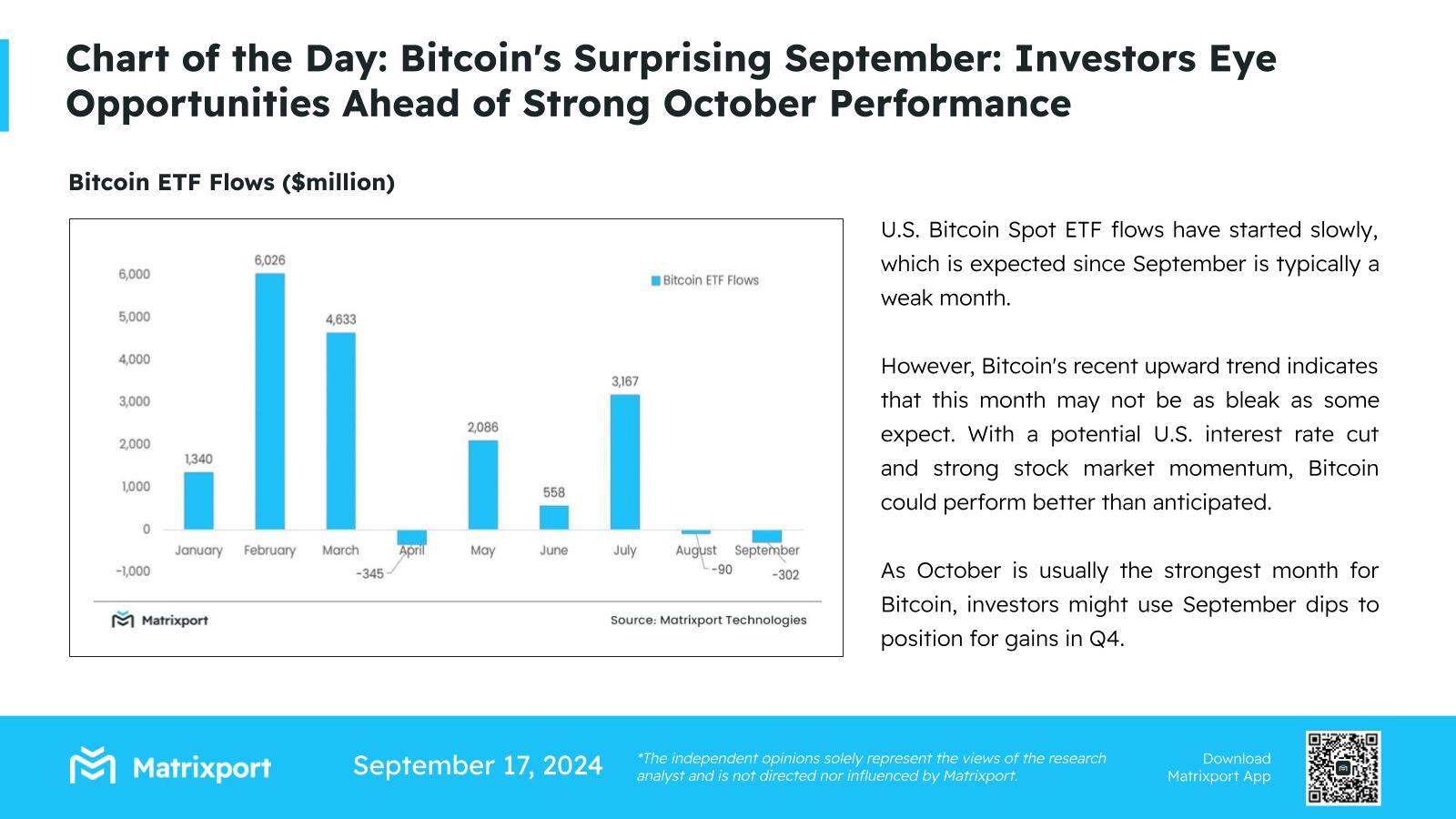

Matrixport’s assessment indicates that the inflow into Bitcoin  $103,540 exchange-traded funds (ETFs) in the U.S. began slowly, aligning with typical market behavior for September. Traditionally, this month sees reduced activity in the cryptocurrency market, resulting in lower investment inflows; however, unexpected price increases have prompted investors to reassess their strategies for the remainder of the year.

$103,540 exchange-traded funds (ETFs) in the U.S. began slowly, aligning with typical market behavior for September. Traditionally, this month sees reduced activity in the cryptocurrency market, resulting in lower investment inflows; however, unexpected price increases have prompted investors to reassess their strategies for the remainder of the year.

The Matrixport report states, “The recent rise in Bitcoin’s price indicates that the market may be preparing for a stronger performance than usual in September.” Factors such as the Fed’s potential interest rate cuts and strong market momentum are likely contributing to this positive outlook.

Currently, the possibility of the Fed lowering interest rates seems particularly influential. Such a reduction typically weakens the dollar, making alternative assets like Bitcoin more appealing to investors seeking to protect against inflation and currency devaluation. Additionally, the strong performance of U.S. equities is boosting investor confidence, which may also spill over into the cryptocurrency market.

Investors View Dips as Opportunities

Historically, October has been the strongest month for Bitcoin. Investors aware of this trend are reportedly viewing any price dips this month as opportunities to accumulate or expand their positions. This approach aims to maximize potential gains in the fourth quarter significantly.

Matrixport’s report notes, “October has typically been a very significant month for Bitcoin, and current market indicators suggest that this year may be no different. Investors are already positioning themselves to optimize potential profits.”

On the other hand, some market analysts caution that while historical trends provide valuable insights, they are not guaranteed indicators for future performance. External factors such as regulatory changes, geopolitical events, and technological developments can significantly impact the cryptocurrency market. Analysts emphasize the need for investors to consider both historical data and current events when making decisions.

Türkçe

Türkçe Español

Español