Gurbir S. Grewal’s departure from the Securities and Exchange Commission (SEC) marks a significant shift in the regulatory landscape for cryptocurrencies. His tenure has been heavily scrutinized, particularly following tumultuous events in 2022, including the FTX collapse. Grewal has often been associated with the SEC’s strict regulatory stance on cryptocurrencies, arguing that the core issue lies within the nature of the digital assets themselves rather than regulatory failures.

Positive News for the Crypto Industry

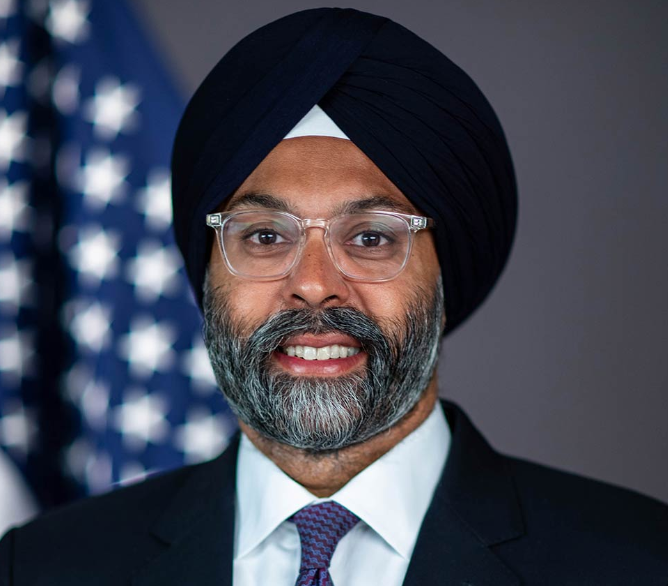

After three years of service, Gurbir S. Grewal announced his exit from the SEC. The announcement today confirms that after 21 years in various roles, he will no longer serve within the SEC. Sanjay Wadhwa, the deputy director of the department, will assume the position of acting director.

Grewal was integral to the SEC’s approach, known for enforcing regulations through punitive measures rather than establishing new rules. His leadership saw the agency file numerous lawsuits against major cryptocurrency firms such as Coinbase, Ripple  $2, and Binance. Gensler reflected on Grewal’s contributions, emphasizing his commitment to safeguarding investors and adhering to securities laws.

$2, and Binance. Gensler reflected on Grewal’s contributions, emphasizing his commitment to safeguarding investors and adhering to securities laws.

Grewal’s Impact on Cryptocurrency Enforcement

Throughout his tenure, Grewal initiated over 100 enforcement actions against cryptocurrency companies, leading to significant market repercussions. The lawsuits filed against Coinbase and Binance in June 2023 were notable highlights of his term, which left a lasting impact on the industry. Grewal’s actions reportedly generated over $20 billion in penalties for the SEC and payments exceeding $1 billion to whistleblowers.

His resignation, coinciding with the end of the SEC’s fiscal year, was not unexpected. Observers note that the change in leadership signals potential shifts in regulatory approaches. The future of the SEC under the new director remains uncertain, especially concerning the regulatory stance towards the cryptocurrency sector.

Türkçe

Türkçe Español

Español